How Bitcoin and Big Tech Helped Me Beat the Market in Q1

Mongkol Onnuan

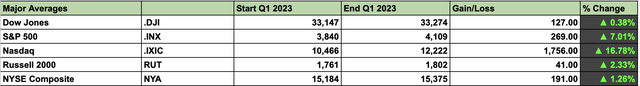

Q1 was an exciting quarter for the markets in general. The S&P 500/SPX (SP500) and other major market averages continued to rally from mid-October lows. SPX appreciated 7% in Q1, Nasdaq 100 up 17%, DJIA closed quarter flat, and the NYSE composite rose just 1% in Q1.

A tale of two markets

Large averages (The All Weather Portfolio)

We saw some divergence in Q1, with many hard-hit tech stocks leading the way in the recent rally. Many Nasdaq names soared in the quarter, while industry and other sectors lagged behind. Investors rotated back to the higher alpha names as risk appetite returned to Wall St. in the first quarter.

All-Weather Portfolio – Breakdown and Review

AWP (The Financial Prophet)

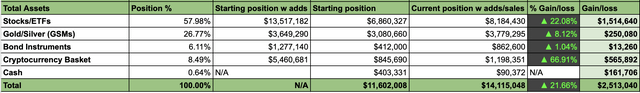

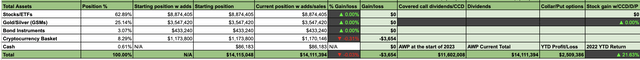

My Diversified All Weather Portfolio (“AWP”) returned approximately 22% in Q1 2023. Bitcoin (BTC-USD)/digital asset segment increased by 67%, accounting for approximately 20% of all profits in AWP. However, the main revenue driver remained the diversified equity and ETF portion of AWP. AWP’s non-GSM equity and ETF segment delivered a return of 22% and a gain of 24.44%, when factoring in dividends, covered calls strategy and multi-name hedges.

Stock segments with the best results

I continued with high-quality, hard-hit tech companies last quarter. Many of my favorite tech stocks probably bottomed around mid-October and have been on fire ever since. At the end of Q1, AWP’s tech plus segment accounted for about 22% of all assets.

Tech Plus: 28% gain in Q1

Stocks/ETFs that outperform include:

- Next Generation Internet ETF (ARKW) – 50% increase.

- ARK Innovation ETF (ARKK) – 33% gain.

- ARK ATR ETF (ARKQ) – 35% gain.

- Warner Bros. Discovery (WBD) – 31% gain.

- Lucid (LCID) – 133% shooting in the air.

- Tesla (TSLA) – 80% increase.

- Palantir (PLTR) – 56% increase.

- Meta (META) – 58% peak.

- AMD (AMD) – 37% increase.

- Nvidia (NVDA) – 31% gain.

Remove – We saw amazing performance in many of our favorite stocks, and we can continue to see big things happen in the technology industry in the next few years. Therefore, high-quality technology companies represent significant potential, even with the risk of short-term volatility in the coming months.

Technology Plus – Q2 Outlook

I’ve accumulated a sizeable Palantir position in Q1 and consider the stock cheap here. There may be volatility in the short term. In the longer term, however, Palantir should be in a winning position. The company houses some of the industry’s most outstanding talent and has significant growth potential globally. Many people wonder exactly what Palantir does because it does so many things in its sector.

Moreover, Palantir’s comprehensive solutions provide the most complete and “best” user experience. Therefore, Palantir may be free from significant direct competition and should continue to grow, becoming increasingly profitable in the coming years. I also accumulated significant positions in Alphabet (GOOG) (GOOGL), Amazon (AMZN) and several other stocks in Q1.

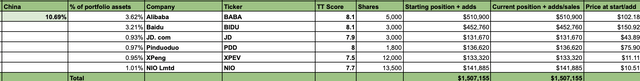

China curve: 17% increase in Q1

Top holdings in China remain Alibaba (BABA), Baidu (BIDU) and several other quality Chinese stocks. E-commerce and electric cars are booming industries in China, and the country’s business is gaining influence beyond China’s borders. It remains beneficial for the Chinese government to be pro-business and support the best technology companies in the economy.

Q2 Allocations – Bet on Alibaba and Baidu 11% in China

China basket (AWP)

Remain cautious

While all investments come with some degree of risk, some are riskier than others. Therefore, we should recognize that Chinese stocks have higher risk factors and may fall due to unexpected geopolitical or other unforeseen events. Nevertheless, many companies in the Chinese segment remain cheap and their shares should rise considerably in the coming years.

The energy and materials segment

12% of assets – 6% gain in the 1st quarter

Several stocks, such as Canadian Solar ( CSIQ ) and Brookfield ( BEP ), stood out, gaining 39% and 24%, respectively, in the quarter. Materials have done well and should remain profitable, especially as inflation persists more than expected in the coming months and quarters.

Outlook for the 2nd quarter: Increased from 13% to 16% of the holdings

Defense and finance

The defense segment returned 2.4%, and financials returned approximately 4% at the end of the quarter. However, both sectors, defense and finance, underwent many corrections in the 1st quarter. The defense segment should be set up to go higher and remain a top segment. While some finances may have more short-term turmoil, it’s an excellent time to consider quality long-term positions. I recently increased AWP’s finance/banking position to 4.4% of assets for the next quarter.

The GSM segment – another strong quarter

The gold, silver and miners segment delivered a significant return of 8% in the first quarter. More notable performers included Kinross (KGC), which rose 28%, and Alamos Gold (AGI), which gained 20%. Other stocks and ETFs also showed 10% plus gains last quarter.

Q2 Outlook – Keep it tidy

I keep a substantial GSM holding of about 25%, about 5% physical and 20% stocks and ETFs. Many gold and silver-related stocks are still trading on ultra-low earnings growth and earnings estimates. Therefore, many GSM stocks could go significantly higher if gold soon moves above $2K (crucial).

Digital Asset Segment

BTC and other risk assets were among the best performers last quarter. Also, many stocks and digital assets have rallied significantly since bottoming out about six months ago. Therefore, while I remain optimistic (with a relatively modest position), we should consider the possibility of short-term pullbacks and the future buying opportunities they may provide. The digital asset segment remains the riskiest element of the AWP portfolio and tight stops should be implemented in case of a reversal. I am considering a stop below a significant support level of $28,000-27,500 and an exit stop if BTC decides to rise.

The bottom line – Get ready for an exciting 2nd quarter

AWP (The Financial Prophet)

You can prepare for an exciting Q2, but a smooth ride is not guaranteed. Tech stocks performed well in the first quarter, but the $64,000 question is how much juice is left? Can the tech segment continue to drive the SPX and other major averages? What will happen with the banking crisis? Will the risk persist? How deep can a recession get?

The questions are many now, and uncertainty may continue to plague the markets for some time. What went up can come down, and I wouldn’t be surprised if we see a significant correction in Q2. Therefore, the SPX could still retest the 3500 low or come lower if the recession becomes too intense. However, I will continue to collect quality companies for sale, build a profitable portfolio and increase income over time.