Fed-Operated Banks Are Losing Faith, Can Bitcoin Come to the Rescue?

Bank-induced financial chaos has triggered a series of reactions that signal depleted confidence in centralized banking bodies. Thus giving rise to a “TradFi winter.” Can cryptos like Bitcoin rise to the occasion amid discouraging steps from regulators?

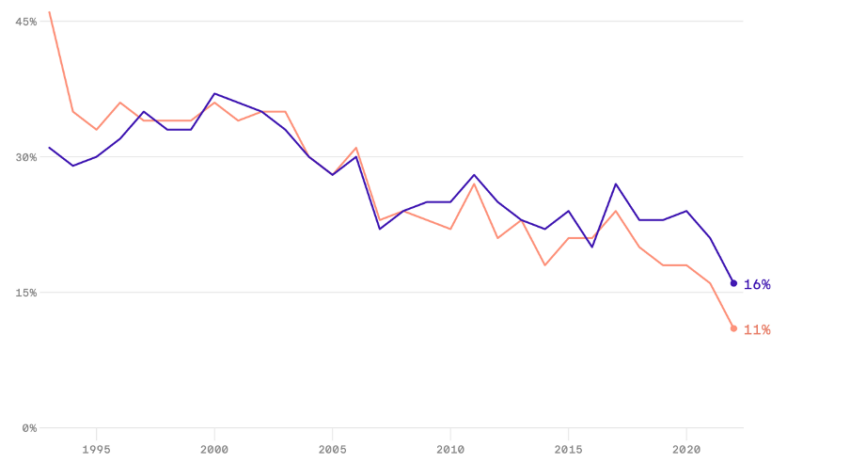

The traditional financial services industry (TradFi) has faced challenges recently, including increased regulation, competition from fintech firms and changing consumer preferences. One of the industry’s biggest concerns is the possibility of a sudden financial crisis, similar to the global meltdown of 2008. Banking institutions have struggled to regain confidence after the Great Recession.

This concern has been heightened by the COVID-19 pandemic, which exposed weaknesses in the financial system and increased the likelihood of a financial debacle.

One of the most important risks facing the TradFi industry is the possibility of a bank run. A bank run occurs when many depositors withdraw their money at once, causing the bank to run out of cash and potentially collapse. Various factors, including rumors of financial instability, concerns about the safety of deposits and changes in government policies, can trigger bank runs.

Deep uncertainty

The risk of bank runs has increased in recent years due to several factors. One is the increased interconnection of the global financial system. Banks are now more interconnected than ever, with complex financial instruments tying them together in a web of financial obligations. This means that if one bank fails, it can trigger a cascade of failures across the system.

Another factor that has increased the risk of bank runs is the growth of shadow banking. Shadow banking refers to offering banking services outside traditional banking channels, for example through hedge funds, money market funds and other financial institutions that are not banks. Shadow banking is often less regulated than traditional banking and can be more vulnerable to financial shocks.

The COVID-19 pandemic further increased the risk of bank runs by exposing weaknesses in the financial system. Many governments implemented shutdowns and other measures that severely affected the economy during the pandemic. This led to a sharp decline in economic activity, which reduced the value of many financial assets.

Huge pressure

The decline in asset values has put pressure on banks and other financial institutions, as they are often heavily invested in these assets. This has increased the risk of bank bankruptcy and made bank runs more likely. In addition, the pandemic led to increased unemployment, which reduced consumers’ ability to repay their debts. Recently, bank account holders of all sizes now have to deal with a new risk following the high-profile collapse of Silicon Valley Bank (SVB).

This has put further pressure on the financial system and increased the risk of financial instability. Traditionally, the financial industry is still highly regulated and centralized, with banks and other institutions acting as intermediaries between customers and financial markets. But in recent years, decentralized finance (DeFi) has become increasingly popular with the rise of blockchain technology and cryptocurrencies. DeFi is built on a decentralized infrastructure that allows peer-to-peer transactions without intermediaries.

While DeFi has brought several benefits, such as increased transparency, accessibility and reduced costs, it has also been associated with risks such as price volatility, fraud and hacks. Some argue that traditional finance is adopting some of these negative aspects of DeFi, leading to a “TradFi winter.”

TradFi Winter is bad news

Former Coinbase CTO Balaji Srinivasan tweeted a report from the research arm of New York-based AllianceBernstein. Here, Srinivasan raised red flags around banks and called out the industry.

“Tradfi takes on some of the worst aspects of Defi. I call this Trafi winter.”

He drew some parallels and criticized regulators for not alerting users to a potential bank failure. He also noted the opaque reporting nature of banking institutions:

“Prior to the printout, banks used accounting tricks to trick themselves and others into thinking they had liquid funds to cover withdrawals. It’s Uncle Sam Bankman Fried.”

By the time the news is broadcast by a reputable reporting agency, “it’s often too late,” he added. These cases have led to a systemic loss of trust in Western banking, similar to the loss of trust in Western media.

In conclusion, the former Coinbase CEO called it “Low trust bank, low trust community.”

A few options

People are now realizing the dangers of high-speed bank runs that can be magnified by social media and instant payment systems. The Federal Reserve is willing to step in and provide liquidity to troubled banks, but it comes at a cost. Ergo, depositors have good reason to look for other alternatives, and thus minimize financial complexity as far as possible.

Can crypto like Bitcoin help? The niche, yet growing asset class has seen a huge increase in value since its inception. Bitcoin and other cryptocurrencies have the potential to address some of the counterparty risks that bank customers may face. One of the advantages of Bitcoin is that it allows peer-to-peer transactions without the need for a trusted intermediary such as a bank.

This means that users can trade directly with each other, which can reduce the counterparty risk associated with traditional banking transactions. But then again, crypto is still a new face in this game. The report states:

“The simplicity of crypto as a digital bearer asset solves the immediate counterparty risks that bank customers face, but customers also demand stability of value. Thus, Bitcoin, as a digital bearer asset, may not immediately appeal to customers who look at stability in nominal USD terms .”

Obstacles on the crypto path

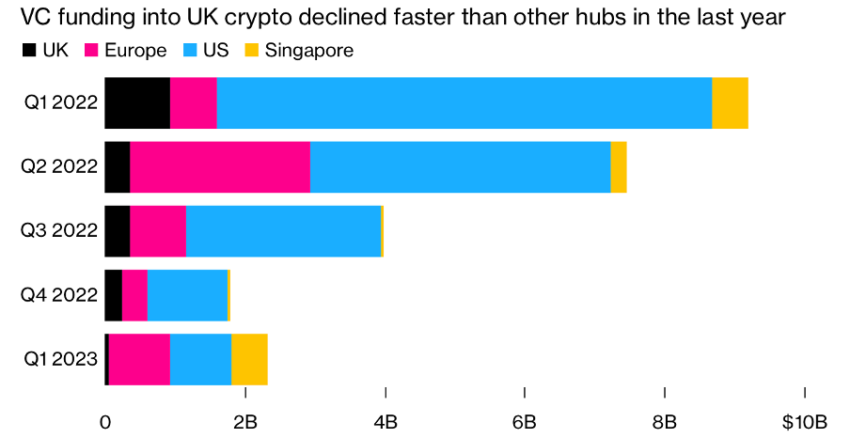

The potential of Bitcoin, or cryptos in general, is huge. But the path to reaching its potential is full of obstacles. Regulators worldwide have taken immediate steps to disregard crypto. In March, the White House called out crypto for having no fundamental value. Recently, the UK government took measures to discourage crypto growth in the region.

Crypto companies are generally subject to myriad restrictions and regulations that vary by jurisdiction. Some conditions that crypto companies may face include the following:

- Licensing requirements: In many jurisdictions, crypto companies must obtain a license to operate as a money transmitter or digital asset exchange.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements: Crypto companies must comply with AML and KYC regulations, including identity verification, transaction monitoring and suspicious activity reporting.

- Capital Requirements: Some jurisdictions may require crypto companies to maintain a certain amount of capital to operate.

- Taxation: Crypto companies may be subject to taxation on their profits and may have to report their transactions to the tax authorities.

- Security and privacy requirements: Crypto companies must protect user data and prevent unauthorized system access.

Failure to comply with these restrictions and regulations may result in penalties, fines or criminal charges. In addition, some crypto companies may face additional challenges, such as difficulty obtaining banking services or having their accounts frozen by financial institutions due to perceived risks associated with the industry.

The paperwork can also be significant, especially for companies that operate across multiple jurisdictions or that offer a wide range of services.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.