FTX’s law firm hits on questions about work before crypto collapse

FTX’s legal woes reach law firm Fenwick & West, which is facing federal law enforcement subpoenas and a class action lawsuit related to the failed crypto exchange.

Bankruptcy counsel for FTX has discussed “federal law enforcement subpoenas to Fenwick” with the law firm’s general counsel, Kathryn Fritz, according to a court document filed in March. The document, which

detailing the work of Sullivan & Cromwell lawyers on FTX’s bankruptcy in January, did not say what the subpoenas requested or what investigation they covered.

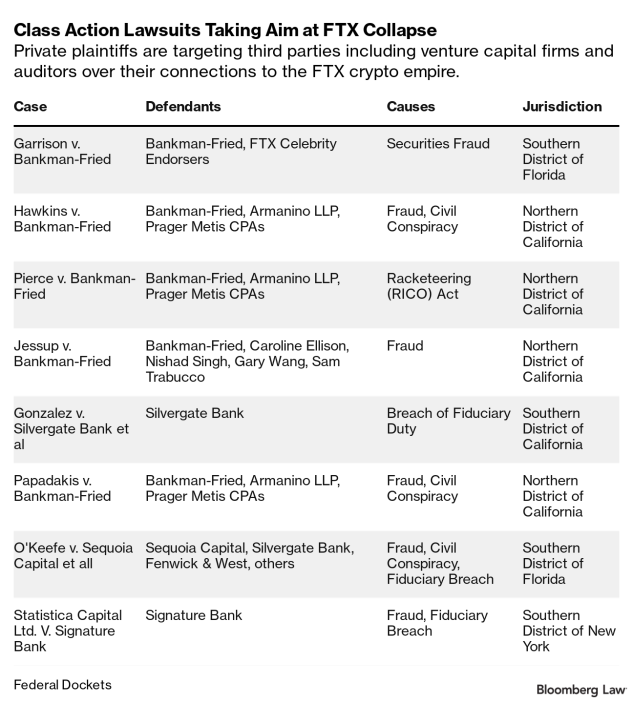

Fenwick is also among a number of companies targeted in a class-action lawsuit alleging the firm aided and abetted a massive fraud led by Sam Bankman-Fried, the FTX founder who now faces 13 charges. The services Fenwick provided were “central to SBF’s fraud,” according to a February lawsuit filed in Miami federal court on behalf of a proposed class of investors.

It’s difficult for any law firm to answer questions about actions for a client, but especially for Silicon Valley-based Fenwick, which cemented its reputation as a go-to operation for the world’s top tech companies after it helped Steve Jobs incorporate Apple Inc. in 1976 The firm, whose clients have included Amazon.com Inc., Tesla Inc. and Meta Platforms Inc., nearly doubled its revenue in the five years to 2021.

“Any time you have a hint of regulatory impropriety, you and the firm take a hit,” said James Cox, a law professor at Duke University. “It is difficult to say how long it lasts and how deep it is. But it is certainly not a feather in the cap.”

Fenwick, Fritz and the firm’s outside counsel in the class action, Florida’s Gunster, did not respond to requests for comment. Sullivan & Cromwell declined to comment.

Fenwick’s role

Fenwick advised FTX and its sister trading shop, Alameda Research, on areas including trademarks, taxes and litigation before the crypto exchange’s implosion into bankruptcy in November. It also helped set up US-based companies associated with FTX and Alameda.

Daniel Friedberg, once the Seattle-based chairman of Fenwick’s payments practice, joined FTX in 2020 and would later become its chief regulatory officer. Former FTX general counsel Can Sun was a former Fenwick employee.

Fenwick has removed references to FTX on its website. The firm trimmed FTX from a list of prominent clients on its website.

“Fenwick & West assisted FTX in developing ‘compliance’ procedures designed to circumvent FTX’s regulatory obligations or conceal its non-compliance,” claims the class action, which seeks unspecified financial damages from Fenwick. In addition to Fenwick, the complaint targets 20 other third parties with an alleged FTX connection, including auditors and venture capital firms.

Fenwick has yet to file a response to the lawsuit.

Steep obstacle

Finding a third party such as a law firm responsible for the underlying fraud is a steep hurdle, said Patrick Coughlin, a Scott & Scott lawyer who represented Enron shareholders after the collapse.

“The biggest challenge here is demonstrating what a law firm knew or didn’t know and their participation in actual transactions,” Coughlin said. “It’s going to be much more difficult to show that third parties – the accountants or the lawyers – were actually involved in the fraud.”

When it comes to subpoenas, the main target may be the client and not the lawyers, said New York University School of Law Professor Jennifer Arlen. “The fact that a law firm was subpoenaed does not mean the firm is in legal jeopardy,” she said.

Prosecutors typically won’t be successful in issuing subpoenas to law firms for conversations with clients, Arlen said. Nor will subpoenas capture work produced or generated on behalf of clients because of attorney-client privilege, she said.

But prosecutors have a right to documents that a client creates and owns and turns over to their law firm to keep, Arlen said.

‘Principal’ advisor

Some details of Fenwick’s relationship with FTX were revealed in January, when Wall Street firm Sullivan & Cromwell faced scrutiny of its past work for the exchange.

Fenwick was FTX’s “principal” adviser on “corporate, operational and corporate governance matters,” Sullivan & Cromwell partner Andrew Dietderich said in a court filing during the bankruptcy proceedings.

He said Fenwick provided the corporate documents and organizational charts needed for the Chapter 11 petition, which Sullivan & Cromwell filed on behalf of FTX on Nov. 11.

Fenwick is among a long list of third parties now facing scrutiny as a result of their alleged connections to the crypto exchange. Federal prosecutors in New York have accused Bankman-Fried of misappropriating billions of dollars in client funds for personal use and making risky bets through Alameda Research.

The accounting firms Prager Metis and Armanino are also defendants in several proposed class actions for allegedly aiding FTX’s fraud.

The companies audited key FTX entities and certified that the companies had controls in place sufficient to protect class member assets, according to the Feb. 22 complaint, “despite knowing full well that such controls were not in place.”

The action against Fenwick and others is currently on hold while the parties await a hearing in May focused on possibly consolidating the private actions related to the FTX collapse.

Skyrocketing income

Since it was founded approximately half a century ago, Fenwick has carved out a niche as a full-service firm for technology and life sciences clients, across areas including intellectual property, corporate and litigation.

The firm reached $723 million in revenue in 2021 — a 93% increase from the $374 million it earned five years earlier, according to figures compiled by The American Lawyer.

In the same time frame, the number of lawyers at the firm increased to 427 from 321. Fenwick has not yet released financial figures for 2022.

With long-established links to the tech and startup space, Fenwick pushed eagerly into the digital assets arena. In addition to its work with FTX, the firm advised Coinbase, the largest crypto exchange in the United States, in its initial public offering in 2021.

The firm has advised Coinbase on more than 15 transactions. It has also represented Yuga Labs, the creator of the Bored Ape Yacht Club collection of non-fungible tokens, in transaction and litigation matters.

The ever-fluctuating state of crypto regulations has made it difficult for some firms to advise clients as they try to scale their companies, and since firms are eager to expand their crypto practice groups, said Eric Chason, a professor at William & Mary Law School.

“You’re operating in kind of a vacuum,” Chason said. “I can see it’s tempting to be taken somewhere you don’t want to go.”

The case is O’Keefe v. Sequoia Capital Operations, LLC, SD Fla., 1:23-cv-20700, 2/22/23.