Bitcoin rises amid banking uncertainty, macro headwinds

Join the most important conversation in crypto and web3! Secure your place today

An eventful March of bank failures, ongoing inflation and other macroeconomic headwinds left investors wondering where to put their trust — and cash — and ultimately proved beneficial for bitcoin and other cryptos that were considered stores of value impervious to turmoil .

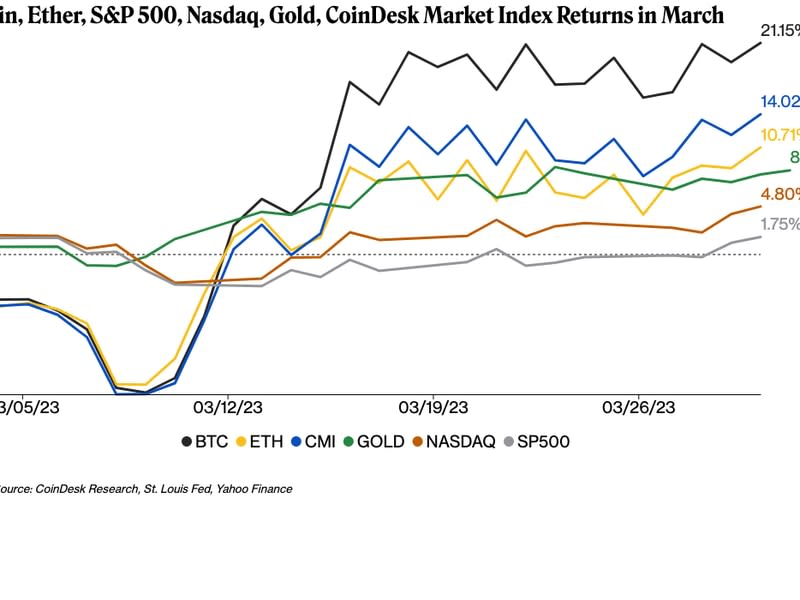

Bitcoin (BTC) was recently trading at around $28,500, up over 21% in March. At one point on Wednesday, the largest cryptocurrency by market capitalization breached the $29,100 mark to hit its highest mark since June 2022. BTC has outperformed the S&P 500, Nasdaq and other traditional assets. The technology-focused Nasdaq rose over 4% for the month.

“The macro landscape has been extremely constructive for ‘alternative money’ in March,” Greg Magadini, director of derivatives at crypto analytics firm Amberdata, told CoinDesk in an email, adding that both BTC and gold, traditionally seen as safe havens assets, had seen “explosive upside volatility” this month.

Magadini wrote that BTC’s recent volatility in the options market following the implosion of crypto-friendly Silvergate and Silicon Valley banks differed significantly from the more dramatic changes following the collapse of the FTX exchange and other crypto disasters last year.

“BTC explodes higher,” he said. “This rush into ‘alternative money’ (BTC and GOLD) shows some panic about keeping the USD clean.

This month’s gains came even as the crypto industry endured the collapse of crypto-friendly banks Silvergate and Silicon Valley Bank and a flurry of regulatory enforcement activity. This week, the US Commodity Futures Trading Commission (CFTC) filed a lawsuit against Binance, the world’s largest crypto exchange by trading volume, and its founder Chengpeng Zhao over alleged violations. The aftershocks of the banking crisis rocked the stablecoin sector earlier this month, but crypto was largely unaffected.

For institutional investors, one of their biggest concerns has not been “the market volatility around bitcoin” but “regulatory volatility and regulatory uncertainty,” Ben McMillan, chief investment officer of crypto asset manager IDX Digital Assets, told CoinDesk ahead of the Binance-CFTC lawsuit news.

Ether (ETH) recently changed hands at $1,820, up 13% in March. Earlier in the month, the second-largest crypto by market cap hit $1,861, its highest level since August 2022.

Winners

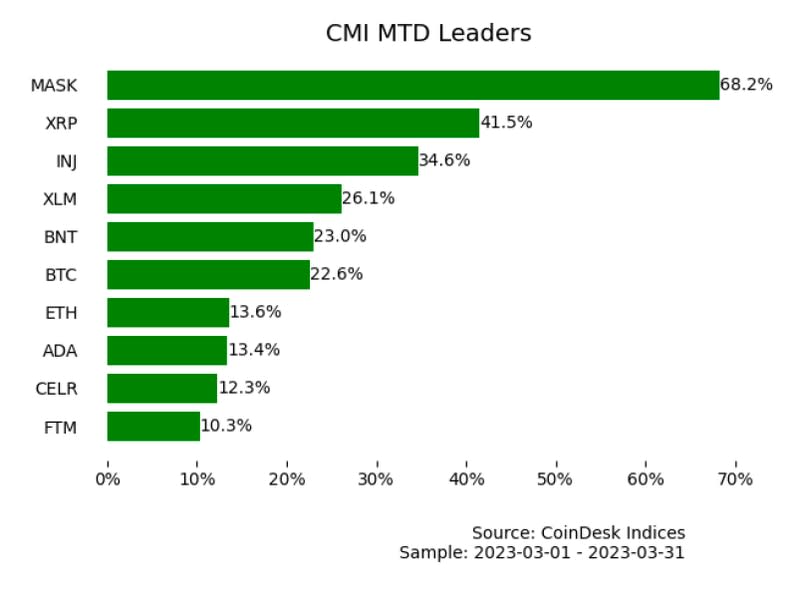

Encrypted messaging protocol Mask Network’s original MASK token grabbed the trophy as the best token among 160 assets in the CoinDesk Market Index (CMI), surging 68% in March and changing hands at $6.30.

The jump came after a whale withdrew about 3.6 million MASK tokens, worth about $14.8 million at the time, from multiple exchanges through multiple addresses, according to an analysis by chain researcher Lookonchain.

Lookonchain said past data patterns show that “in many cases, transfer will lead to higher MASK prices, while transfer will lead to a price drop.”

Crypto payments platform XRP Ledger’s XRP token was the next best performer, climbing over 41% to recently trade at 54 cents. Part of the increase came after reports that XRP issuer Ripple was well positioned to win a landmark case with the US Securities and Exchange.

“XRP has been in a legal battle for a while, but the fact that we can finally see a legal conclusion for XRP gives it a lot of value,” Magadini told Amberdata.

Injective Protocol’s INJ token and Stellar’s XLM token rose 34% and 26% respectively.

Looking by sector, the CoinDesk Currency Index was the month’s biggest gainer with a 21% gain, followed by the Smart Contract Platform sector’s 9% gain.

Losers

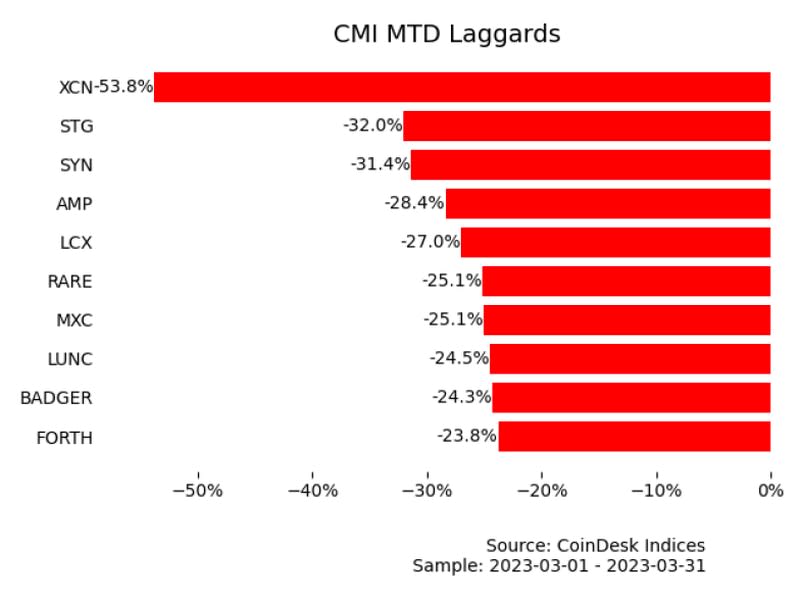

Chains XCN token in CMI’s currency sector was among the biggest CMI laggards, plunging over 53% in March.

Cross-chain bro protocol Stargate Finance’s STG token in the Decentralized Finance (DeFi) sector surged 32% to trade at 71 cents, according to data aggregator CoinGecko.

StargateDAO intended to reissue STG tokens by March 15 amid community concerns about liquidity and security stemming from the protocol’s entanglement with Alameda Research, the trading arm of controversial crypto exchange FTX. But the group abandoned those plans after a rebuke from FTX liquidators.

The AMP token, a collateralized token designed to accelerate transactions in crypto networks, fell 28%, while crypto exchange LCX’s LCX token fell 27%.

Going forward

Stefan Rust, a crypto investor and CEO of data aggregator Truflation, wrote in an email to CoinDesk on Wednesday that traditional finance (TradFi) had reached a tipping point. “People seem to realize that the banking crisis is not really over,” he wrote.

Rust noted that the bank collapses had eliminated valuable resources for investors and others eager to participate in the digital asset ecosystem, and hinted at increasing regulatory pressure in the US that could create obstacles to the industry’s growth. “Many are trying to navigate the on-and-off situation and find loopholes,” he wrote.

But he added that the recent stalemate between DeFi and TradFi is likely to stick. “In the long term, there will be a whole new on-and-off system between the DeFi, crypto and fiat worlds, as trust in centralized, regulated institutions has definitely broken its back,” he wrote. “There is no longer a need to keep all your funds in one bank, a central entity that holds all your assets in custody, because who knows what will happen to that entity and ultimately your savings.”

“Markets always take some time to adjust, regain confidence and find new avenues and funding streams. However, money will always move upwards,” he wrote.

James Rubin contributed to this report.