All Season vs Bitcoin Price Above $30,000, Here’s What Could Happen in Q2 2023

- Bitcoin price is on the verge of breaking through a multi-month barrier of $28,567, but repeatedly fails to break it.

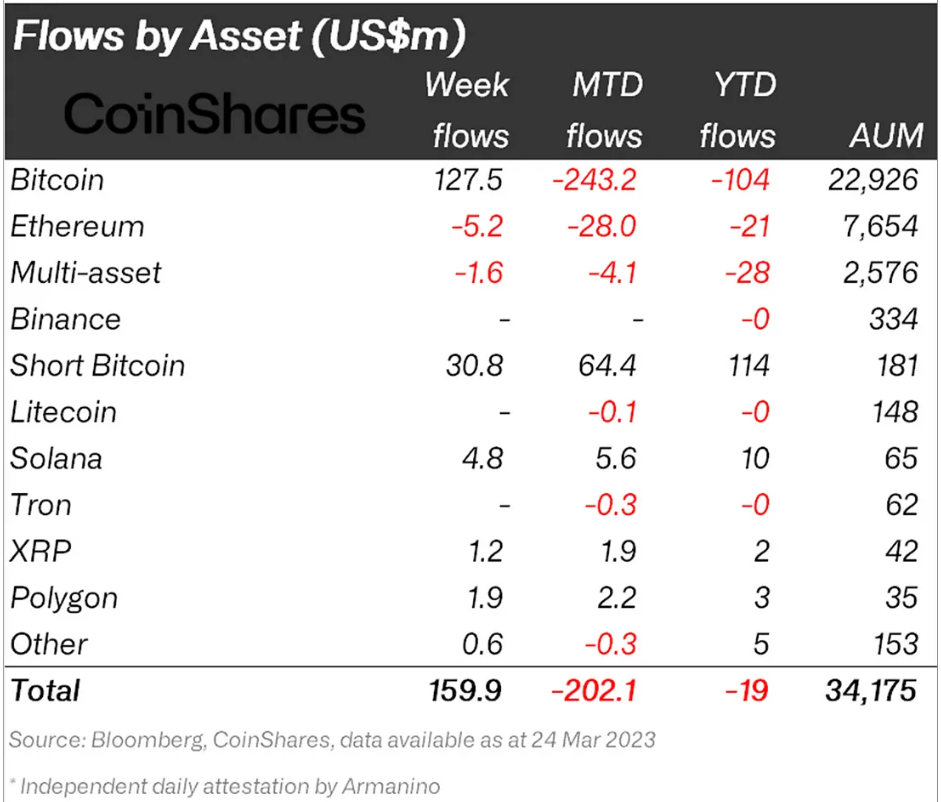

- Institutional interest has increased significantly recently, albeit in favor of BTC and not altcoins.

- While the flow of capital may indicate an alt season to come, Bitcoin big wallet holders are bracing for another quarter of gains.

Over the past few months, the Bitcoin price has emerged as one of the best performing assets in the entire crypto market, leaving behind Ethereum, other altcoins and even meme coins. The rally recorded on the charts makes the investors receptive to whether BTC will continue to rise or whether this is the end of the line.

Bitcoin price to dominate the possibility of an alt season

Bitcoin price trading at $27,800 is very close to pushing beyond the $30,000 mark. The growth observed in the first quarter of the year neutralized the possibility of altcoins taking over the market. And if the same is observed during the next quarter, an alt season may have to wait longer.

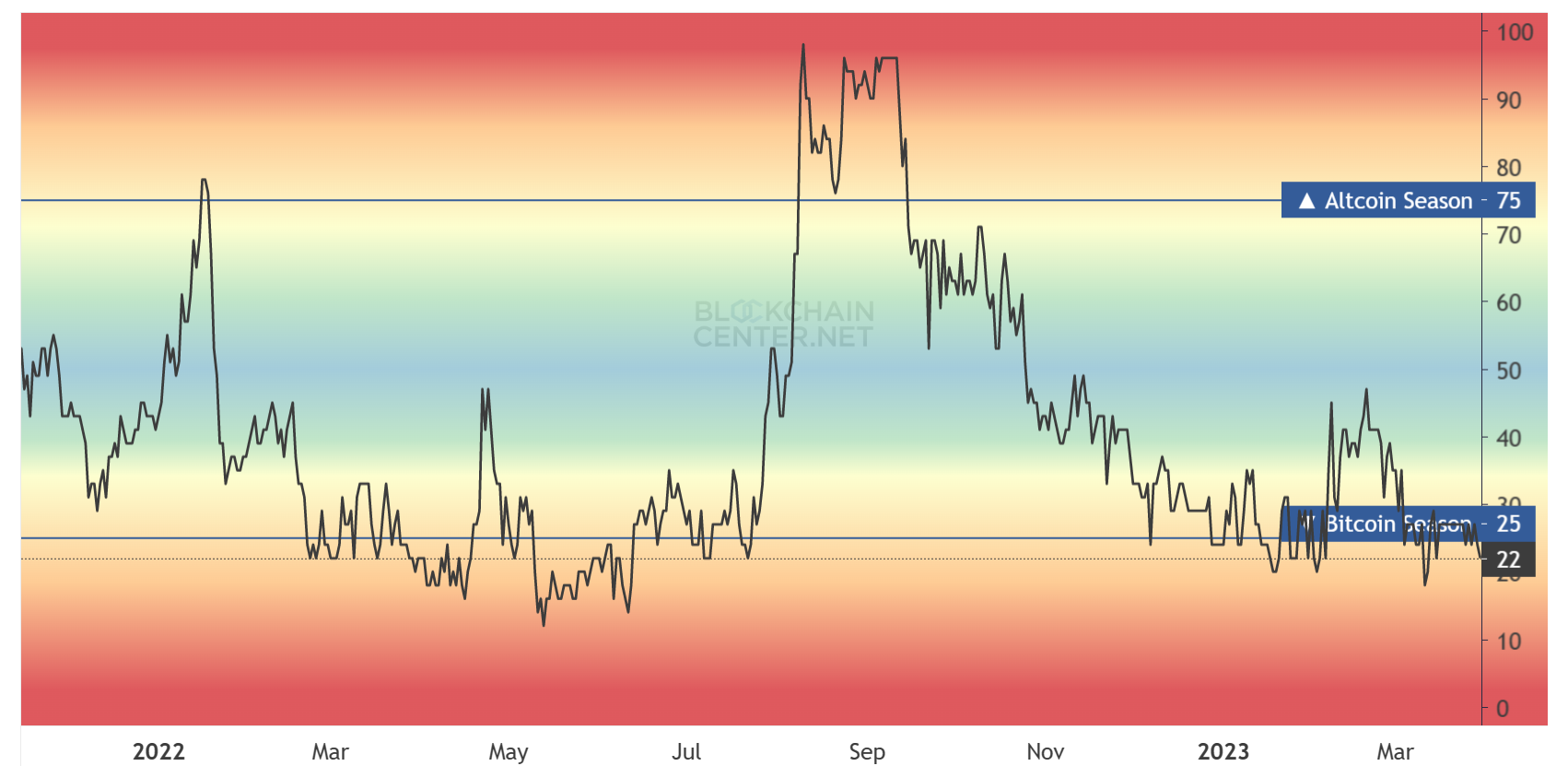

An alt season is the period when altcoins perform and give better returns than Bitcoin. Typically, an all-season occurs when the top 50 cryptocurrencies outperform Bitcoin in a 90-day period. Generally, an alt season comes after the largest cryptocurrency in the world has rallied as the capital gained during this period flows into altcoins.

All seasonal indicator

However, looking at the indicators, this may not be the case for now. This is because two of the most important groups of investors favor Bitcoin price appreciation at the moment. Bitcoin major wallet holders and institutional investors have been piling up and investing in BTC in recent weeks, raising expectations of a rally.

%20[00.20.33,%2031%20Mar,%202023]-638158043950750125.png)

Bitcoin whale stock

The addresses holding 10 to 10,000 BTC have grown during Q1, with some decline observed in the addresses holding 1,000 to 10,000 BTC.

Furthermore, institutional investors have also diverted their funds over the past week, with Bitcoin receiving the largest share of them. The week ending March 24 saw $127.5 million flow into BTC, the highest since July 2022.

Bitcoin institutional inflows

Therefore, the market is still in a Bitcoin season and will continue unless BTC fails to break the critical resistance of $28,567, which has been the case for two weeks now. Turning it to support will push the Bitcoin price towards regaining $30,000.

BTC/USD 1-Day Chart

However, if a break fails, the price will be brought back to the critical support level of $24,943. Losing it will cause the Bitcoin price to reach the bottom of $22,000 to $20,000.