Bitcoin On Course For Best Quarter Since Early 2021, Here’s What Q2 Could Hold For BTC Price

Bitcoin, the world’s first and largest cryptocurrency by market capitalization, is coming off its best quarter in exactly two years.

Assuming Bitcoin is able to close out Friday’s session at or above today’s levels in the $28,200s, the cryptocurrency would have gained a whopping 70% since the start of the year.

Back in Q1 2021, Bitcoin doubled in price from just above current levels to close to $59,000. In fact, the end of Q1 2021 marked Bitcoin’s best quarterly closing level ever.

Bitcoin’s sudden return to form in 2023 comes amid a more favorable macro backdrop.

Fed-tightening bets have eased in recent weeks amid concerns about weakness in the banking sector, which has also spurred a safe-haven bid for “hard money” like precious metals and proven cryptocurrencies like Bitcoin (which many refer to as digital gold).

Bitcoin’s 2023 rally has likely also been driven by mean reversion and improvements in Bitcoin’s on-chain health – various technical and on-chain indicators have been flashing in recent months that Bitcoin had been oversold last year and that the bottom of the bear market is now here. probably in

Read more:

With the world’s largest cryptocurrency defying the bears in Q1 2023, investors are wondering what Q2 might hold for Bitcoin.

Things have looked good for the medium-term technical outlook since Bitcoin’s hugely important pullback from its 200-day moving average and realized price below $20,000 earlier this month, which also coincidentally coincided with a retest of the Q4 2021 and late -Q1 2022 downtrend peaks.

All of Bitcoin’s major moving averages are pointing higher and all have crossed each other in a bullish fashion – the 21DMA is above the 50DMA, which is above the 100DMA, which is above the 200DMA).

That means the door appears to be open for a rally above $30,000 in Q2 and a retest of the key resistance area $32,500-$33,000.

But as all traders know, technicality is not everything in the markets. A number of important fundamental themes are likely to have a major impact on Bitcoin’s price in Q2. Let’s take a look at the most important topics.

Will the banking crisis worsen and stimulate a new demand for Bitcoin in safe havens?

In the wake of ATM runs resulting from concerns about poor balance sheet management, three crypto/tech/startup-friendly banks (Silvergate, SVB and Signature Bank) collapsed or were shut down by regulators earlier this month.

This sparked concerns about a wider US (and global) banking crisis that could threaten the entire financial system.

For now, the response from policymakers has prevented a broader bank run on U.S. financial institutions — authorities ensured that all depositors at those three banks did not lose any funds, insured deposits at other banks, and went beyond the Federal Deposit Insurance Fund’s usual $250,000 per account protection pledge.

In addition, the authorities introduced new liquidity programs to ease balance sheet pressure from other vulnerable banks, as well as strengthening USD liquidity swap programs with other major central banks.

These liquidity programs mean the Fed’s balance sheet has shot up from under $8.35 trillion at the beginning of March to nearly $8.75 trillion at the end of March.

That’s about $400 million in liquidity injections, reversing the liquidity withdrawals of the past four months that led the Fed to allow $95 billion a month in Treasuries and mortgage-backed securities to roll off its balance sheet without reinvestment.

Elsewhere, a consortium of major US banks even came together to help rescue the vulnerable First Republic bank, injecting it with $30 billion in deposits.

While fears of a full-blown banking crisis have eased somewhat this week, also helped by an agreed acquisition of SVB’s assets, the situation remains fragile, and for now Bitcoin retains its “safe haven” bid.

Bitcoin is seen by its proponents and many investors as a safe alternative to fiat currency, which is not considered 100% safe stored in a bank thanks to the shared reserve banking system.

If Q2 sees a resurgence of banking crisis concerns, this should underpin the Bitcoin price, even if a proactive response from policymakers continues to keep a lid on things and avert a full-blown financial crisis.

Will the Fed Continue to Tighten and Could This Derail the Bitcoin Bulls?

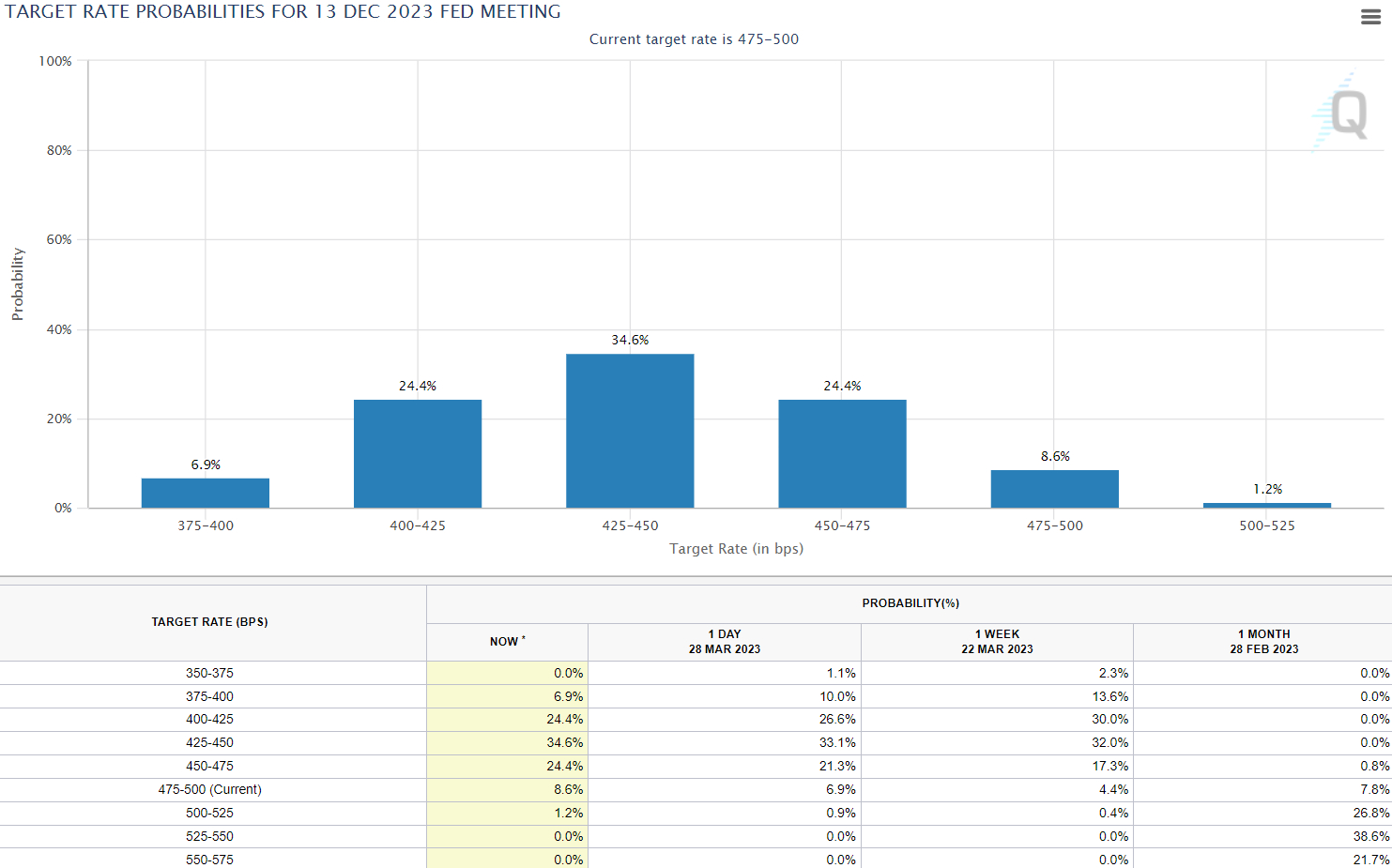

Less than a month ago, US money market participants were pricing in a strong likelihood that the US Federal Reserve will raise interest rates to around or above 5.5% by the end of the 2nd quarter.

In the wake of the rise of banking crisis concerns, these tightening expectations have seen a massive drop.

Alongside safe demand for hard currency, easing in tighter betting has been a key tailwind for Bitcoin, which tends to outperform when economic conditions ease.

According to CME’s Fed Watch Tool, which provides implied probabilities of where Fed interest rates could be in the future based on money market prices, the Fed’s tightening cycle is now most likely over.

Also, an aggressive tightening cycle is now priced in, with money market interest rates expected to fall to the low-4.0% range by December, compared with expectations a month ago that rates would still be in the mid-5.0% range.

The Fed last week raised interest rates by 25 bps to a range of 4.75-5.0%.

The narrative driving the aggressive rate-cutting appears to be that 1) further tightening will increase the risk of a worsening banking crisis and 2) the US is likely to enter a recession later this year as banks scale back lending and focus on strengthening their balance sheets . .

Both of these are seen as highly deflationary, meaning markets appear to have concluded that US inflation (which remains well above the Fed’s target) will fall rapidly later this year, giving the Fed room to cut the interest rate.

While money markets may be right to bet on an aggressive incoming rate cut cycle, there is no guarantee that things will go down this way.

Various inflation measures surprised to the upside in Q1 2023, and the US economy, particularly the labor market, remains remarkably resilient.

If that remains the case in Q2, money markets may have to bet on a Fed rate cut.

That could be a headwind for Bitcoin and the broader crypto market.

Conversely, if the lagged effects of 2022’s aggressive tightening finally start to result in weakness in the labor market and inflation resumes its downward trend, this could lead to further interest rate cut efforts, adding further fuel to the Bitcoin bull market.

US Crypto Crackdown Expands as SEC and CFTC Battle For Regulatory Authority

Crypto regulation in the US (and elsewhere) could be a key to price action in Q2. In the US, regulatory agencies including the US Securities and Exchange Commission (SEC) and the Commodity Futures and Trading Commission (CFTC) have gone after large centralized crypto players.

Last week, the SEC issued a Wells Notice to Coinbase warning the crypto exchange that it faces a lawsuit over 1) its various betting programs (which the SEC views as unregistered securities) and 2) its listing of tokens, some of which the SEC considers to be securities , which means that Coinbase will then be an unregistered securities exchange.

Elsewhere, the SEC’s ongoing lawsuit against Ripple, the creator of XRP and the XRP Ledger, could come to a head next quarter – XRP has recently rallied on optimism that the SEC will lose its bid to label XRP as an unregistered security issued by Ripple.

Meanwhile, the CFTC announced this week that it is going after Binance over operating under the table as an unregistered US digital commodity exchange and having a bogus AML/KYC compliance program.

These are just a few of the highest profile cases, but they show how the US government in 2023 is trying to make its mark on the crypto market via regulation via enforcement.

The two cases also highlight a clash of visions between the SEC and the CFTC. The former has stated that they view almost all cryptocurrencies as securities.

The latter are considered by many to be commodities. In fact, in its latest lawsuit against Binance, it named Bitcoin, Ether, Litecoin, Tether and Binance USD as commodities.

The SEC has labeled Binance USD as a security in a lawsuit against issuer Paxos, and has indicated that it is also looking at other stablecoins and Ether as securities.

How the SEC vs CFTC battle could affect Crypto/Bitcoin

In the crypto space, it is generally seen as a positive if the CFTC’s view wins and generally seen as a negative if the SEC’s vision wins, as the latter would mean a much more demanding regulatory regime, as well as a mountain of potential fines and penalties for industry players over previous discretion.

More specifically, if the SEC’s argument that most cryptocurrencies are securities gains ground, this is considered likely to slow the development of the crypto industry in the United States.

It is also likely to result in a large increase in barriers to investing in crypto for US-based retail traders and institutions.

That would be a disaster for cryptocurrencies labeled as a security, or at risk of being labeled. But the impact on Bitcoin is unclear.

Counterintuitively, it could benefit Bitcoin if there is a significant flight to port within the crypto space, with Bitcoin the only cryptocurrency the SEC has directly said it does not view as a security.

Traders will be watching closely for an appearance by SEC Chairman Gary Gensler before Congress on the 19th.th April for further guidance on the SEC’s regulatory plans for the crypto sector.

Can the narrative of adoption by Asia gain further ground?

Other regulatory-related themes to monitor include the policy pivot seen in Hong Kong.

Earlier this quarter, Hong Kong announced it would make certain blue-chip cryptocurrencies legal to trade again, announcing a new licensing regime for crypto firms.

Crypto investors saw this as China’s government, which controls politics in Hong Kong, “testing the waters” for a potential reintroduction of crypto in China.

Crypto was outright banned in China in September 2021 and legalization, even of just a small number of known cryptocurrencies, could trigger huge investment inflows.

Further signs of China’s growing interest in a return to the global crypto market could thus provide a strong tailwind for Bitcoin in the coming quarter, as traders point to expected Chinese inflows ahead.

Meanwhile, another regulatory story to watch is the progress of regulation in the UK and Europe. The UK has stated a desire to become a major global crypto hub, while lawmakers in the EU and are currently debating the bloc’s Markets in Crypto Assets (MiCA) bill.