Bitcoin profits are taken as exchange flows increase

Bitcoin flows to and from centralized crypto exchanges have increased to their highest level in ten months. Furthermore, BTC prices are recovering from their minor decline earlier this week.

Bitcoin markets have taken a breather in the last week or so. However, some chain metrics continue to signal that recovery is taking place and that the bears are weakening.

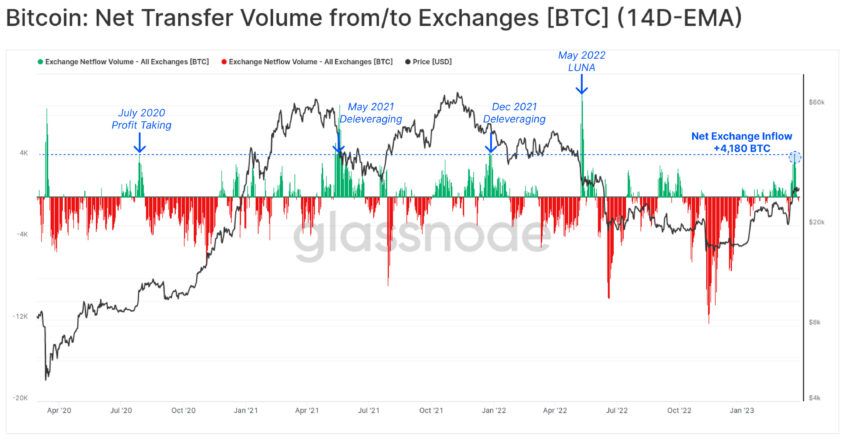

Glassnode’s March 28 “Week on Chain” report showed net currency flows ticking higher by about 4,180 BTC last week. It added that this is the largest net increase since LUNA collapsed in May 2022.

Net currency inflow has been positive for most of this year. This follows a massive exodus of crypto assets from centralized exchanges in Q4 2022 in the wake of the FTX meltdown.

“Past instances of similar or larger net inflows over the past cycle have all been aligned with major market volatility events, usually to the downside,” Glassnode noted.

Bitcoin profit taking

The latest positive flows to stock exchanges are an indication that some profit taking is taking place.

“This suggests that some level of profit-making is underway, as investors take chips off the table.”

The analysts added that 65% of the weekly flow was from short-term holders. Long-term holders accounted for just 7.5% of total deposit volume, it noted.

Last week saw the biggest net gain since May 2022, when the Terra ecosystem collapsed. On March 23, BTC hit a 2023 high of $28,792, but has been retreating ever since.

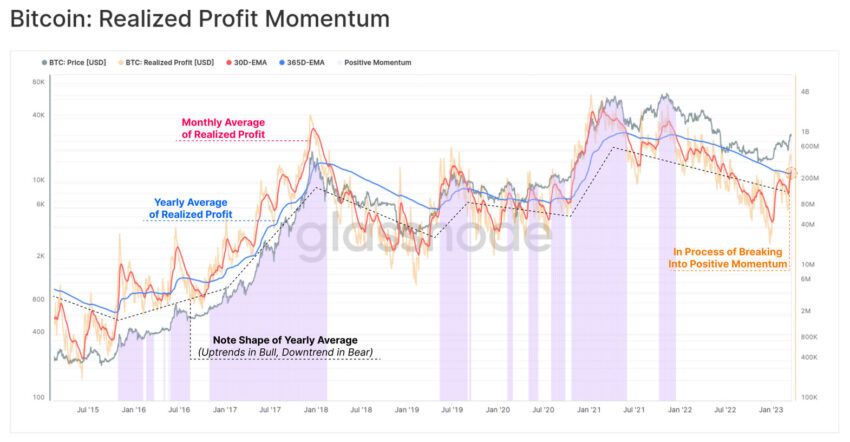

However, Glassnode observed that the size of realized profits is still well below typical bull market levels.

Overall, the markets appear to have moved out of full bear territory, but have yet to enter a bull phase.

“This reinforces our observations from last week that the market appears to have returned to a more neutral gear, resembling a more transitional market structure.”

Furthermore, realized gain momentum appears to have changed to a positive structure. This is an indication of a transitional phase where the markets switch from bear to bull. However, the price does not move in a straight line, so there may still be more downside ahead.

BTC recovers losses

Bitcoin prices are on track to recover this week’s losses caused by the CFTC Binance lawsuit. BTC dropped to an intraday low of $26,700 on March 28, but has since recovered to reach $27,600 during the morning of March 29.

At the time of writing, BTC was trading up 2.3% on the day to $27,588.

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use this information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.