Greenpeace criticizes Bitcoin, ignores energy balancing benefits

How Bitcoin Mining Could Improve Grid Efficiency, Encourage Use of Renewable Energy and Create a More Sustainable Financial System Despite Greenpeace’s Criticism.

Demand response programs have become critical to balancing electricity supply and demand. Essentially, they improve grid efficiency and integrate renewable energy sources as the world moves towards cleaner technologies. Surprisingly, Bitcoin mining can play a significant role in these programs, leading to a more sustainable and efficient financial system.

However, not everyone is on board with this idea, as Greenpeace’s recent campaign against Bitcoin’s climate impact shows.

Greenpeace’s “Skull of Satoshi” artwork

In an effort to raise awareness of the environmental impact of Bitcoin mining, Greenpeace partnered with art activist Benjamin Von Wong for its ongoing “change the code, not the climate” campaign. It aims to convert Bitcoin’s consensus mechanism to a more environmentally friendly proof-of-stake (PoS) model.

March 23, Greenpeace revealed his commissioned artwork, called “Skull of Satoshi”. The “Skull of Satoshi” is an 11-foot-tall (3.3 meter) skull with the Bitcoin logo and red laser eyes.

Made from recycled electronic waste, the head is adorned with “smoke stacks” to symbolize the “fossil fuel and coal pollution” caused by Bitcoin mining and the “millions of computers” used to validate network transactions.

Balancing the Grid with Bitcoin Mining

Despite the controversy surrounding the environmental impact of Bitcoin mining, it has the potential to contribute positively to environmental efforts.

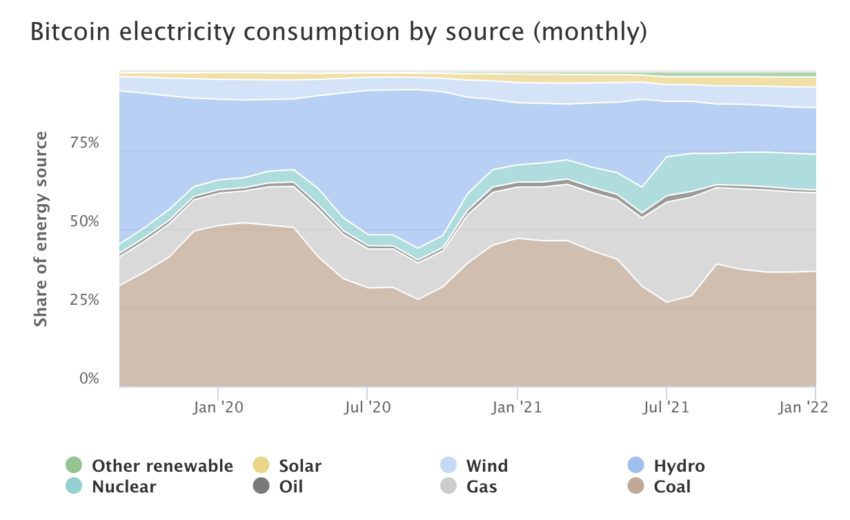

During periods of high demand for electricity, supply is often thin, resulting in increased costs and potential grid instability. Conversely, excess energy, especially from intermittent renewable sources such as solar and wind, can be wasted during periods of low demand. Bitcoin mining offers a solution to this problem.

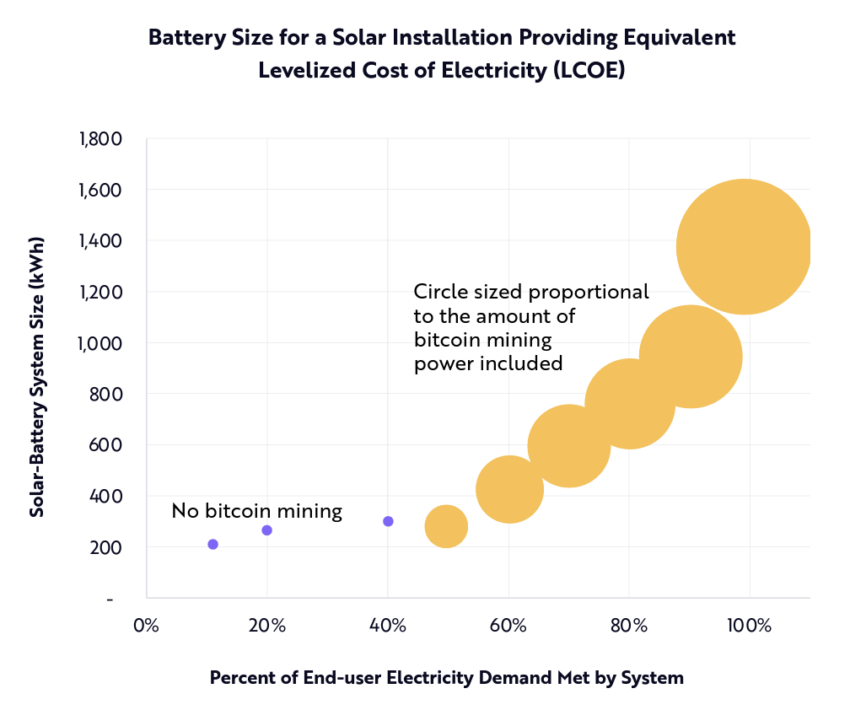

ARK’s research suggests that expanding a solar system’s battery capacity by 4.6 times and integrating a Bitcoin mining operation could meet over 99% of consumer demand while maintaining profitability.

With its on-demand energy consumption, Bitcoin mining can act as a flexible load, adjusting energy use based on network conditions.

By participating in demand response programs, miners help absorb excess energy during periods of low demand, effectively acting as a “battery” that stores energy in the form of digital currency. This process helps balance the grid and promotes the use of renewable and existing natural energy sources.

Fred Thiel, CEO of Marathon Digital Holdings, a Bitcoin mining company with a wind-powered facility in West Texas, said:

“If we want more and more renewable energy to be built in this country, we need to provide a load that allows them to monetize that generation capacity. Bitcoin mining is the perfect load for renewable energy.”

An efficient and environmentally friendly financial system

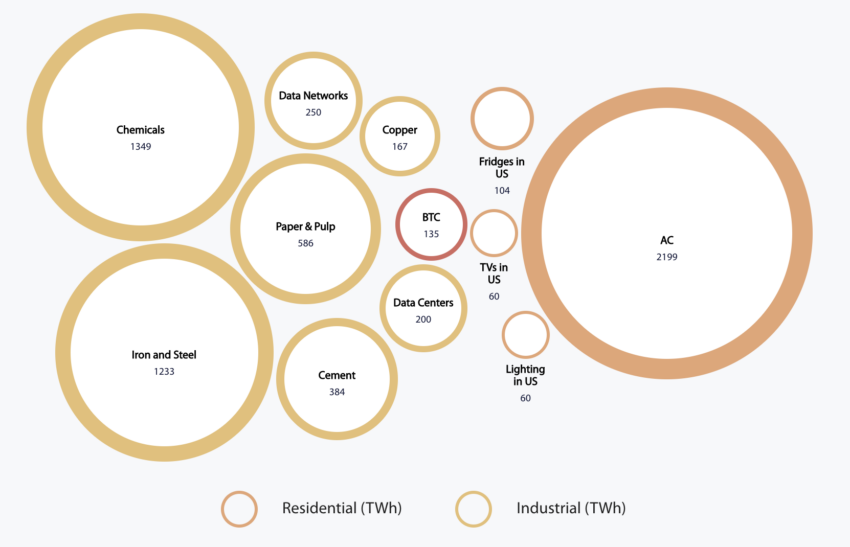

In addition to the environmental benefits, Bitcoin mining contributes to a more streamlined financial system. Traditional fiat-based banking and financial infrastructure requires enormous resources, including millions of employees, thousands of branches, data centers and energy consumption.

In contrast, the Bitcoin network acts as a decentralized economic backbone, requiring far fewer physical resources and personnel to operate.

Bitcoin’s decentralized nature eliminates many intermediaries in the financial system, reducing overhead costs and streamlining processes. This is why Charles Hoskinson, co-founder of Cardano, mean that “crypto must de-risk the unstable and volatile banks.”

A 24/7 global financial network

The Bitcoin network operates 24/7, offering near-instant global settlements. This is in contrast to the slow traditional financial system that can take days to clear and settle cross-border transactions.

According to Cathie Wood, CEO of Ark Invest, as the US banking system faced turmoil due to bank runs that put regional banks at risk, Bitcoin, Ethereum and other cryptos continued to function smoothly. The instability of the banking system posed a threat to stablecoins, which act as gateways to DeFi.

The increased efficiency of the Bitcoin network means reduced energy consumption per transaction. For this reason, switching to a Bitcoin-based financial system can result in significant energy savings. The computing power needed for mining is less resource intensive than maintaining the existing financial infrastructure.

Wood argues that regulators should concentrate on the centralized and opaque weak points of the traditional banking system rather than hindering the progress of decentralized, transparent and accountable financial platforms that lack central points of failure.

As the Bitcoin network continues to mature and gain acceptance as a global financial system, the potential to improve network efficiency and reduce overall energy consumption will become increasingly apparent.

Despite the skepticism expressed by environmental groups such as Greenpeace, Bitcoin mining has the potential to play a central role in the future of energy and finance.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.