BTC, ETH, XRP, BNB, ADA and SOL – Cryptopolitan

The weekly crypto price analysis reveals that most of the coins have been trading in a neutral trend with bulls and bears equally active in the market. Throughout the week, the top coins have remained bounded between their upper and lower limits. Bitcoin has been trading between $26,787 and $28,755 with occasional price increases. Ethereum (ETH) has also been trading in a tight range between its 1,723 and 1,839 levels.

Ripple (XRP) managed to remain a bit more volatile as it has steadily climbed above the $0.40 mark in recent days. Binance Coin (BNB) has been trading in the range of $318 to $324 since last week. Cardano (ADA) has been trading in a range between $0.3328 and $0.3868, while Solana (SOL) had a strong week as it broke out of its previous range and stayed above the $20.00 mark most of the time.

On March 24, unease over the potential resurgence of a banking crisis sent European markets into an unsettling decline. This was triggered when Deutsche Bank’s credit default swaps inexplicably turned volatile on the 23rd – sending shares plunging 11% for no apparent reason. The specter of volatility cast a pall over investors and their decision-making that day, accelerating the market decline across Europe.

Christine Lagarde, president of the European Central Bank, was able to ease global markets with her statement that euro banking institutions were well guarded due to reforms implemented after the global financial crisis. This may partly contribute to the strong rise that US stock indices are experiencing from their low intraday levels. Although the banking crisis has been positive for Bitcoin’s price, crypto prices are still traded in range-limited areas.

BTC/USD

On March 23, Bitcoin formed an intraday candlestick pattern indicating that buyers and sellers were in a state of uncertainty. Bitcoin price has been trading in a range between $26,787 and $28,755, with both buyers and sellers active. BTC/USD is currently trading at $27,556 with a loss of 1.05 percent in the last 24 hours.

The technical indicators for BTC/USD suggest that there is more room for the cryptocurrency to go higher in the near term. RSI has been trading near the 63.53 level and MACD made a bearish crossover today after staying in bullish territory for a while.

ETH/USD

Ethereum has successfully breached the 1700 level in the last few days and is currently trading at $1739 with a loss of 0.97 percent in the last 24 hours. ETH/USD has been consolidating within its range since the beginning of the week and is likely to rise further if it can break above the 1900 level.

The market cap of Ethereum is currently around $213 billion and a 24-hour trading volume of $8.84 billion. The ETH/USD technical indicators suggest that the sellers are in control and the market today following some bullish momentum. The RSI and MACD are bearish while the stochastic oscillator is neutral.

XRP/USD

Ripple managed to remain a bit more volatile as it rallied against the US dollar and breached the $0.40 mark in recent days. XRP/USD is currently trading at $0.444 with a gain of 3.78 percent in the last 24 hours and an increase of almost 8 percent in the last week.

The technical indicators for XRP/USD are mixed, as the MACD is bearish while the RSI and Stochastic Oscillator are bullish. A break above the $0.45 level could trigger more buying and XRP/USD could continue its upward momentum towards the $0.50 mark in the near future, and if bears gain the upper hand, it could fall back towards the $0.40 mark.

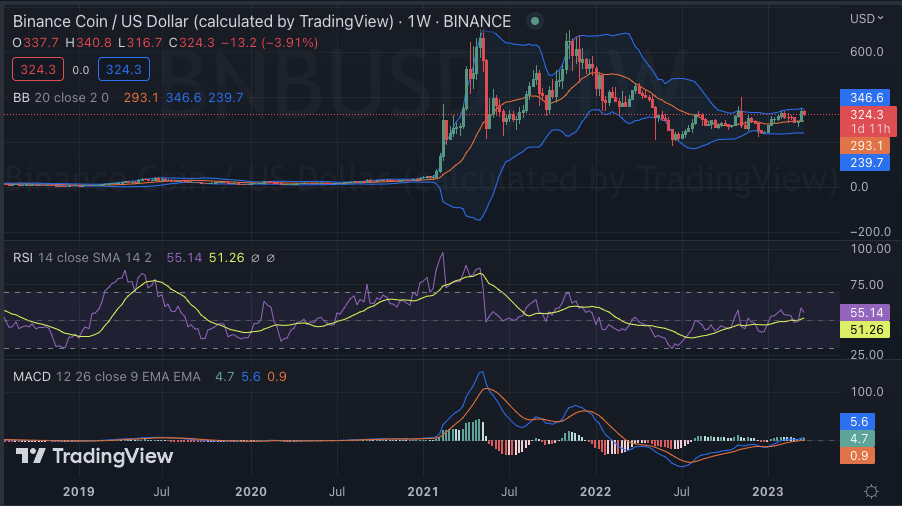

Binance Coin (BNB)/USD

According to our weekly crypto price analysis, Binance Coin has been trading in the neutral zone with bullish and bearish corrections at the same time. Today’s BNB/USD pair is trading at $317.73 with a minor gain of 0.02 percent in the last 24 hours. The coin has also lost more than 5.73 percent in the last seven days.

Looking at the technical indicators, we can see that MACD (Moving Average Convergence Divergence) has crossed the zero line, indicating a bullish trend while RSI (Relative Strength Index) is currently trading near 55.14 levels. On the upside, buyers will look to break through the $324.18 resistance level, while on the downside, they will aim to defend the support around $317.78. If the bulls manage to break through this resistance and maintain the momentum, we could see BNB/USD test its all-time high of $389.39.

ADA/USD

Our weekly crypto price analysis reveals that Cardano has been in a tight range for the past few days as it fluctuates between $0.3328 – $0.3868 with no clear direction in sight yet. Today’s ADA/USD pair is currently trading at $0.3587 with a minor loss of 1.17 percent in the last 24 hours and a total gain of 0.66 percent in the last week.

The technical indicators for ADA/USD are bearish as the MACD is currently in a bearish crossover and the RSI is trading near 45.45 levels. From a support standpoint, buyers will be looking to defend the $0.357 level, while on the upside, they need to break past the $0.3643 resistance for further upside momentum. If the bulls pull it off, we could see ADA/USD trade back in the $0.36 – $0.38 range within a few days. The 50-day moving average still indicates a bearish trend, so traders should be cautious and aware of further downside risks.

SOL/USD

Solana has been quite volatile in recent days as it trades between $20.44 – $23.58 and today’s SOL/USD pair is trading at $20.68 with a loss of 0.91 percent in the last 24 hours and a total decline of 7, 53 percent in the last week.

On the upside, buyers will look to break past $21.69 for further bullish momentum, while on the downside, they will aim to defend the $20.36 level as a key support. If the bulls manage to break through the resistance and maintain the momentum, we could see SOL/USD test its all-time high of $24.64 shortly.

The technical indicators for SOL/USD have been in the mixed territory with the MACD being bearish while the RSI is neutral. The 50-day moving average still indicates a bearish trend, so traders should be wary of further downside risks in the near term.

Weekly Crypto Price Analysis Conclusion

Overall, the market has been quite mixed this week with some coins showing gains while others have lost. It is important to pay close attention to the key levels and technical indicators of each coin before investing or trading. Buyers should look for bullish breakouts while bears should wait for bearish trends to emerge for them to exploit the market. With that in mind, we expect to see some volatility and possible price movements soon as we approach the end of the week.