Bitcoin as a hedge against hyperinflation: the future of finance

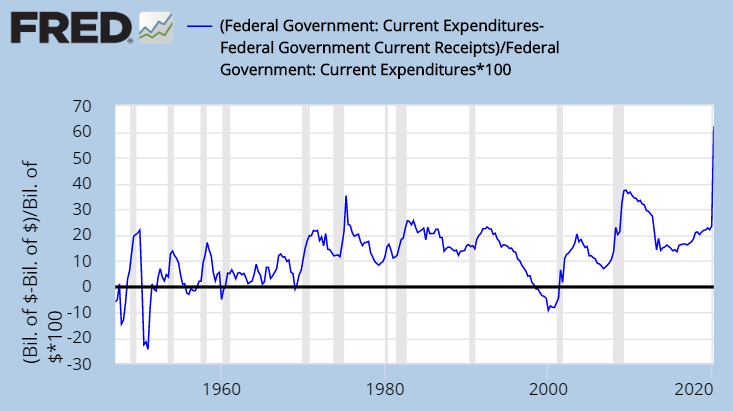

Over the past 50 years, the cost of living has skyrocketed, raising concerns about whether our current economic trajectory is leading to hyperinflation. As prices continue to rise, many are turning to alternative solutions like Bitcoin to protect their wealth and guard against the potential collapse of traditional financial systems.

As we witness a changing global financial landscape, the battle between hyperinflationary fiat currencies and the disruptive power of digital assets like Bitcoin is becoming increasingly apparent. With both sides vying for supremacy, it is crucial to understand the key differences and driving factors that separate them.

A tale of two currencies

The specter of hyperinflation is vast, with notorious examples such as Zimbabwe and Venezuela etched in recent memory. These financial disasters highlight the vulnerability of fiat currencies to the whims of government policies and excessive money printing.

Meanwhile, Bitcoin’s limited supply of 21 million coins has positioned it as a digital alternative to gold. Its decentralized nature provides insulation from monetary policy that contributes to hyperinflation, making it an attractive option for those seeking a hedge. Furthermore, Bitcoin’s global acceptance and growing institutional interest have cemented its status as a viable competitor against traditional currencies.

The Zimbabwean nightmare

In the late 2000s, Zimbabwe experienced one of the worst cases of hyperinflation in history. At its peak, prices doubled every 24 hours, rendering the local currency virtually worthless. The underlying causes included political instability, widespread corruption, and a series of failed economic policies, such as the confiscation of commercial farms and excessive money printing to pay the national debt.

In contrast, the value of Bitcoin has grown exponentially since its inception in 2009. Although it has experienced volatile price swings, it has ultimately proven to be a more stable store of value than the Zimbabwean dollar. Today, a growing number of Zimbabweans are adopting cryptocurrencies such as Bitcoin to circumvent their country’s economic challenges and gain access to global markets.

Venezuela’s cryptocurrency lifeline

Venezuela’s ongoing economic crisis has led to widespread hyperinflation, with the Bolivar’s value plummeting by over 99% in just a few years. In response, many Venezuelans have turned to Bitcoin as a means of preserving their wealth and conducting transactions beyond the reach of government control. They have used the cryptocurrency to buy essential goods and services, pay money abroad and even pay employees.

Remarkably, Venezuela now ranks among the top countries in terms of Bitcoin adoption. This demonstrates the cryptocurrency’s potential to serve as a lifeline in the face of economic turmoil. The government has even launched its own digital currency, the Petro, in an attempt to circumvent international sanctions and stabilize the economy.

A digital haven for the Argentine peso

Argentina has also struggled with chronic inflation, reaching 94.8% in 2022. In an effort to protect their savings, many Argentines have embraced Bitcoin as a viable alternative to the beleaguered peso. This trend reflects a growing recognition of cryptocurrency’s ability to shield wealth from the ravages of hyperinflation.

In addition, the Argentine government has imposed strict capital controls, making it difficult for citizens to access foreign currency. Bitcoin’s decentralized nature allows Argentines to bypass these restrictions and access the global economy, further strengthening its appeal as an alternative to fiat currency.

Bitcoin’s Achilles heel

Despite all its apparent advantages, Bitcoin is not without disadvantages. Cryptocurrency’s volatile price swings can pose risks to those looking to preserve wealth. In addition, the relatively low transaction speeds and high fees may deter some potential users.

Also, governments and central banks are cracking down on cryptocurrencies in an effort to preserve their monetary authority.

Such actions could impede Bitcoin’s adoption and hamper its ability to serve as a hedge against hyperinflation. For example, China’s strict measures against crypto trading and mining have significantly disrupted the global market.

Another issue is the environmental impact of Bitcoin mining. The energy-intensive process is criticized for its significant carbon footprint, prompting some governments to consider measures to curb large-scale mining.

The intersection between traditional and digital finance

As the cost of living rises, attention is drawn to potential of Bitcoin to act as a shield against hyperinflation. Still, Bitcoin’s long-term success remains to be seen, underscoring the importance of adopting sound economic policies and responsible money management.

This convergence of traditional finance and cryptocurrencies signals a pivotal moment in global finance. As central banks venture to create their own digital currencies, or CBDCs, the financial landscape is preparing for a significant shift, transforming the way we perceive and manage money.

Mapping the future

As the world confronts rising costs of living, Bitcoin emerges as a potential hedge for individuals seeking protection from the damaging effects of hyperinflation. While cryptocurrencies offer promising solutions, the journey ahead is fraught with challenges such as regulatory restrictions and environmental concerns. The financial prosperity of countless individuals depends on successfully addressing these issues as we navigate the evolving economic landscape.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.