Crypto VC funding was resilient in the bear market. It is now going through this mini-bull cycle

Join the most important conversation in crypto and web3! Secure your place today

Good morning. Here’s what happens:

Prices: Bitcoin starts Asia trading day in the red for the first time in a long time.

Insight: The crypto venture capital industry is experiencing a mini bull market.

Prices

CoinDesk Market Index (CMI)

1,188

-16.2 1.3%

Bitcoin (BTC)

$28,006

+63.9 0.2%

Ethereum (ETH)

$1760

-17.1 1.0%

S&P 500

3,951.57

+34.9 0.9%

Gold

$1,982

+12.4 0.6%

Nikkei 225

26,945.67

−388.1 1.4%

BTC/ETH prices per CoinDesk indices, as of 07:00 ET (11:00 UTC)

Is Bitcoin’s Rally Coming To An End?

Good morning Asia, here’s how the markets begin the Eastern trading day.

Bitcoin begins the trading day in the red, down 0.63% to $27,805. Ether is down 2.5% to $1,741.

The big question on everyone’s mind is, of course, interest rates.

In a recent note, Goldman Sachs chief economist David Mericle said the Fed will pause rate hikes due to stress on the banking system.

“While policymakers have responded aggressively to prop up the financial system, markets appear to be less than fully convinced that efforts to support small and medium-sized banks will prove sufficient,” Mericle wrote. “We believe Fed officials will therefore share our view that stress in the banking system remains the most immediate concern for now.”

Delphi Digital co-founder Tom Shaughnessy says the market is giving mixed signals. While many say the possibility of the Fed halting interest rate hikes is a bullish signal for bitcoin, the reality may be something else entirely.

“The data suggests that when the Fed stops hiking or swinging, that’s historically when the markets sell off,” he said on a recent CoinDesk TV appearance. “I think the recovery is less about the Fed stopping, and more about liquidity pressure or excess there.”

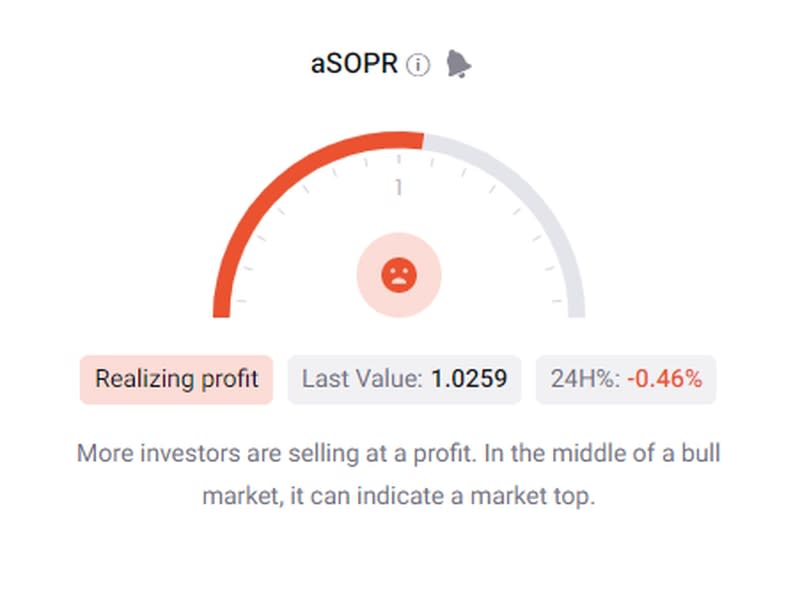

Data from CryptoQuant may support Shaughnessy’s thesis. Its adjusted exit profit gauge, which tracks the profitability of HODLers, shows that more investors are selling at a profit. In the middle of a bull market, this can indicate a market top.

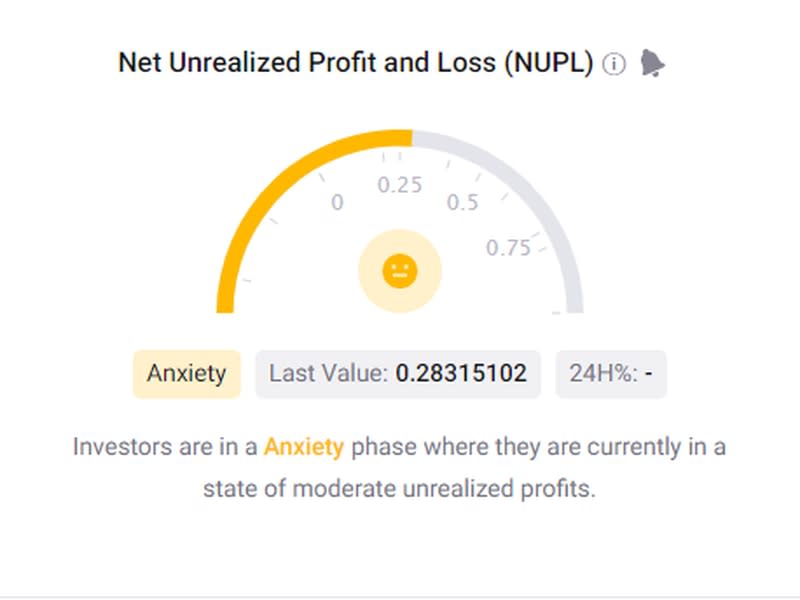

At the same time, net unrealized profits and losses show that investors are in an anxious phase, where they have moderate unrealized profits.

All eyes will be on the Fed’s next announcement to see if it is bullish or bearish for bitcoin.

Biggest winners

Biggest losers

Insight

Crypto VC funding was resilient in the bear market. It is now going through this mini-bull cycle.

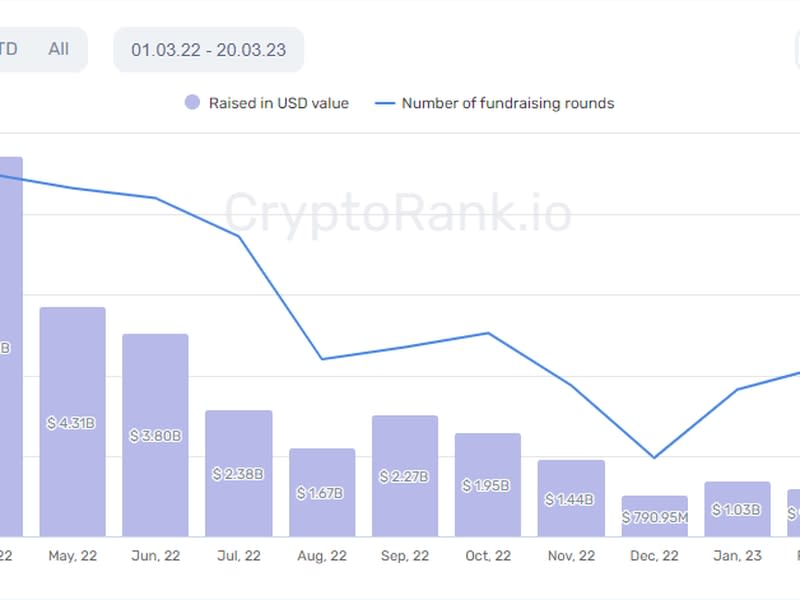

The crypto winter was a tough and cold winter for venture capital deals. A report from CoinDesk in January painted a bleak picture for VC activity: down 91% year-over-year.

But spring has begun, and crypto is once again on the way. The macroeconomic environment has gone a little weird, and bitcoin has $30,000 in its sights.

Crypto VC funding is coming right back with it.

Data from CryptoRank.io shows that a rebound is taking place.

“Despite the inherent volatility of the cryptocurrency market, venture capitalists remain undeterred and continue to invest significantly in the industry, recognizing its enormous potential for long-term growth,” CryptoRank’s analyst team said in a note prepared for CoinDesk.

CryptoRank’s analysts say that the VC market’s confidence is boosted by the significant increase in the number of funding rounds observed in recent months, which the analysts say indicates the growing interest and optimism in the industry.

“Many funds reported losses in 2022 and must now reduce investment activity,” the analysts said in their note. “Other VCs, who were more cautious with their investments last year, are now taking the opportunity to use the preserved capital.

Banking will continue to be a challenge

In the days before Silvergate’s collapse, bitcoin was stuck between Silvergate and China. The looming loss of cryptobanks pulled prices down and increased selling pressure, while the China narrative about Hong Kong’s relaxing institutional and retail regulations pulled it up.

And then the Bank Term Funding Program (BTFP) happened, with a big money print from the Fed.

Risk assets are suddenly back in play.

Banking remains a challenge, but other financial institutions are stepping up to the plate, some of which are outside the US and beyond the reach of its regulatory regime.

For VCs, this is a separate and unique matter; they need a bank that is familiar with the sector. Crypto and tech startups as well as small VC funds are rejected by many banks because they are considered not worth the risk.

“The issue has far broader implications than the temporary depegging of stablecoins. We expect to see a slowdown in VC activity, which will have a knock-on effect on crypto fundraising,” the analysts wrote in their note. “SVB provided one of the most popular banking infrastructures for VC investors. Now they have to look for new opportunities, but the pressure on crypto-friendly banks is a significant red flag.”

This could be Singapore’s time to shine. It is understood that banks with USD rails will step up and fill the gap. DBS is believed to be a contender, given that it operates a crypto exchange. Or, it could be something else entirely.

“Crypto VC fundraising is driven by a younger generation of alternative fund managers breaking out of TradFi institutions to raise equity capital in Asia,” adds Katherine Ng, CEO of TZ APAC, Asia’s leading Tezos blockchain incubator.

For now, US banks still dominate the sector and have outsized influence in all regions. But it may be time for other institutions to step up.

Important events.

08:30 HKT/SGT(00:30 UTC) Reserve Bank of Australia meeting minutes

20:30 HKT/SGT (12:30 UTC) European Central Bank President Lagarde’s speech

20:30 HKT/SGT (12:30 UTC) Bank of Canada Consumer Price Index Core (YoY/Feb)

CoinDesk TV

In case you missed it, here’s the latest episode of “First Mover” on CoinDesk TV:

Bitcoin Breaks Above $28K; New York Community Bank buys large chunk of failed Signature Bank

Non-crypto-related deposits held by former Signature Bank (now Signature Bridge Bank) will be taken over by Flagstar Bank, NA, a subsidiary of New York Community Bancorp, starting Monday, according to the FDIC. Custodia Bank founder and CEO Caitlin Long responded. Additionally, Carole House, former White House National Security Council Director of Cybersecurity and Secure Digital Innovation, discussed her new role on the CFTC’s Technology Advisory Committee.

Headings

The US Supreme Court hears the first crypto case on Tuesday: Coinbase is asking the Supreme Court to put a pair of class-action lawsuits on hold while the exchange tries to force the plaintiffs into arbitration.

Digital asset outflows continue for 6th week despite Bitcoin price rise: The data may reflect investors’ need for liquidity during the banking crisis, says a CoinShares report.

Credit Suisse’s acquisition shows that the banks still have a banking problem: Bitcoin and crypto will not dissolve the banks.

Crypto.com moves closer to an operational license in Dubai: The platform is now in the second phase of a three-state licensing process.

Open Interest in Bitcoin Futures Hits Annual High of $12B: A rise in open interest along with a rise in price is said to confirm an uptrend.