With the crypto economy experiencing significant gains in the past week and the price of ethereum rising 11.9%, the market capitalization of Lido’s staked ether has increased to $10.3 billion. This recent increase has propelled the token’s overall market capitalization to the ninth largest position, according to crypto market capitalization aggregation site coingecko.com.

Lido Finance’s TVL dominates Defi with a share of 21.59%

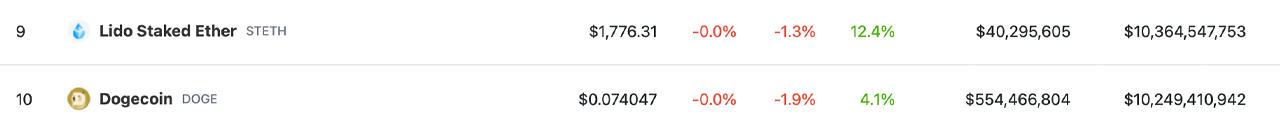

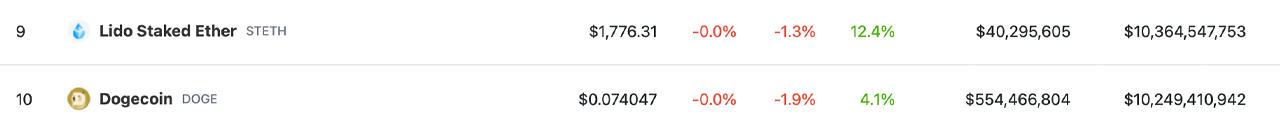

The value of floating staking tokens associated with ethereum (ETH) has increased significantly in the past week following ether’s 11.9% rise against the US dollar. Notably, Lido’s staked ethereum token, STETH, now has a market cap of over $10 billion, reaching $10.36 billion on Monday, March 20, 2023. According to coingecko statistics, STETH’s market cap is now in ninth place, with dogecoin’s (DOGE) market cap letters occupying the tenth position.

Over STETH, the market cap of polygon (MATIC) is at $10.42 billion. Currently, there is a circulating supply of around 5.8 million STETH, and in the last 24 hours, the token has recorded $22.35 million in global trades. The most active exchanges dealing with STETH on Monday are Bybit, Gate.io and Huobi. STETH has gained 12.4% this week and 4.6% over the past 30 days.

Currently, Lido Finance’s website estimates that STETH players receive around 5.9% Annual Percentage Rate (APR) by staking the token. At the time of writing, Lido is the largest decentralized finance protocol (defi) of the total value of $49.01 billion (TVL) on Monday. Lido’s TVL accounts for 21.59% of the entire value locked in defi. Over the past seven days, defillama.com statistics show that Lido’s TVL has increased by 8.9%, and over 30 days it has grown by 17.07%.

Defillama.com explains that as of Monday, 7.83 million ETH worth $13.98 billion have been staked in floating stake protocols today. Lido’s STETH represents 74.51% of the total. Coinbase’s Wrapped Ether token protocol has $2.1 billion in total value locked, or 1.16 million Ethereum. It is the second largest liquid input project in terms of TVL.

While STETH appears on coinecko.com as the ninth largest coin by market capitalization, this is not the case with other crypto market aggregation sites such as coinmarketcap.com. Because it is a synthetic version of Ether, some crypto market aggregation sites do not include STETH in their top ten, despite its capitalization.

Tags in this story

5.9% APR, Assets, Blockchain, coingecko.com, Coinmarketcap.com, Crypto, Crypto Assets, Crypto Market Aggregation Sites, Cryptocurrency, Decentralized Finance, DeFi, defillama.com, Deposits, Developers, Dilution Value, ETH, Ethereum, Ethereum Withdrawal , Lido, Liquid Staking, Mars, Market cap, ninth largest coin, protocol, stake deposit, Staked ETH, Staked Ether, Statistics, STETH, STETH market cap, STETH trades, STETH volume, technology, TVL, value locked

What are your thoughts on the growing market cap of STETH and its role in the growing liquid stake ecosystem? Do you think STETH will continue to climb the ranks of the top cryptocurrencies? Share your thoughts on this topic in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons