Kevin Helms

A student of Austrian economics, Kevin found Bitcoin in 2011 and has been an evangelist ever since. His interests lie in Bitcoin security, open source systems, network effects and the intersection of economics and cryptography.

all about cryptop referances

A US congressman has called on the federal government to temporarily insure all bank deposits in the country. After the collapse of several large banks, he emphasized that if the government does not do this, there will be a race against smaller banks. “This is a contagion that can spread throughout the banking system,” he warned.

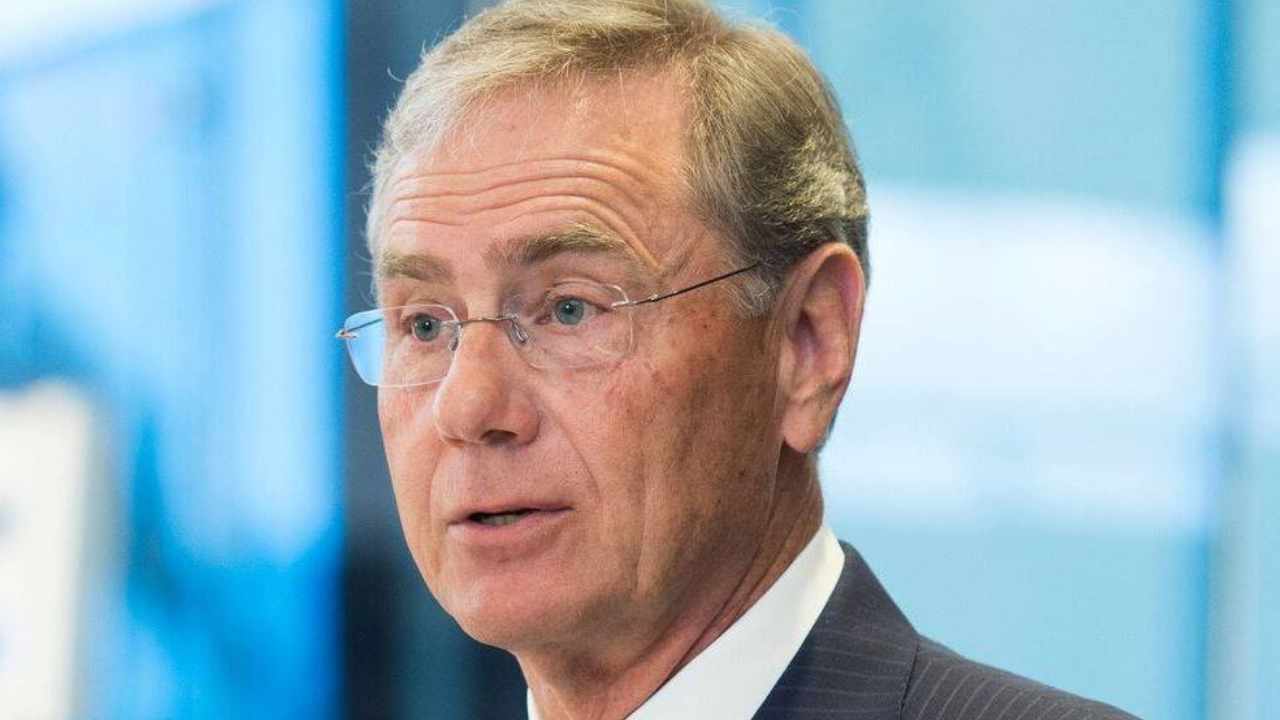

US Congressman Blaine Luetkemeyer (R-MO), a former banker and member of the House Financial Services Committee, said last week that the government should temporarily insure all bank deposits in the country.

His statement followed the collapses of several major banks, including Silicon Valley Bank and Signature Bank. To prevent financial damage, the Biden administration and regulators guaranteed all deposits at the two banks, even those that exceeded the $250,000 Federal Deposit Insurance Corporation (FDIC) deposit insurance limit.

Noting that extending the deposit guarantee would “instill confidence in the system,” Luetkemeyer was quoted by Politico as saying:

If you don’t do this, there’s going to be a run on your smaller banks… Everybody’s going to take their money and run to the JPMorgans and these too-big-to-fail and they’re going to get bigger and everybody else is going to to become smaller and weaker and that will be really bad for our system.

“The thought process here is that this is a contagion that could spread throughout the banking system if it’s not contained and if people don’t stop and be calm in their assessment of the situation,” the congressman said.

He suggested that the government could guarantee “every single deposit in this country and every bank” for six to 12 months until “the interest rate situation [is] solved, and these banks will get back on solid footing,” the news agency reported. However, the publication noted that the congressman later changed his position, and a spokesperson for him stated that the guarantee could be in place for “maybe 30 to 60 days.”

On Friday, Peter Orszag, CEO of financial advisory firm Lazard, shared a similar view in an interview with CNBC. “Regional banks have relied on the business model that relied on uninsured deposits,” he said, adding:

Here’s what needs to happen at this point: The government needs to make explicit what many people assume, which is that uninsured deposits will not exist for the foreseeable future. Everything is insured.

As for whether it would create a moral hazard where banks feel they can “take significant risks with depositors’ money,” Orszag insisted: “I don’t think it will create a moral hazard.” While stressing that “There’s going to be a lot more regulation,” he noted, “You’re going to see continued flow of deposit concentration.”

While some people, like Congressman Luetkemeyer and Orszag, have expressed the need for the federal government to guarantee all deposits in the country, Treasury Secretary Janet Yellen told the Senate Finance Committee on Thursday that not all deposits will be guaranteed. Nonetheless, she insisted that “our banking system remains healthy.”

Do you think the federal government should guarantee all deposits? Let us know in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.