Bitcoin Price Prediction As BTC Breaks Through $27,000 Barrier – Here Are Price Levels To Watch

Bitcoin, the world’s largest cryptocurrency by market capitalization, made headlines recently when it broke through the $27,000 barrier for the first time. This price surge has sparked speculation about where Bitcoin is headed next, with many analysts and investors offering their predictions.

Likewise, Ethereum also drew strong buying interest, with its value increasing by 24.75% to reach the $1,794 mark. However, the reason for this rise can be attributed to the impact of inflation in the US, rather than hyperinflation.

This indicates that the value of the US dollar is declining, which is expected to encourage investors to seek alternative forms of currency to protect their assets.

As a result, Bitcoin, which is decentralized and not connected to any government, can be seen as a more stable investment option, thus increasing demand and increasing its price even more.

In addition, the bullish prediction of former Coinbase CTO Balaji Srinivasan, who says that Bitcoin’s value will reach $1 million in the next 90 days, was perceived as a major factor driving the cryptocurrency’s price.

This optimistic comment is expected to motivate more investors to buy Bitcoin, increasing demand and causing the price to climb even higher.

Risk-on wave in the cryptocurrency market amid the US financial crisis

The global cryptocurrency market has continued to show a bullish sentiment and is still on the rise, reaching over $1.16 trillion. However, the ongoing financial crisis in the United States, particularly the upheaval in the banking industry, has caused investors to turn to cryptocurrency as an alternative.

It is worth noting that the recent bankruptcy of Silvergate, a financial services provider for cryptocurrency companies, along with the government’s acquisition of insolvent banks such as Silicon Valley Bank and Signature Bank, have created challenges for banking businesses related to cryptocurrency.

Therefore, these crises have highlighted the effectiveness of cryptocurrencies, which have emerged as a safe haven during the ongoing financial crisis in the United States.

It is important to note that investors are looking for alternative options to protect their funds, and Bitcoin, which is decentralized and not subject to any government, seems to meet these criteria and is seen as a more reliable investment option.

As a result, the crypto market has been on an upward trend, with Bitcoin and other cryptocurrencies reaching new multi-month highs.

Bitcoin Continues to Rise, Analysis Suggests Potential for Further Growth

Since Wednesday, the price of Bitcoin has continued to rise, recently passing $27,000, resulting in an increase in profitable transactions on the BTC network compared to unprofitable ones.

Furthermore, a new research report from CryptoQuant author and analyst Ankur Banerjee, using the Elliott Waves analysis approach, indicates that Bitcoin, the world’s largest cryptocurrency, has the potential for further value growth.

This optimistic forecast is likely to increase demand for Bitcoin and increase its price, as investors may see it as a potentially profitable investment option.

Ex Coinbase CTO Bets $2 Million on Bitcoin Hitting $1 Million

Balaji Srinivasan has placed a $2 million bet that Bitcoin’s price will reach $1 million by June 17. Balaji S. Srinivasan is a businessman and investor from the United States. He was previously the Chief Technical Officer of Coinbase and one of the founders of Counsyl.

Balaji Srinivasan has placed a $2 million bet on Bitcoin reaching $1 million in value, citing his belief that hyperinflation in the US will make BTC more attractive. If Bitcoin fails to reach the $1 million mark, Srinivasan will lose the bet and will have to pay 1 BTC and $1 million in USDC to the person who placed the bet.

However, if Bitcoin’s price reaches $1 million, Srinivasan will receive 1 BTC and $1 million in USDC, potentially attracting more investors to the cryptocurrency.

Bitcoin price

Bitcoin is currently trading at $27,200 with a 24-hour trading volume of $32.3 billion. Bitcoin has fallen by 0.64% in the last 24 hours. On the technical front, the BTC/USD pair is trading with a bullish bias, facing immediate resistance at the $27,740 level.

On the upside, if there is a bullish breakout of the $27,740 level, it could potentially drive BTC’s price towards the $29,000 or $30,700 mark. Meanwhile, the support level is holding steady at around $26,600 and $25,200.

Buy BTC now

Top 15 Cryptocurrencies to Watch in 2023

Industry Talk has compiled a list of the top 15 cryptocurrencies to watch in 2023, with insights from the experts at Cryptonews. Whether you are a seasoned crypto investor or new to the market, this list provides valuable information on promising altcoins that could potentially have a significant impact on the industry.

Stay updated with new ICO projects and altcoins by checking back regularly.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

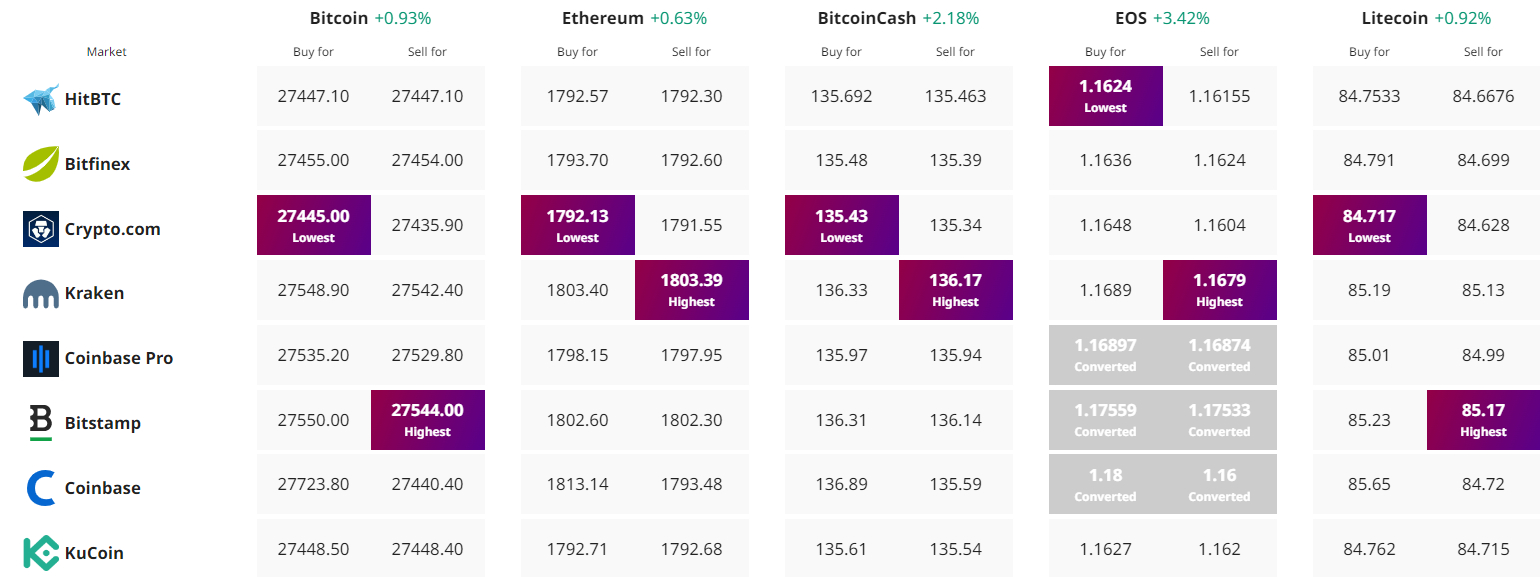

Find the best price to buy/sell cryptocurrency