Quant Suggests Tesla’s Bitcoin Dump Behind Recent Red Coinbase Premium

A crowd has suggested that the reason behind the recent negative Coinbase Premium may have been due to Tesla’s Bitcoin sale.

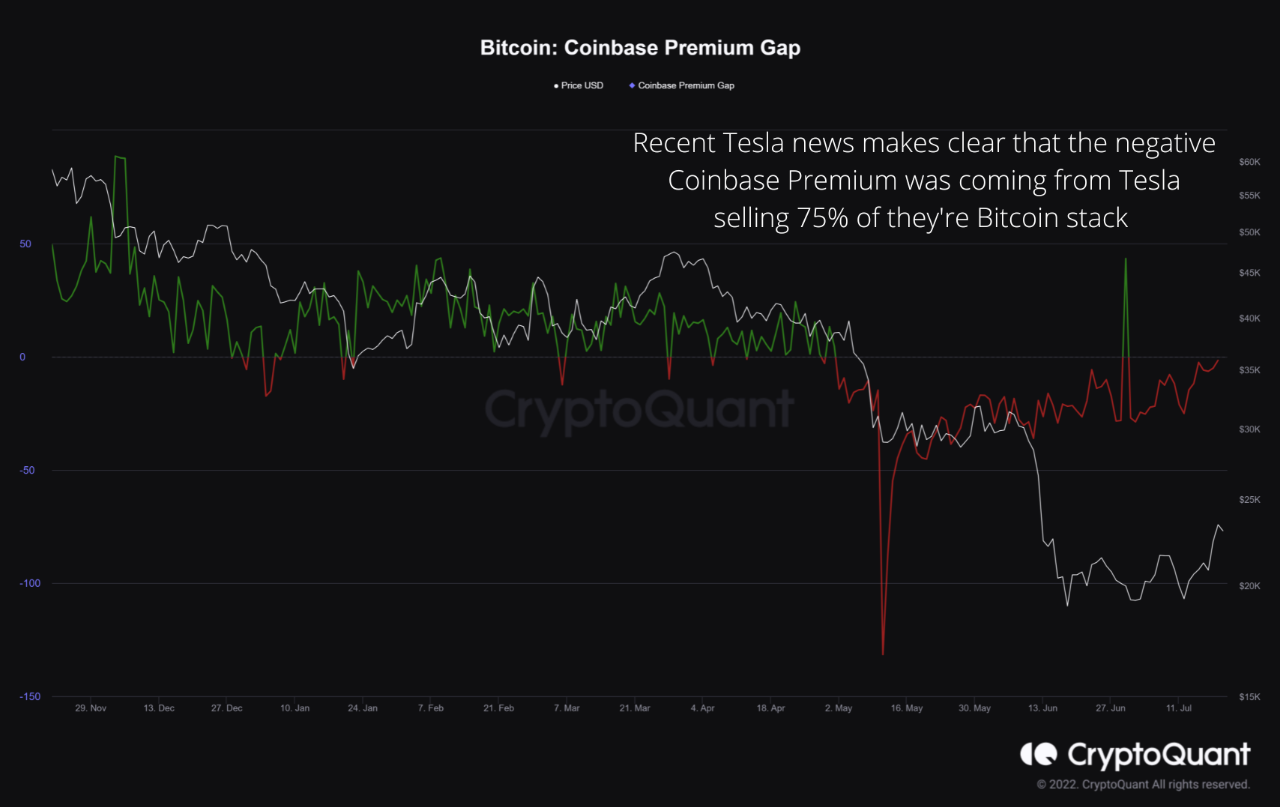

Tesla Dumps 75% of Bitcoin Inventory May Be Behind Negative Coinbase Premium Gap

As explained by an analyst in a CryptoQuant post, the news of Tesla selling 75% of its BTC holdings appears to be behind the recent negative premium gap on Coinbase.

“Coinbase premium gap” is an indicator that measures the price difference between the Bitcoin listings on the crypto exchanges Coinbase and Binance.

Since Coinbase is popularly used by US investors (especially large institutions) while Binance has a more global user base, this indicator can tell us about the buying or selling behavior of the US-based owners.

When the value of the metric is negative, it means that the value of BTC listed on Coinbase is currently less than on Binance. This suggests that there has been some selling by American investors.

Related Reading | Bitcoin Hashrate Downtrend Leads to Largest Negative Difficulty Adjustment in a Year

On the other hand, the value of the prize gap being greater than zero means that there are currently purchases on Coinbase.

Now, here is a chart showing the trend of the Bitcoin Coinbase prize gap over the past few months:

The value of the metric seems to have been red during the past couple of months | Source: CryptoQuant

As you can see in the graph above, the Bitcoin Coinbase prize gap has been negative for quite some time now, in addition to a brief spike to greenbacks.

Quant notes that this was an indication that there was continued heavy selling by high net worth investors or institutions based in the US.

Related Reading | Uniglo (GLO) Unveils Fractional Ownership, Eclipsing Bitcoin (BTC), Ethereum (ETH) and Cardano (ADA)

The recent news that Tesla has dumped 75% of its total BTC holdings makes it clear that the source of the sale was Elon Musk’s company.

As visible in the chart, the Coinbase premium gap has also improved in recent days as selling pressure from Tesla has subsided.

BTC price

At the time of writing, Bitcoin’s price is hovering around $22.6k, up 15% in the last seven days. Over the past month, the crypto has gained 10% in value.

The chart below shows the trend in the price of the coin over the last five days.

Looks like the value of the crypto has shown some decline over the last 24 hours | Source: BTCUSD on TradingView

A couple of days ago, Bitcoin had observed a strong uptrend, but in the last 24 hours the coin has fallen as a reaction to the news of Tesla’s dump.

Featured image from Shubham Dhage on Unsplash.com, charts from TradingView.com, CryptoQuant.com