Banks may lose out to stablecoins if they don’t match corporate demand for DLT, blockchain payments – Ledger Insights

Late last year, research involving 830 large companies found that corporate treasurers and CFOs want to use blockchain, particularly for supply chain, trade finance and cross-border payments. However, the company’s view is that the banks are not keeping up. Report authors east & partners and PCM warn that banks must move faster or risk new competitors exploiting stablecoins to offer businesses the services they demand.

The researchers note that banks no longer rank as major players in cross-border personal money transfers, with banks charging nearly double their most expensive non-bank competitor. However, consumer-to-consumer cross-border payments are just $800 billion a year compared to a B2B figure of $150.7 trillion, according to EY. So there is a lot for the banks to lose.

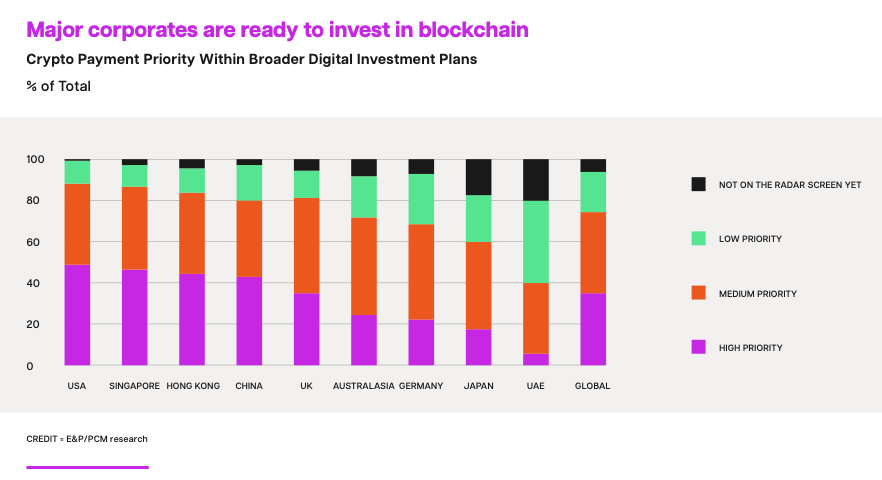

Blockchain solutions have a high priority

More than three-quarters of companies said blockchain solutions were a medium or high priority for their treasury teams, with China and the US leading the way. However, there may be some bias because participating in the research required the treasurer or CFO to have some understanding of CBDC, stablecoins, blockchain or cryptocurrency.

Sustaining competitive advantage ranked as a key driver of enterprise adoption (37.6%), particularly in Asia. A quarter of large companies see maintenance costs for older systems as a key motivation. Just over half of the respondents expect blockchain to enable cheaper transactions and settlements, closely followed by speeding up transactions. This particularly applies to cross-border payments for less popular currency pairs. More than a third (37.7%) expect blockchain to make transactions safer.

Businesses found several barriers to adopting DLT solutions, with a lack of connected partners ranking highest at 45%. This may be because some trade finance platforms, such as we.trade and Marco Polo, failed to gain traction. Other significant barriers include high start-up costs (31.1%) and lack of support from their banking partner (30.1%). They also see blockchain adoption as an increasing cybersecurity risk (42%), but the security risk of cryptocurrencies is perceived to be far higher (70.5%).

While several questions focused on crypto payments, the researchers believe the responses indicate minimal experience handling crypto payments from many finance departments.

Lack of bank support

A small number of comments show a lack of bank support. A large German manufacturer observed: “Our banks are not particularly helpful or informative, but there is a lot of noise out there.”

A major UK wholesaler said: “From what we’ve seen, there are some implementation hurdles in DLT; The banks seem to be making it up as they go along, which doesn’t make it any easier.”

“We’ve been chasing our payments bank for guidance on where they’re at with DLT payment solutions and haven’t really had much of a response,” said one major Australian agricultural exporter. “Difficult for us to move forward without knowing how our bank handles the technology.”

At Ledger Insights, we have seen that the vast majority of banking companies focus on trade finance and bond issuance. There is a lot of interest in DLT for securities settlement, but less banking for corporate payments, although there are certainly pockets of activity.

The report shows that some treasury departments are already experimenting with stablecoins. However, stablecoins are very thinly traded apart from the US dollar, which is not mentioned in the report. It raises the question of the extent to which businesses plan to use stablecoins for trade finance and cross-border payments unless they pay or receive in US dollars.

A useful tip that makes sense: corporate treasurers are more comfortable talking about CBDC and stablecoins rather than blockchain, DLT and cryptocurrency.