Cryptocurrency prices rise due to support for depositors from Silicon Valley Bank

Cryptocurrency prices have risen as investors breathed a sigh of relief that US regulators moved to strengthen the US banking system following the collapse of Silicon Valley Bank.

Bitcoin and ether, the two most traded coins, have risen by a fifth since their lows on Friday, as traders were reassured by promises from the US government that deposits in the failed Silicon Valley and Signature banks would be protected. Bitcoin jumped 6 percent on Monday alone.

The two banks, along with Silvergate, which also failed last week, were used by crypto companies as conduits for payments between crypto and sovereign money, and custodians of assets.

The rising asset prices are a sharp reversal after months of pressure from US banking regulators, who have been scrutinizing the links between the crypto world and the traditional financial system. Authorities have repeatedly warned banks about the potential risks associated with holding crypto deposits.

Over the past five years, banks such as Signature and Silvergate had sought to appropriate billions of dollars in deposits from crypto customers, building specialized payment networks to handle conversions from dollars to digital tokens.

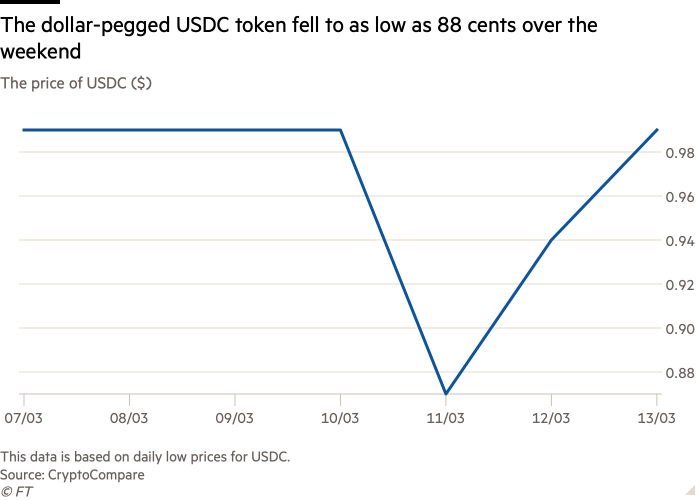

The so-called stablecoin run by US company Circle, called USDC, also surged after the Federal Reserve and Treasury increased lenders’ access to quick cash following government takeovers of Silicon Valley Bank and Signature. USDC is the second largest stable coin in the crypto market.

Stablecoins play a key role in connecting traditional and crypto markets, and traders use them as cash or a store of value between crypto trades. USDC usually tracks the value of the dollar one-to-one, but traded as low as 88 cents on Saturday after Circle said it had a $3.3 billion exposure to SVB. The value of the USDC stablecoin rose to more than 99 cents on Monday.

“The Fed and others have indirectly helped avert another crypto crisis,” said Ram Ahluwalia, CEO of investment adviser Lumida Wealth Management. “They didn’t intend to bail out crypto, but the USDC stablecoin – and by extension the rest of the digital asset market – was a boon to US regulators bailing out SVB depositors.”

Michael Safai, managing partner at crypto trading firm Dexterity Capital, said he had been concerned about the widening gap between the price of USDC depegging and the dollar.

“It definitely wasn’t going to be a good thing and we’re glad it worked out the way it did all things considered,” he said.

Many of the listed crypto-related companies also rose on Monday as the stock markets reopened. Crypto exchange Coinbase rose 10 percent and miner Marathon Digital rose 20 percent after it said its $142 million in cash at Signature was safe and accessible.

“Crypto is not going to live in a cartoon metaverse, it needs access to the real world. The industry’s weakest feature remains its links to regulated banking,” said Ilan Solot, co-head of digital assets at Marex, a financial services platform.