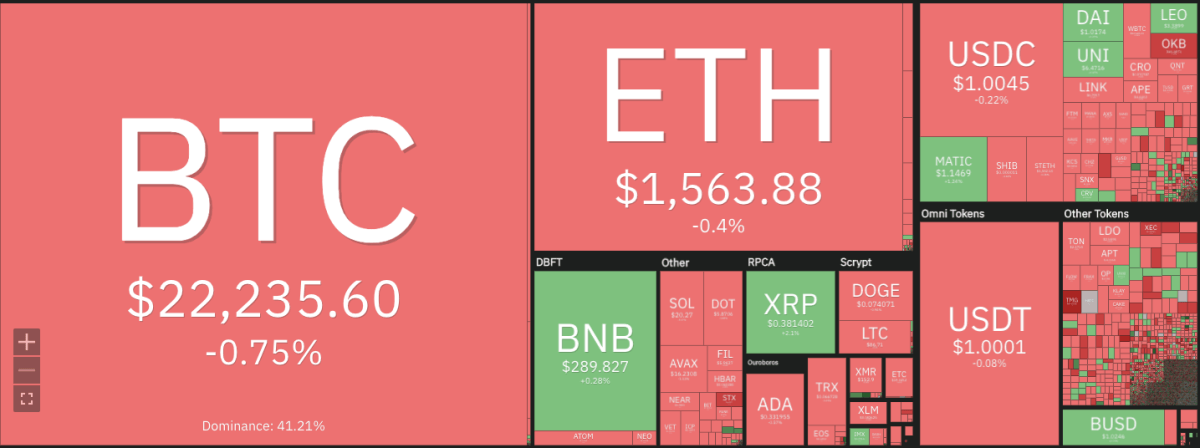

BTC shows a descending pattern following a bearish takeover – Cryptopolitan

Bitcoin price analysis shows a decrease in price today. The day started with selling pressure building in the market, and the price fell from $22,539 to $22,316. The BTC/USD pair has been consolidating since yesterday and a breakout is yet to be observed in the coming days as the coin is still holding its price level. Selling pressure brings the price down towards the moving average value.

The bearish momentum is overwhelming as buyers pull back, contributing to the decline. The downward pressure looks set to continue for the rest of the day, and the price may go further down than today’s price level.

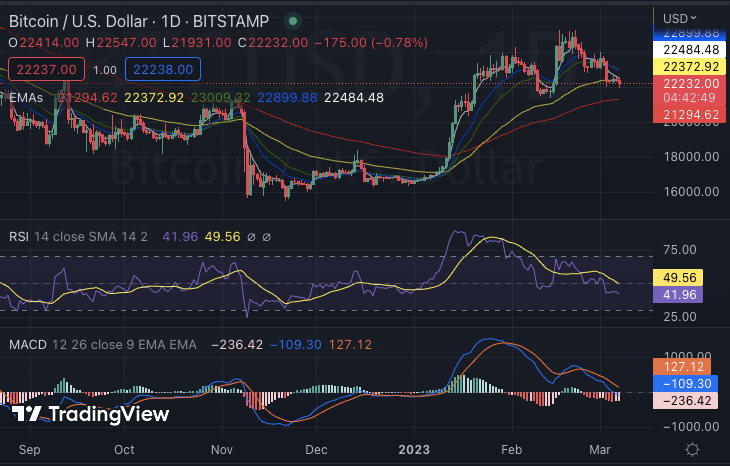

Bitcoin Price Analysis on a 1-Day Price Chart: Bears Take Control as BTC/USD Breaks Key Support at $22,069

Bitcoin price analysis 1-day price chart also shows bearish momentum as the bears maintain their advantage. The BTC value has decreased somewhat in the last couple of hours. At the time of writing, it is $22,316 and on the way down. The BTC/USD pair has lost around 1.43 percent since the start of the current session. Bitcoin price analysis trading volume is considered to be relatively low at the moment, indicating a lack of buyers in the market. It currently stands at $21 billion, with a market cap of $428 million.

The daily chart for BTC indicates a bearish crossover with the MACD, indicating more losses in the short term. The Relative Strength Index (RSI) is still trending lower and is currently positioned at 41.96; any further downward pressure could make it even lower. The 50-day exponential moving average (EMA) is currently noted at $21,931, while the 200-day EMA is seen around $22,232, indicating that bulls need to take control of the market soon and bring in some buying pressure or prices may continue lower from here.

BTC/USD 4-Hour Price Chart: Price action expected to remain bearish

The 4-hour Bitcoin price analysis shows that the price level will continue to decline as long as the bears maintain their dominance. The BTC value is hovering around $22,316 after going through some degree of decline in the last few hours. The hourly technical indicators show that the 9-EMA and 21-EMA are also bearish and indicate a downtrend for the pair. The relative strength index (RSI) has dropped to an index of 34.46 on the hourly charts. It is now in the direction of the oversold region.

The MACD levels also show bearish momentum in the market, with the orange line below the blue line. The MACD histogram also appears to be in negative territory, indicating a bearish market for BTC.

Bitcoin price analysis conclusion

Overall, Bitcoin price analysis shows that bears are still in control of the market and will maintain their dominance if no bullish momentum is seen in the short term. The support level for the token is present at the $22,069 level, which, if broken, could signal further losses for BTC. On the upside, resistance is present at the $22,539 level, which, if breached, could signal an upside in prices.

While you wait for Bitcoin to move forward, check out our price estimates on XDC, Polkadot and Curve