FTX’s crash exposes black holes in insurance that risk hindering the recovery of the crypto sector

There is a long road ahead of us to repair confidence in crypto after unprecedented bankruptcies and hacks, including the major challenge of providing investors with a way to insure themselves against such events.

Brokerage accounts often come with some coverage against outcomes such as bankruptcy, but digital asset platforms provide little if any shield, a reality underscored by the November collapse of Sam Bankman-Fried’s FTX exchange.

Investors seeking such guidelines face a tough task. Traditional insurers are wary, and crypto-native solutions in decentralized finance – or DeFi – account for a fraction of the $1.1 trillion digital asset sector. For example, funds locked in DeFi insurance protocols amount to about $300 million, compared to more than $80 billion in DeFi services overall, according to data from DeFiLlama.

DeFi uses digital ledgers and automatically runs software known as smart contracts to deliver services, cutting out middlemen.

‘Very hard’

“Last year highlighted the importance of insurance, but it seems like a very difficult problem for DeFi to solve,” said Riyad Carey, a research analyst at crypto data provider Kaiko. “Defending a protocol or position is challenging.”

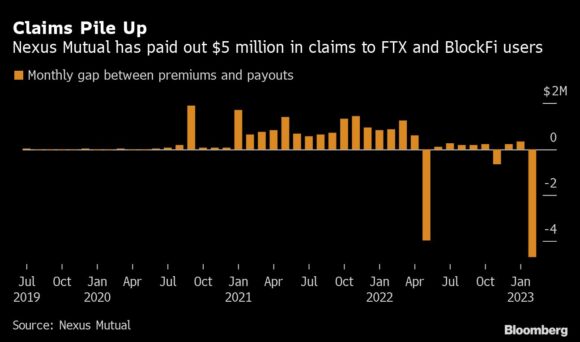

The largest DeFi insurance provider is Nexus Mutual, a membership-based service that accounts for approximately 70% of funds locked in crypto-native insurance protocols. Nexus Mutual has paid out approximately $5 million in claims from the bankruptcies of FTX and crypto lender BlockFi. It expects to pay another $2 million, but those numbers are dwarfed by the billions of dollars removed by FTX alone.

“One of the things we underestimated a little bit was how correlated they were,” said Nexus Mutual founder Hugh Karp, referring to the risk profiles of centralized crypto lenders and custodians. “They all fell together at the same time — they weren’t necessarily independent.”

Stable coins, bridges

However, Nexus Mutual’s risk experts decided not to offer coverage for algorithmic stable coins and software bridges connecting different blockchains. Both of these segments suffered heavy losses last year: the TerraUSD stablecoin ecosystem suffered a $60 billion wipeout, while cross-chain bridge hacks accounted for 64% of the estimated $3.1 billion stolen from DeFi services.

The surge in recent bankruptcy-related claims led payouts to exceed premiums in January by a record $4.7 million at Nexus Mutual. Karp said the insurance pool has sufficient funds to absorb the trend.

Karp argues that DeFi insurance will play a larger role as the digital asset industry matures. Kaikos Carey sees a lot of unmet demand that can be captured by new players, such as older insurance companies.

At the same time, Bitcoin and Ether reserves at centralized crypto exchanges have declined since the dissolution of FTX – a sign that many investors have opted for the added protection of keeping custody of their tokens offline, rather than on digital asset platforms.

Photograph: The FTX Cryptocurrency Derivatives Exchange logo on a laptop screen staged in Riga, Latvia, November 24, 2022. The implosion of Sam Bankman-Fried’s FTX empire dealt a heavy blow to the Bahamas’ ambitions to be a hub for the crypto industry, and it causes massive pain to the locals who treated the now bankrupt exchange like a bank. Photo credit: Andrey Rudakov/Bloomberg

Copyright 2023 Bloomberg.

The most important insurance news, in your inbox every working day.

Get the insurance industry’s trusted newsletter