Bybit expands Mastercard’s crypto footprint with new debit card

Dubai-based crypto exchange Bybit plans to launch a new debit card on the Mastercard network to allow crypto payments in the US and some European states.

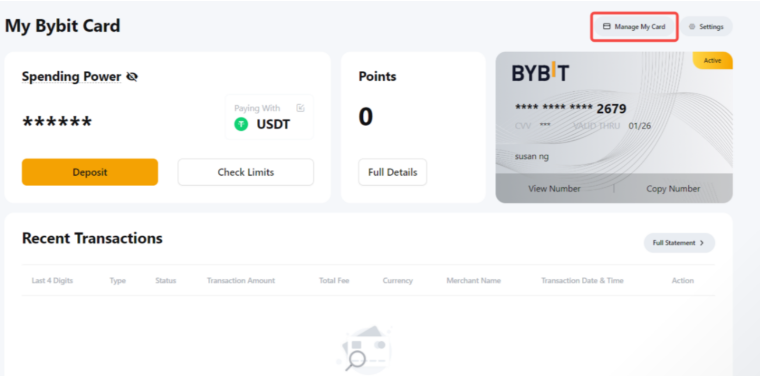

Bybit will convert customers’ Bitcoin, Ether, USDC, USDT or XRP balances into US Dollars or Euros before payment.

Bybit debit card attracts 0.9% conversion fee for crypto payments

At launch, the card will be available to residents of the UK and certain countries within the European Economic Area. Bybit requires a minimum crypto balance worth 10 pounds sterling or euros for crypto payments.

The card will first try to use fiat or convert the customer’s chosen crypto to fiat for payments. Bybit will charge a crypto conversion fee of 9% for crypto payments. Payments made in foreign currency attract an additional 0.5% foreign exchange fee. If the balance of the selected crypto-asset is insufficient, the transaction will be rejected. The exchange will freeze customer funds until the seller completes the transaction.

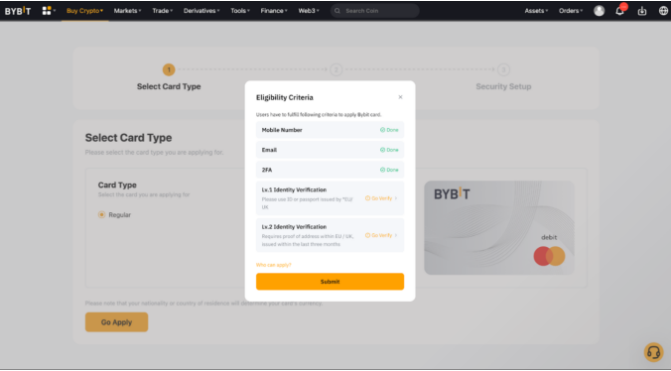

Bybit users who apply for the card must link an email address and phone number to their Bybit account. This information will enable the use of Google Two Factor Authentication. Customers in the United States and some countries in the European Economic Area must also submit a passport or identity card and proof of address no older than three months to complete an identity verification process.

Binance launched a Mastercard debit card in Latin America in January 2023 to enable Brailizan customers to pay at Mastercard-approved merchants using 14 cryptoassets.

Do Payment Networks Prefer Centralized Stablecoins?

Stablecoins create an important link between decentralized and traditional financial worlds. They are tied to the value of one unit of a specific fiat currency through algorithms that use other cryptocurrencies or off-chain assets such as government bonds.

Payment networks such as Mastercard can redeem stablecoins that exchanges send for real currencies without having to convert them to fiat currency. In particular, these networks favor issuers of centralized stablecoins rather than decentralized stablecoins.

Mastercard’s recent partnership with Web 3 firm Immersve allows users to pay for virtual and physical goods and services using Mastercard’s network. Users pay for purchases using crypto in self-storage crypto wallets. After a successful transaction, users’ crypto is converted to USDC stablecoin for fiat settlement on the Mastercard network.

A recent report suggested that Mastercard and Visa were “hitting the brakes” on their crypto assets, although Visa’s crypto chief said they would continue to pursue projects related to stablecoin settlements.

Centralized issuers Tether and Circle maintain the value of their coins using fiat reserves.

Decentralized issuers, on the other hand, often maintain the value of their coins through arbitrage or over-collateralization algorithms. For example, to mint one DAI, the stablecoin issued by the decentralized protocol MakerDAO, you must pledge more than $1 in ETH.

However, decentralized stablecoins can pose a higher risk to payment networks than centralized coins because their weaknesses often only become apparent during periods of market stress.

DAI lost its peg to the US dollar during a crash in March 2020. It rose to $1.10, prompting the issuer to introduce additional arbitrage mechanisms to maintain the link. Decentralized stablecoin UST was knocked off the hook by several large transactions underscoring its algorithmic arbitrage mechanism on the weekend of May 7, 2022.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Sponsored

Sponsored

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.