Bitcoin Price Prediction As Uncertainty And Doubt In Connection Fear Sends BTC To $22,000 Level – Where Is BTC Heading Now?

The price of Bitcoin has been very volatile in recent days due to the uncertainty surrounding Tether, the world’s largest stablecoin. Tether has been facing legal issues, which has led to fear, uncertainty and doubt in the cryptocurrency market, causing BTC to fall to the $22,000 level.

Meanwhile, several well-known cryptocurrencies, including Litecoin (LTC) and Dogecoin (DOGE), have also seen small price declines.

The recent decline in the crypto market can be attributed to the release of US manufacturing numbers and concerns about the availability of banking services for crypto companies in the US.

In this article, we will examine the current state of the cryptocurrency market and make a Bitcoin price prediction for the coming days.

Silvergate Uncertainty, Weakened Crypto

After the market closed on Wednesday, Silvergate filed a report with the Securities and Exchange Commission (SEC), announcing a delay in filing its annual report as it assesses the impact of several events on its operations.

As a result, the value of cryptocurrencies, including Bitcoin, fell sharply and have shown mixed signals. It is worth noting that the Silvergate event has had a significant impact on the value of cryptocurrencies.

Notably, Silvergate Capital ( SI ) announced Wednesday night that it would delay filing its annual report due to losses incurred from the FTX crash in November and several regulatory probes.

Consequently, this had a detrimental impact on market sentiment, causing investors and traders to lose faith in the stability and security of the crypto industry, which could result in a widespread sell-off in the market.

Also, the backlash against Silvergate Capital has led to increased regulatory scrutiny of the cryptocurrency industry, making authorities more hesitant to issue licenses to crypto-related businesses. This could potentially limit the industry’s growth and expansion.

Risk aversion in the Bitcoin market

The global cryptocurrency market is poised to end the week on a bearish note due to a number of factors. The release of robust US economic data has raised speculation that the Federal Reserve may take more aggressive action to combat persistent inflation by raising interest rates.

Investors and traders closely monitor economic indicators in preparation for potential interest rate hikes and inflation. With a good economy and continued inflationary pressure present, it is likely that the Federal Reserve will increase the key interest rate to a level higher than expected at the end of last year.

Bitcoin price

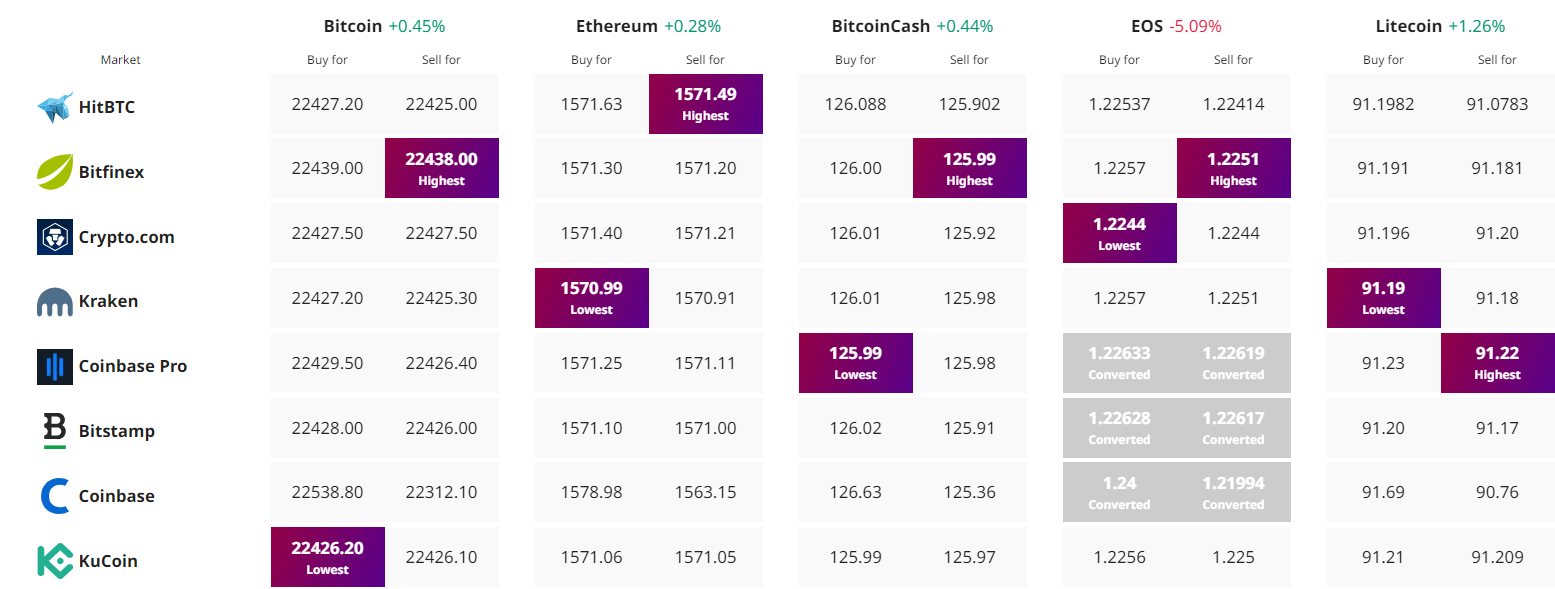

Bitcoin is currently priced at $22,357 with a 24-hour trading volume of $18.5 billion, showing a fall of 0.25% in the last 24 hours. Similarly, Ethereum is trading at $1,570 with a 24-hour trading volume of $6.7 billion and has fallen by 0.15% in the last 24 hours.

According to technical analysis, the BTC/USD pair may break the symmetrical triangle pattern at the $23,250 level. In such a scenario, the BTC price may be exposed to the support zone of $22,046. A further breakdown below this support zone may cause BTC to fall to $21,450.

Also, the presence of a bearish engulfing candle indicates a strong selling bias. However, if the candles close above this level, a bullish bounce-off could occur, targeting $22,800 or higher, towards $23,750.

Buy BTC now

Bitcoin Alternatives

Investors interested in buying Bitcoin may want to explore alternative options that offer greater potential for short-term growth.

Cryptonews has conducted a comprehensive analysis of the top 15 cryptocurrencies that investors should consider for 2023. Click the link below to learn more.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

Find the best price to buy/sell cryptocurrency