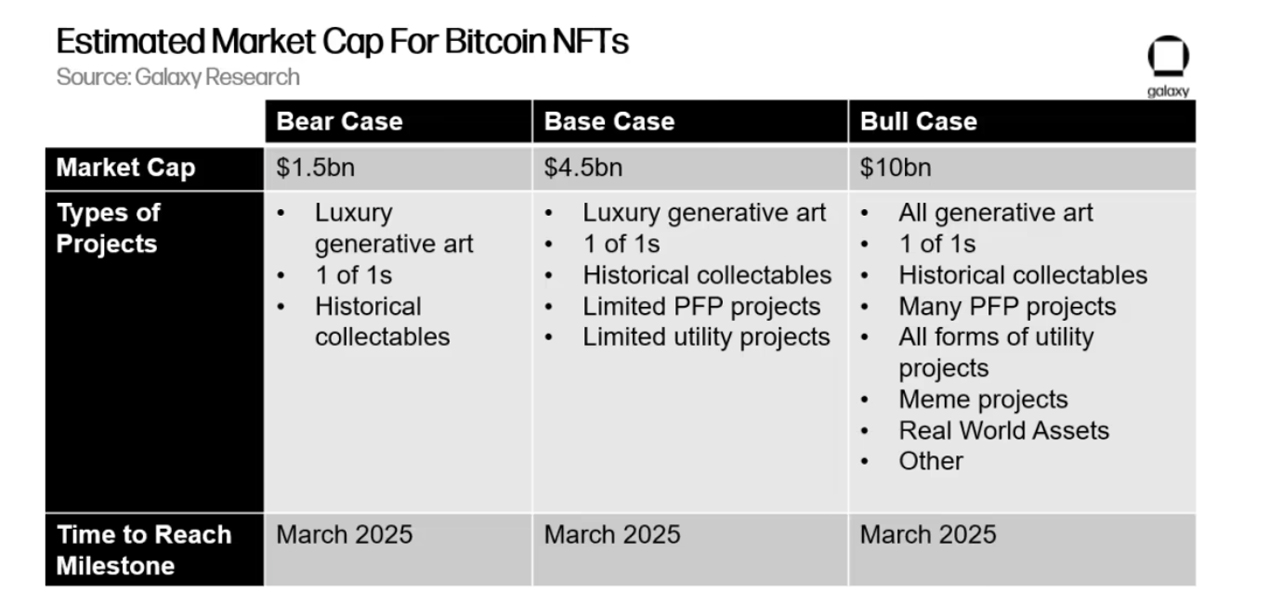

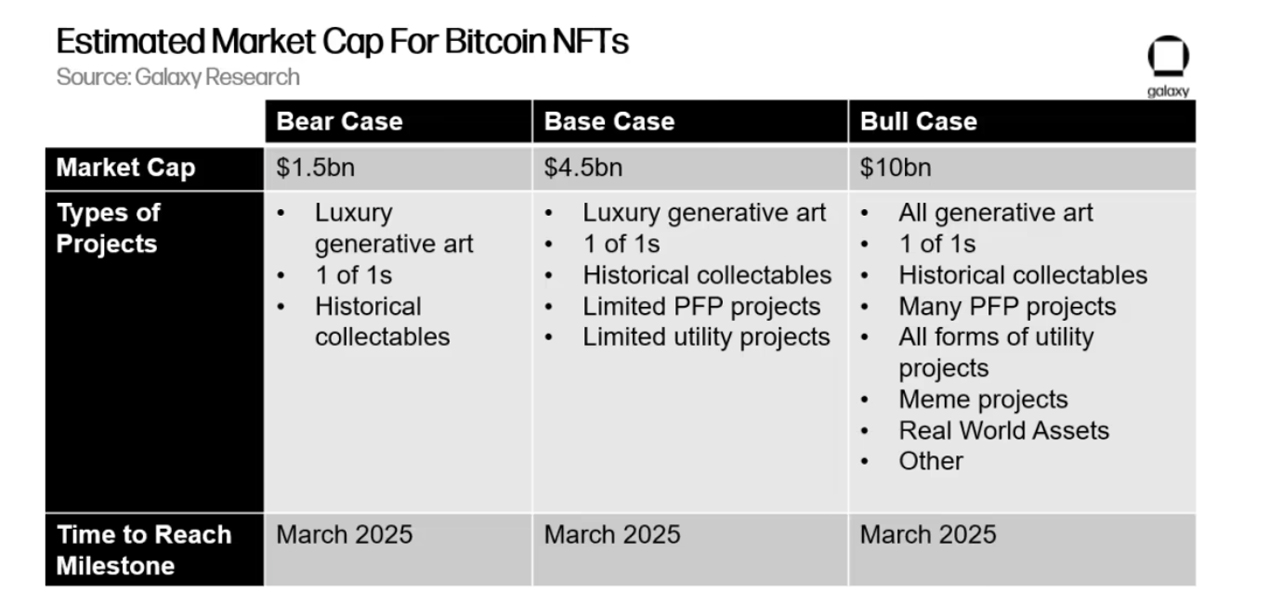

As the number of Bitcoin-based Ordinal inscriptions approaches the 300,000 mark, Galaxy Digital’s research team published a report on the topic that says the market size of non-fungible tokens (NFTs) built on Bitcoin could reach $4.5 billion in the next the two years. The researchers at Galaxy believe that new use cases stemming from the inscription trend will “drive increasing interest and adoption” of bitcoin.

Galaxy researchers are exploring potential use cases of Bitcoin-based ordinary inscriptions and NFTs

At the time of writing, there are more than 288,000 Ordinal inscriptions on the Bitcoin blockchain, as the trend has swelled sharply since the beginning of February 2023. Four days ago, the number of Ordinal inscriptions reached 200,000, and on the same day, Yuga Labs, the creators of the Ethereum NFT- collection Bored Ape Yacht Club (BAYC), revealed that they had created a collection of 300 inscriptions to auction the artwork. Six researchers and managers from Galaxy Digital published a report on the subject and considered that it is possible that Bitcoin NFTs “built on inscriptions [and] Ordinals” could reach $4.5 billion by 2025.

“Inscriptions significantly expand the design space of Bitcoin,” Galaxy’s report said. “The addition of significant data storage with strong availability assurances opens up a variety of use cases, many of which are just beginning to be explored, including things like new types of decentralized software or Bitcoin scaling techniques. However, even the NFT use case alone has the potential to dramatically expand the scope of Bitcoin’s cultural impact.”

Galaxy researchers emphasize that the ecosystem is still very young, but note that “the infrastructure is emerging quickly.” One of the most important building blocks for the technology will be wallets, according to Galaxy’s paper on the inscription topic. In addition, the study delves into the various collections that have characterized recent times, such as Taproot Wizards, Bitcoin Punks and Ord Rocks. The paper mentions the marketplace Openordex, which leverages “partially signed bitcoin transactions (PSBT) to enable the trustless entry and purchase of inscriptions.” In addition, Galaxy scholars also discuss the controversy surrounding the Ordinal inscriptions.

The researchers note that they believe technical arguments have already been largely avoided, and a social movement to stop Ordinal inscriptions is unlikely to happen. “Ultimately, because witness data can be pruned and old data can be avoided in initial block download (IBD) by enabling assumevalid=1, we see that the technical arguments against inscriptions are already mostly mitigated,” the Galaxy researchers wrote. “On the narrative side, Ordinal Inscription transactions are valid for all nodes on today’s Bitcoin network. A social movement to make changes to Bitcoin so that Ordinal Inscriptions are no longer possible must emerge to change that, an outcome we are looking at as unlikely.”

Galaxy’s study also notes that, unlike Ethereum, due to the lack of smart contract technology within Bitcoin, NFT royalties are also unlikely. The researchers believe the criteria for blue-chip Ordinal listings will be “dynamic” and the market “could see significant secondary volume.” While the study mentioned a number of tools, Galaxy Ordinal believes inscription market infrastructure will be developed by the second quarter of this year. As a result of all these trends, layer two (L2) or other types of Bitcoin scaling solutions will be pushed to the forefront of development.

“The rise of inscriptions, and the low probability that functionality will ever be removed from the project, has the potential to re-evolve Bitcoin, driving new use cases, interest and adoption,” Galaxy’s study concludes.

Tags in this story

adoption, artwork, Bitcoin, Bitcoin (BTC), Bitcoin Inscriptions, Bitcoin Ordinals, Bitcoin Punks, Blockchain, blue-chip inscriptions, BTC, BTC Inscriptions, BTC Ordinals, controversy, Cryptocurrency, cultural impact, Ecosystem, Ethereum, Galaxy Digital , inscriptions , layer two solutions, market size, Marketplace, NFTs, Openordex, Ord Rocks, Ordinal inscriptions, partially signed Bitcoin transactions, report, Researchers, Royalties, secondary volume, social movement, taproot wizards, technical arguments, use cases , Wallets, Yuga Labs

What do you think about the potential impact of Ordinal Inscriptions on the future of Bitcoin and the wider use of NFTs? Share your thoughts in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons, Sergey Nivens, Galaxy Digital Report,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.