Binance Again, Gensler and Voyager

Crypto News: We give you an overview of what has happened in crypto this week. And Groundhog Day springs to mind. Again.

This week the spotlight is on Binance (again). Forbes alleged that the exchange transferred $1.78 billion in stablecoins to hedge funds. According to the news outlet, Binance emptied the collateral from B-peg USDC without reducing the supply. The B token is issued to allow the use of other blockchain tokens on the BNB chain. The exchange is supposed to issue the B token only after storing 100% security of the original token. For example, for every 100 B-USDC, it must have 100 USDC as collateral.

Unsurprisingly, both Changpeng Zhao, Binance’s CEO, and the community cried “FUD” at the news.

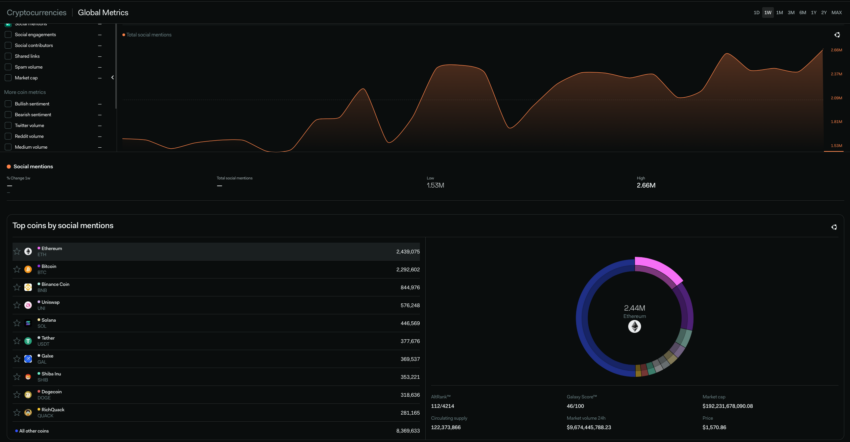

Crypto News – Socially

Executioners Guns for Crypto

If there were any doubts about Gary Gensler’s long-term goals for crypto, his interview with New York Magazine put them to rest. In his words, everything but Bitcoin falls under the jurisdiction of the Securities and Exchange Commission (SEC). And according to Gensler, the “road” or “runway” for cryptocurrency companies not listed with the SEC is getting “shorter.”

Gensler also argues that the structure of up-and-coming crypto companies makes it difficult to regulate them in the US jurisdiction. He noted: “Anything but Bitcoin, you can find a website, you can find a group of entrepreneurs, they can set up their legal entities in an offshore tax haven, they can have a foundation, they can lawyer it up to try to arbitrage and make it difficult jurisdictionally or so on.”

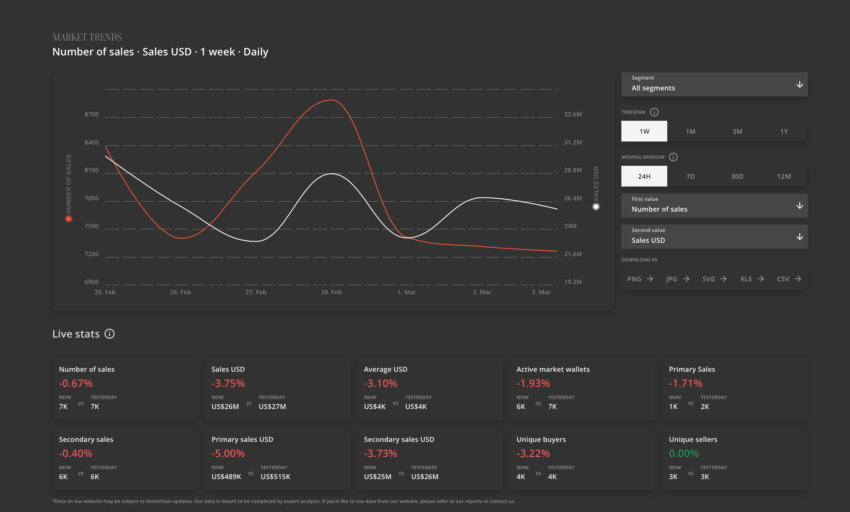

This week in NFT Sales

Non-fungible token (NFT) sales reached levels not seen since the start of the crypto winter. Blur, again, was responsible for the 117% jump in volume last month compared to January. Blurred trading volume accounts for almost all of the month-to-month gains made by the market.

Voyager assets on their journeys

A bit of on-chain investigation revealed that bankrupt lender Voyager appeared to be offloading its assets via Coinbase. Lookonchain found data that allegedly shows the lender has sent various crypto assets to the crypto exchange since February 14. Some of the assets included Ethereum, Shiba Inu, SushiSwap, Chainlink and others. Cumulatively, these assets were valued at over $100 million.

Voyager was one of several crypto firms to collapse in 2022. The lender filed for bankruptcy in July, citing volatile market conditions.

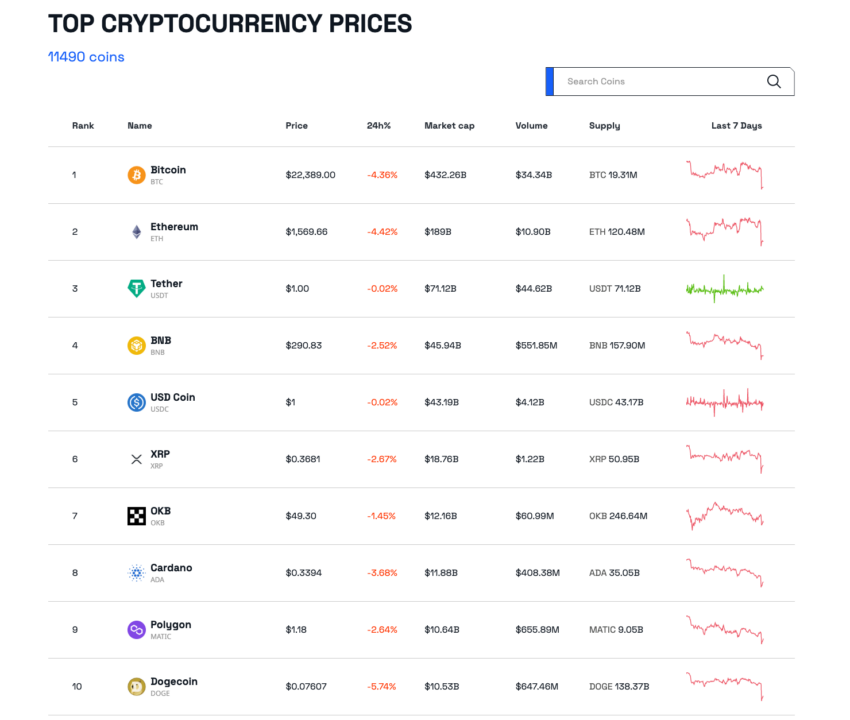

News about crypto coins

Maker (MKR) was this week’s biggest gainer, rising almost 23%. ssv.network (SSV) was second, up 13% and SingularityNet (AGIX) was third with 10%. The biggest losers were led by Conflux (CFX), down just over 30%. Klaytn (KLAY) and Hedera (HBAR) both fell 19%.

Crypto Mac Jacking

Some news to remove smug grins from the faces of Mac users: malware has been detected on MacOS. And even worse, it targets your cryptographer. Crypto-jacking software appears to spread through pirated versions of Final Cut Pro, a movie editing suite.

Jamf Threat Labs, a cybersecurity firm for the Apple ecosystem, first discovered the malware. It spent the past few months tracking the malware variants that have recently resurfaced. Similar crypto-jacking malware hit Apple’s operating system in 2018. Moral of the story – don’t use pirated software, kids.

Polkadot (DOT) gives mixed signals

BeInCrypto senior analyst Valdrin Tahiri spotted a bearish divergence in the daily timeframe, which could cause short-term pain for DOT holders. However, he found not one but two bullish signs on the weekly timeframe, which could lead to some significant long-term gains for the coin.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.