Bitcoin price prediction – why it will be a struggle to catch up to $24k if Wednesday’s US data is strong

Bitcoin (BTC), the world’s largest cryptocurrency, was able to recover some of its recent losses and attract modest bids above the $23,500 level as the crypto market started the month on a positive note. This was attributed to Abu Dhabi’s plan to create a free zone for the crypto industry, which will offer zero taxes and 100 percent foreign ownership of digital and virtual asset firms.

In addition, France has shown its willingness to implement strict licensing regulations related to anti-money laundering (AML) and know-your-customer (KYC) protocols for cryptocurrency companies to prevent money laundering and terrorist financing. This was also considered a significant factor in reducing losses and restoring some momentum in the cryptocurrency industry.

The likelihood of interest rate hikes and a possible government crackdown on the cryptocurrency industry could deter investors in the coming weeks. In addition, the current state of the crypto market and regulatory concerns have caused Visa and MasterCard to delay their cryptocurrency plans, which could also limit any potential upward momentum in BTC prices.

Abu Dhabi establishes welcoming regulatory environment for crypto industry

As previously reported, the city of Dubai in the United Arab Emirates has promoted the cryptocurrency industry by establishing a free zone that offers zero tax and 100 percent foreign ownership of digital and virtual asset companies.

In addition, the international financial hub in the UAE’s capital, Abu Dhabi Global Market (ADGM), has introduced a new regulatory framework for digital assets. This includes the creation of a regulatory sandbox to enable developers of digital assets to test their products and services in a secure environment.

In addition, ADGM has launched “Spot”, a digital asset marketplace that provides a secure and regulated environment for users to trade cryptocurrencies, fiat currencies and other digital assets. This move is part of Abu Dhabi’s wider aim to position itself as a major hub for fintech and digital innovation and to establish a significant presence in the global cryptocurrency market.

Abu Dhabi is striving to attract a variety of digital asset firms, such as cryptocurrency exchanges, digital wallets and blockchain companies, by offering a welcoming regulatory atmosphere and attractive tax benefits. This is considered a significant breakthrough for the cryptocurrency industry, potentially spurring growth in the sector in the near future.

France adopts strict licensing regulations for cryptocurrency companies

The French National Assembly has recently passed a bill that aims to enforce stricter licensing regulations for new cryptocurrency businesses to align with upcoming EU regulations.

This move demonstrates France’s commitment to fighting financial crime and protecting its citizens from illegal activities. By requiring cryptocurrency companies to comply with AML/KYC requirements, France is sending a clear message that it takes financial crime seriously and is taking steps to prevent it.

It is noteworthy that the proposal received 109 yes votes, which is 60.5%, against 71 no votes, or 39.5%. After being approved by the French Senate, the measure will now be handed to President Emmanuel Macron, who has 15 days to sign it or send it to the legislature.

It will be interesting to see how this new regulation is implemented and how it affects the French cryptocurrency market. While some companies may struggle to comply with the new regulations, others may see it as an opportunity to demonstrate their commitment to transparency and ethical business practices.

Bitcoin price

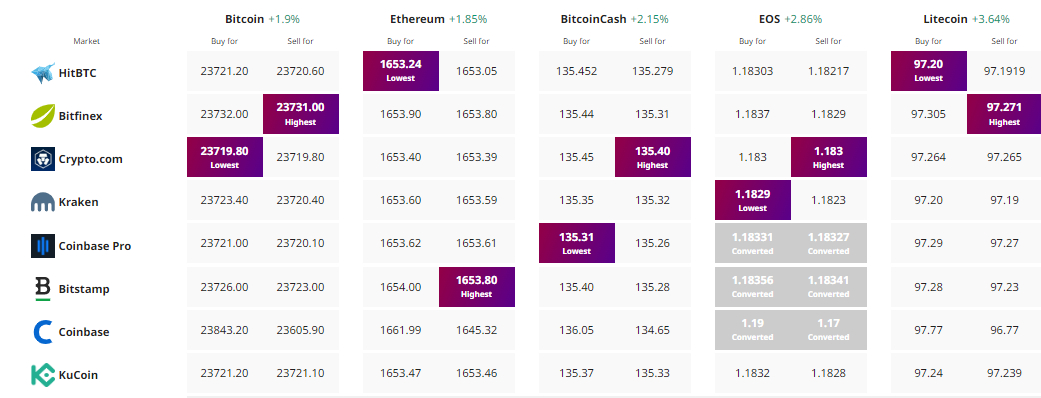

The price of Bitcoin is currently at $23,796, with a 24-hour trading volume of $22.5 billion. Over the past 24 hours, Bitcoin has increased by around 1.50%. Ethereum, on the other hand, has a current price of $1650 and a 24-hour trading volume of $7.4 billion, with a gain of 1.25% in the last 24 hours.

On the 4-hour chart, Bitcoin had trouble breaking the crucial resistance level of $23,750. The failure to sustain above this level led to a bearish correction, which could push the BTC price towards the $22,800 support level. If this support level does not hold, it could the next support area would be around $22,150.

Although the BTC/USD pair is currently oversold, a rebound is possible if the oversold condition persists, allowing Bitcoin to break past the $23,500 resistance level and potentially lead to a price of $24,250.

Buy BTC now

Bitcoin Alternatives

Investors interested in buying Bitcoin may want to explore other options that offer more short-term growth potential. Cryptonews has conducted a detailed analysis of the top 15 cryptocurrencies that investors should consider for 2023. Click below to learn more.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

Find the best price to buy/sell cryptocurrency