Bitcoin Price Prediction – BTC Advances Into Week, But Can It Reclaim $24ki Today?

The price of Bitcoin has been calm and trading sideways in recent weeks. However, as the new week begins, there are signs of progress for BTC. The big question on everyone’s mind is whether Bitcoin can regain the $24k mark today.

In this article, we will explore the current state of the market and analyze the factors that may affect the price of Bitcoin in the short term.

Understand the current crypto regulatory landscape

At the G20 meeting in India on February 25, International Monetary Fund (IMF) Managing Director Kristalina Georgieva expressed a preference for identifying and regulating crypto-assets rather than implementing a blanket ban. However, the possibility of banning private cryptocurrencies still remains on the table.

In a recent interview with Bloomberg (February 27), Georgieva clarified her comments regarding a potential blanket ban on cryptocurrency, acknowledging the current uncertainty surrounding the classification of digital currency. She also discussed the UNFPA’s position on digital assets and its preferred regulatory framework.

Senior White House officials have recently urged the US Congress to step up efforts to regulate the cryptocurrency sector, while the UK government has proposed plans to subject crypto assets to the same legal framework as traditional financial services.

As the demand for additional regulation grows, understanding potential regulatory structures and how to operate in a more regulated cryptosphere has become increasingly important to cryptocurrency investors.

Anticipate prolonged interest rate increases

The latest gross domestic product (GDP) figures as of February 23 reveal that the US economy expanded by 2.7%, slightly less than the preliminary estimate of 2.9%. Meanwhile, the Bureau of Economic Analysis (BEA) reported on February 24 that inflation rose 5.4% in January compared to a year earlier, as shown in its personal consumption expenditure (PCE) data.

The higher-than-expected PCE price index, the Federal Reserve’s preferred inflation gauge, supports a hawkish approach. The Federal Reserve has set a target of 2% headline inflation, and market participants expect interest rates to rise for an extended period to control inflation.

During the early US session, retail sales data showed mixed results. In January, orders for manufactured goods fell 4.5%, mainly due to a drop in volatile passenger aircraft orders. However, there was good news for the early-year economy, as business investment increased at the fastest rate in five months.

According to economists polled by the Wall Street Journal, orders for durable goods, which include products such as cars, airplanes and computers intended to last at least three years, were expected to fall 3.6%. But excluding transportation, new orders rose a solid 0.7% last month.

In addition, a crucial measure of business investment saw its most significant growth since last summer.

Grayscale Inc. CEO Requests SEC Approval of GBTC Exchange-Traded Fund

Grayscale CEO Michael Sonnenshein advocates converting GBTC to an ETF, a goal the firm has been pursuing for some time. According to Sonnenshein, the SEC is violating APA’s Section 706(2)(A) by approving Bitcoin futures ETFs but not GBTC’s conversion. Grayscale’s GBTC, which enables institutional investors to gain regulated Bitcoin exposure, has been trading at a significant discount to NAV.

If the SEC approved the conversion, the discount would disappear and GBTC would trade near the spot price of Bitcoin, drawing in new investors and generating billions in capital.

Bitcoin price

Currently live Bitcoin the price today is $23,250 with a 24-hour trading volume of $23.3 billion. Bitcoin is down almost 1% in the last 24 hours. The current CoinMarketCap ranking is #1, with a live market cap of $448 billion.

On the 4-hour time frame, Bitcoin struggled to surpass the significant resistance level of $23,750. The close of candles below this level resulted in a bearish correction, potentially pushing the price of BTC further down to the $22,800 mark.

The immediate support level for the BTC/USD pair is currently at $22,800 and a break below this could expose BTC’s price to the next support area at the $22,150 level.

Although the BTC/USD pair is currently oversold, a rebound is possible if the oversold condition persists, allowing Bitcoin to break past the $23,500 resistance level and potentially lead to a price of $24,250.

Buy BTC now

Bitcoin Alternatives

Investors looking to buy into Bitcoin may want to consider alternatives with more room for short-term growth. Cryptonews has released an in-depth analysis of the top 15 cryptocurrencies that investors may want to consider for 2023. Click below to find out more.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

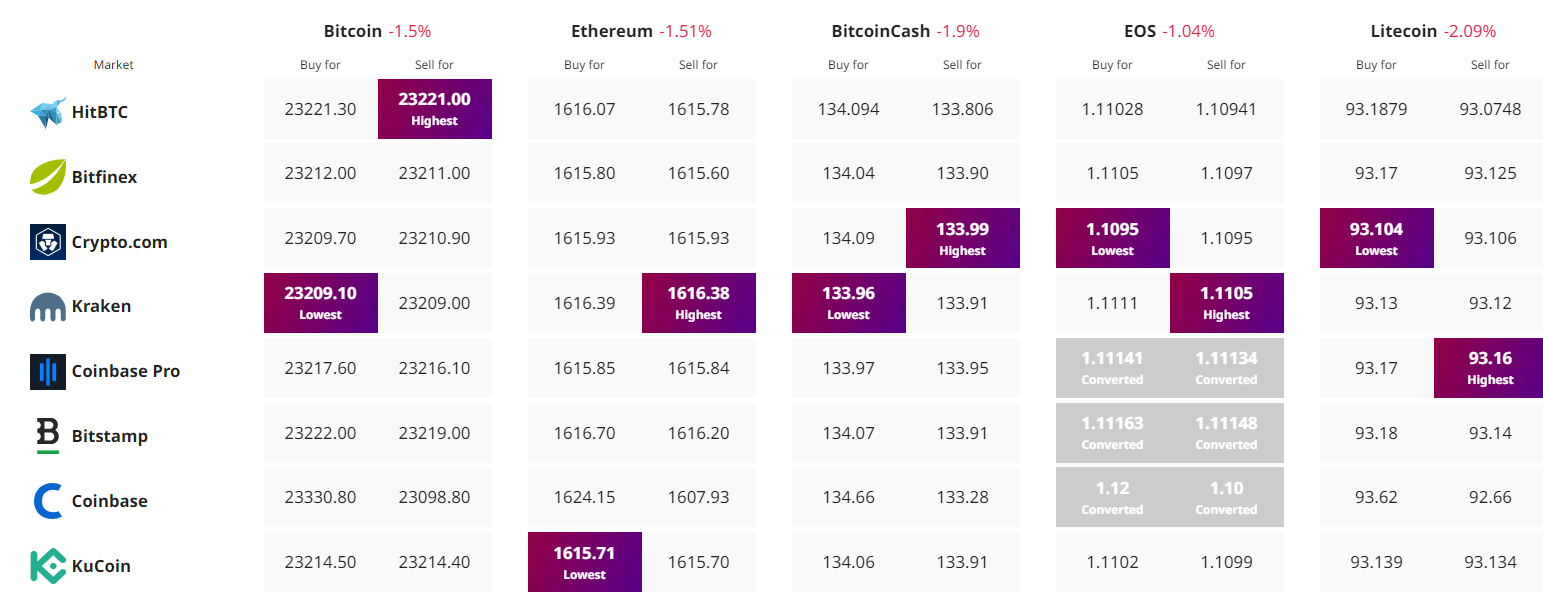

Find the best price to buy/sell cryptocurrency