After a brief dip in mid-February 2023, artificial intelligence (AI) cryptoassets have continued to see gains over the past 30 days. Currently, out of 74 listed AI-focused cryptocurrencies, the net worth of all these tokens has risen to more than $4 billion, which accounts for 0.37% of the entire crypto-economy’s value.

The majority of listed AI cryptocurrencies are seeing positive gains in the past month

Artificial intelligence (AI) has been a dominant theme in 2023, resulting in a significant increase in the value of AI-focused tokens this year. Bitcoin.com News reported on the rise of these cryptocurrencies in late January, and despite a brief pullback in mid-February, AI cryptoassets have continued to see gains throughout the month.

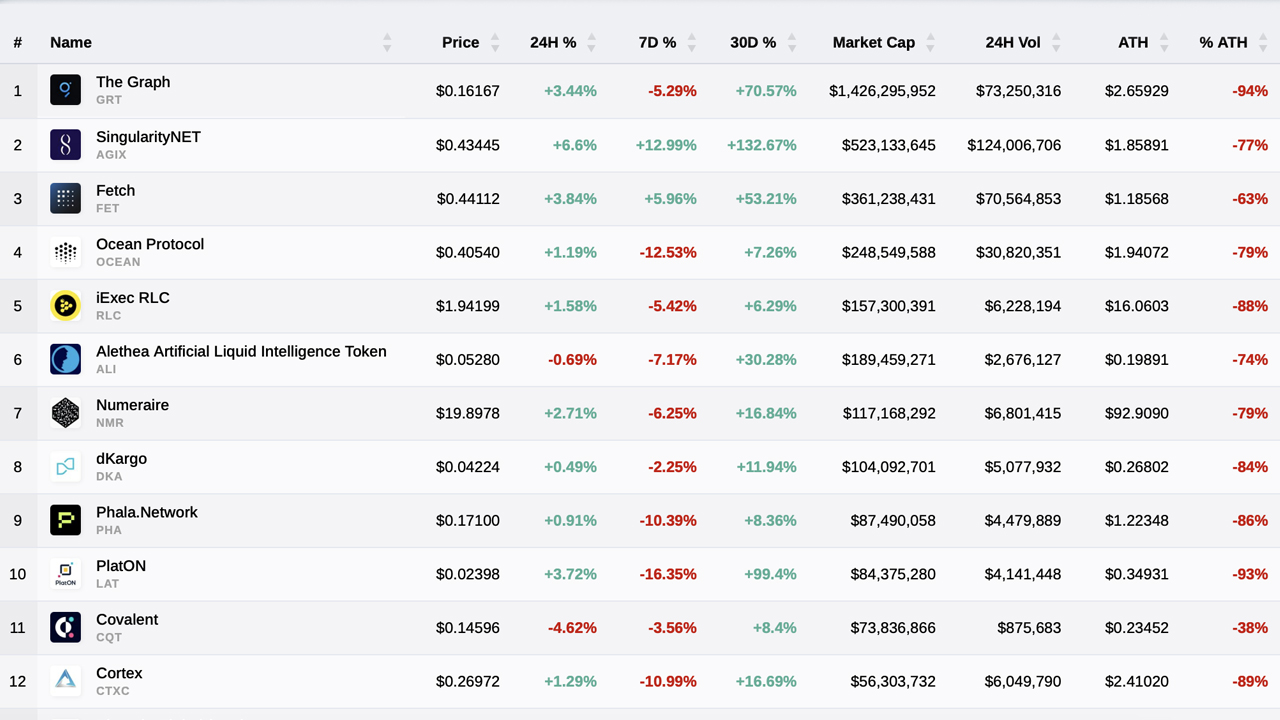

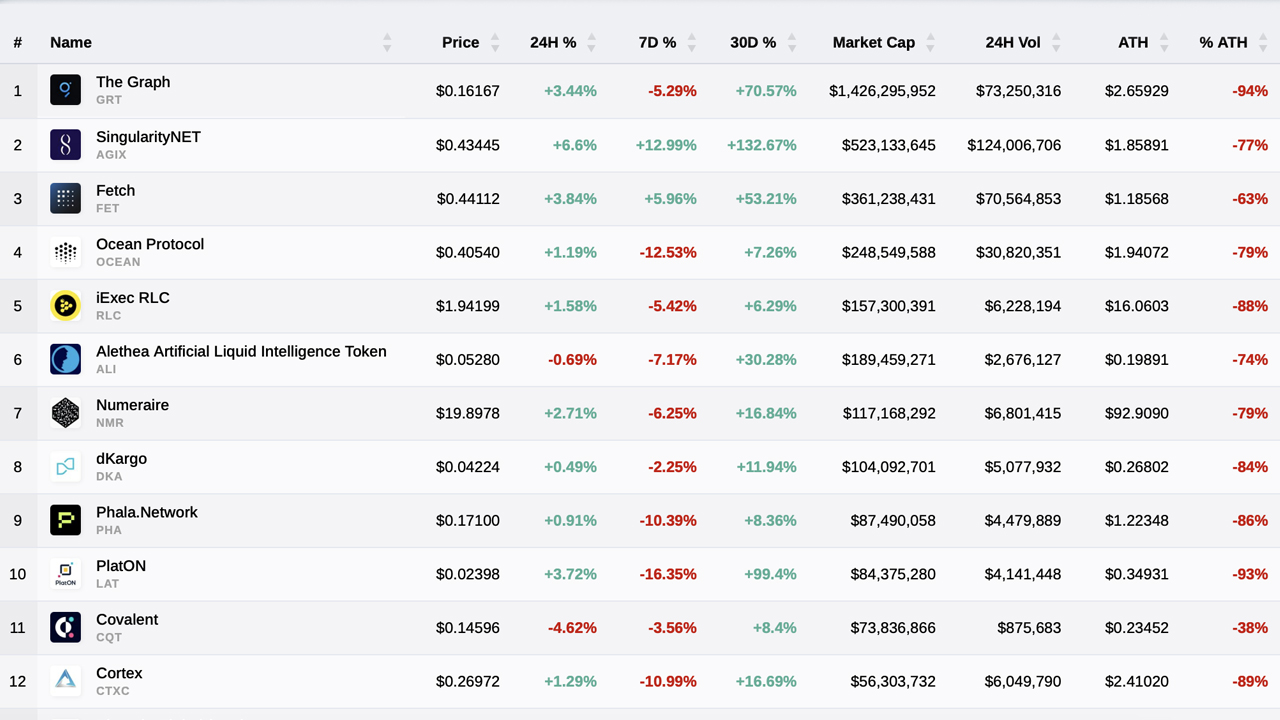

According to data from cryptoslate.com, 74 AI-centric digital currencies are now worth $4.03 billion, accounting for 0.37% of the total crypto market and 1.19% of the smart contract token market. Moreover, the majority of the 74 listed cryptocurrencies related to artificial intelligence have experienced positive gains in the past month.

The largest of the AI-focused digital currencies is graph (GRT), with a current market cap of approximately $1.42 billion. GRT has traded up 70.57% against the US dollar in the last 30 days. Singularitynet (AGIX), the second largest AI-centric crypto-asset, is up 132.67% this month.

Fetch.ai (FET) is up 53.21% and ocean protocol (OCEAN) is up 7.26% in the 30-day period. Iexec rlc (RLC), the fifth largest AI-focused token, gained 6.29% against the US dollar last month. The top five AI digital currencies, namely graph (GRT), singularitynet (AGIX), fetch.ai (FET), ocean protocol (OCEAN) and iexec rlc (RLC), account for $2.69 billion, or 67.3 %, of AI. -The crypto economy’s $4 billion.

Other notable winners in the AI digital currency market this month include the alethea artificial liquid intelligence (ALI) token, which surged 30.28%; phoenix global (PHB), which swelled by 23.64%; xmon (XMON), which jumped 30.47%; measurable data token (MDT), which increased by 124.97%; and singularity dao (SDAO), increased by 121.48%.

At the time of writing, the 74 AI-centric digital currencies have collectively risen 3.07% against the US dollar in the last 24 hours. However, over the past seven days, the artificial intelligence digital currency sector has experienced a decrease in value of 4.14%. Trading volume for the AI currency market in the last day was approximately $444.39 million. This figure represents 0.8% of today’s global trading volume of $55.39 billion in the last 24 hours.

Tags in this story

ai, alethea artificial floating intelligence token, artificial intelligence, cryptoassets, cryptocurrencies, cryptoslate.com, data, digital currencies, Fetch.AI, future, gains, global trading volume, graph, iexec rlc, market cap, measurable data token, mid-February, Ocean Protocol, phoenix global, Pullback, singularitydao, Singularitynet, smart contract token market, Surge, Tokens, Trading Volume, US dollar, xmon

What are your thoughts on the continued growth of AI-focused cryptoassets? Do you think these digital currencies will continue to see significant gains in the future? Share your opinions in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.