Is Bitcoin a Smart Investment for Your Portfolio Now (Cryptocurrency: BTC-USD)

FluxFactory/E+ via Getty Images

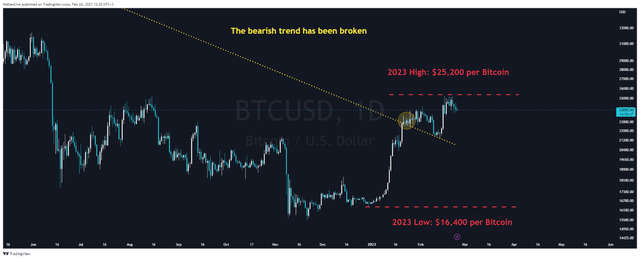

On January 20, 2023, the price of Bitcoin (BTC-USD) broke through the bearish trend that had been observed for fourteen months and thus brought a touch of optimism to the crypto market. Bitcoin has been consolidation in the $21,500-$25,300 range since late January, indicating the first significant signs of market stabilization as the Fed continues to raise interest rates and heighten geopolitical tensions around the world over a Chinese balloon entering US space and heightened hostilities between Russia and Ukraine.

N_Aisenstadt – TradingView

This article will present the factors that continue to exert a downward pressure on the price of coins and do not allow to talk about a complete change from a bearish trend to a bullish trend. On the other hand, more and more signs in the market indicate the beginning of an improvement in investment interest in cryptocurrencies after the devastating news of hacker attacks on crypto exchanges and even the bankruptcy of some of them in the second half of 2022.

Increasing fees in the Bitcoin network

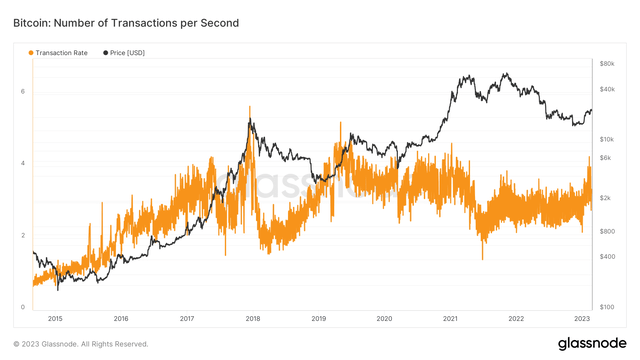

One of the first factors that begin to point to the transition of the crypto industry from a bearish cycle to a bullish cycle is the increase in the average transaction fee in the Bitcoin network. The main reason for the increase in commissions is the increase in the number of transactions in the Bitcoin network, and as a result, the competition for inclusion in blocks is increasing. Consequently, crypto miners are starting to choose transactions with higher fees to maximize revenue for their services.

Source: Author’s elaboration, based on Glassnode

After reaching a multi-year high in November 2021, the price of BTC was in a bearish trend until January 16, 2023. At the same time, fee income remained extremely low for only four months after the price of Bitcoin reached $65,000 per coin. After many market participants became disillusioned with cryptocurrencies and apathy reigned, relatively low prices attracted new traders and investors who took advantage of the situation.

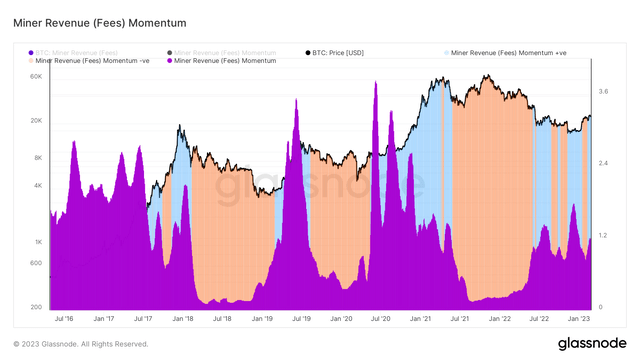

Source: Author’s elaboration, based on Glassnode

Currently, we can see the fee momentum break above one, indicating an increase in demand for block space. As a result, this not only leads to an improvement in miners’ profits, but can also confirm the emergence of hope among members of the crypto community with the subsequent end of the crypto winter.

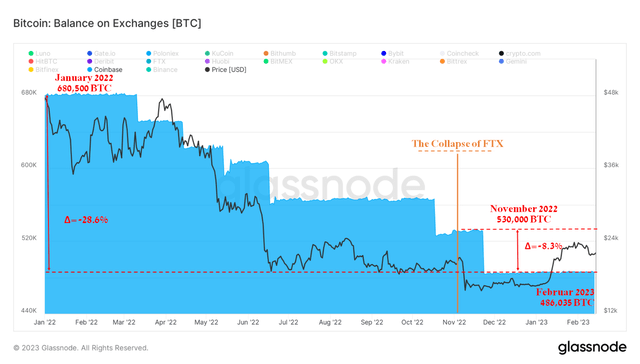

The balance on crypto exchanges continues to decrease

In recent quarters, the cryptocurrency industry has been inundated with news of various exchange hacks. 6 October 2022there were reports on many information resources that hackers successfully hacked the blockchain associated with Binance, stealing $566 million in BNB, Ethereum (ETH-USD), Fantom (FTM-USD), Polygon (MATIC-USD) and other coins.

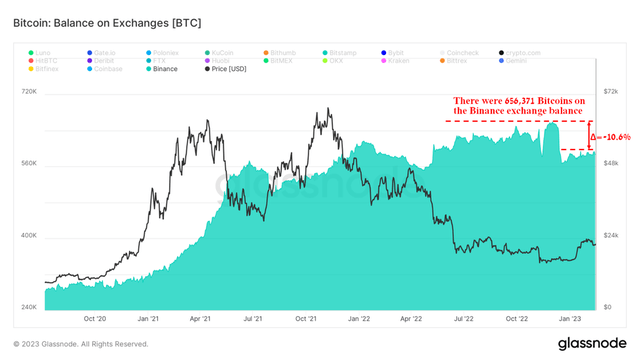

And in mid-January 2023, FTX (FTT-USD) stated in a report to creditors that $415 million in digital assets were stolen due to hacking attacks. And as a result, many investors began to be more conservative in holding Bitcoins, Litecoins (LTC-USD) and other coins, moving them to safer offline crypto wallets. Also, trust continues to decline in exchanges that were actively used to transact coins until Q3 2022, and currently many of their clients prefer to keep their assets under control.

On November 22, 2022, the total number of Bitcoins held by Coinbase (COIN) was around 531,242, and the next day there was a significant withdrawal of funds of over 44,000 BTC as a result of the spread of unwanted reports about the bankruptcy of FTX. On a larger scale, there is a trend towards reducing the holding of coins by investors on the balance sheet of a crypto exchange. So, since the beginning of 2022, Coinbase’s customers have withdrawn a little less than 195,000 Bitcoins, thus creating further pressure on the financial position of one of the largest exchanges in the world.

Source: Author’s elaboration, based on Glassnode

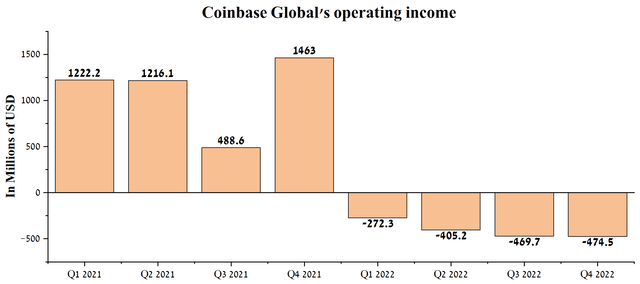

Moreover, one of the additional reasons for the reduction in the Coinbase balance could be the desire of investors to take profit from their investments due to the increase in the price of Bitcoin by a little over 40% in the last month and a half. Overall, in the fourth quarter of 2022, the company had an operating loss of $474.5 million, in stark contrast to the last three months of 2021, when Coinbase had its highest operating income ever. The continued downward trend in operating income from quarter to quarter is a red flag and could be a significant cause for concern for investors and the entire crypto community.

Source: Author’s elaboration, based on Seeking Alpha

In addition, Binance’s partner in the issuance of Binance USD, Paxos, is under the gun. The US Securities and Exchange Commission has started a discussion with Paxos about the need to change the legal status of this stablecoin, and the regulator is also considering steps against the company. In the event that Binance USD (BUSD-USD) is recognized as a security, this will open Pandora’s box, as a result of which many other stablecoins can receive this status, which will lead to stricter regulation and loss of interest from traders and investors in the crypto industry. You can already see how the balance of Bitcoin at Binance (BNB-USD) has fallen by 10.6% from its peak in Q4 2022.

Source: Author’s elaboration, based on Glassnode

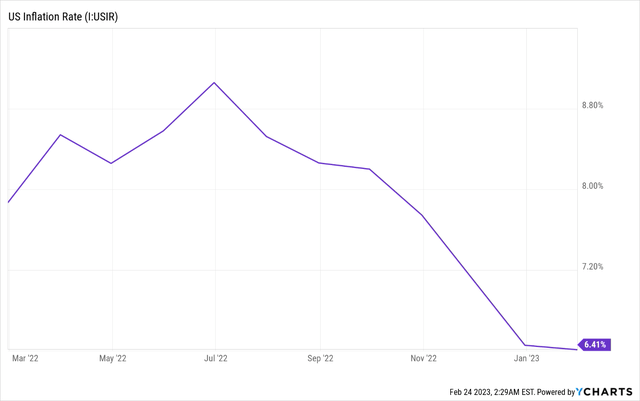

Fat interest rate increase

At the meeting of the Federal Open Market Committee, which was held from January 31 to February 1, the majority of participants agreed that it is necessary to raise interest rates by 0.25%, which is in line with the expectations of investors and traders. The negative moment, however, was the information that several meeting participants were in favor of raising the interest rate by 0.5%, and thus this could lead to higher borrowing costs and, as a result, lead to a decrease in economic growth. One of the possible reasons why some members of the FOMC want to tighten monetary policy and thus raise the key interest rate by 50 basis points may be the fact that the pace of slowing inflation is slowing and as a result it is necessary to act more aggressively to reach the inflation target of 2%. So the US annual inflation rate was 6.41% as of January 31, 2023, which is only 0.04% less than last month.

Source: YCharts

If the Fed raises interest rates by 0.5%, this will strengthen the US dollar and increase investment interest in US Treasuries (US10Y) (US2Y) compared to Bitcoin, which is trying to break out of the bearish cycle.

Conclusion

After a fourteen-month long bear market that brought frustration and apathy to various digital assets from members of the crypto community, the first significant signs of its recovery finally appeared on the horizon.

During the bearish period, there has been a redistribution of Bitcoin ownership from investors who are less disciplined and less confident in the asset to those who clearly understand the value of cryptocurrencies in a rapidly evolving digital world. In recent weeks, there has been a significant increase in the number of transactions, which positively affected miners’ profits. In Q1 2023, two key players in the crypto industry, Riot Platforms (RIOT) and Hut 8 Mining (HUT) announced an increase in Bitcoin mining. Given the increased price of cryptocurrencies and the increase in the number of mining equipment, it can be said with great confidence that the largest Bitcoin mining companies have passed the test of the strength of their financial position from Mr. Market.

According to a report by Fidelity Digital Assets, a subsidiary of Fidelity Investments, European and American institutional investors have reported an improvement in the perception of cryptocurrencies and continue to increase their investments in various digital assets. In my estimation, in 2023 there will be a tightening of regulation from various government agencies, which on the one hand will reduce the appetite of speculative traders in the short term, but on the other hand will attract attention from the long term. long-term and more conservative investors. So, for example, according to the optimistic forecast of ARK Invest, the price of Bitcoin can reach 1.48 million dollars by 2030, but with a more conservative estimate, Katie Wood’s company (ARKK) can reach the price of the most popular cryptocurrency in the amount of $258 500, which is significantly higher than today’s values. In addition, many institutional market players continue to reduce interest in commodity behemoths such as Exxon Mobil (XOM), Occidental Petroleum (OXY) and Chevron Corporation (CVX) and are beginning to increase their appetite for riskier assets.

In conclusion, I would like to note that according to my model, in the next two weeks, I expect a correction in the price of Bitcoin due to the strengthening of the US dollar against other currencies during the Fed’s interest rate hike and also the tightening of tensions between the administration of the US President Joe Biden and the Chinese government. After that, the accumulation phase can come, which I will use to buy shares in Bitcoin mining companies and ETFs involved in digital asset management.

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Be aware of the risks associated with these stocks.