BTC Fails To Break Above $23,725, What’s Next?

Bitcoin and Ethereum, the two largest cryptocurrencies in terms of market capitalization, continue to attract the interest of traders and investors worldwide. As the Asian trading session unfolds, the crypto market remains relatively stable, with BTC hovering just above the $23,000 level and ETH retreating above $1,600.

The major cryptocurrencies, including Bitcoin and Ethereum, are trading within tight price ranges as market participants prepare for a busy week ahead amid the lack of volatility.

Before we examine the technical outlook, let’s take a quick look at the market’s fundamentals.

Venture Capitalist predicts explosive gains of up to 2200% for crypto assets

According to Chris Burniske, a venture capital firm Placeholder partner, Stacks (STX), an altcoin that aims to increase the utility of Bitcoin (BTC), has enormous upside potential. Burniske argues that Ethereum’s (ETH) layer-2 ecosystem has attracted significant amounts of new capital and attention, while Bitcoin has been left behind due to the abandonment of efforts to make its flagship blockchain programmable.

However, with limited competition in the field, Burniske believes Bitcoin’s tier-2 ecosystem is nearing its peak, which will benefit STX. STX is currently valued at $1.36 billion in fully diluted network value (FD NV), or 0.28% of BTC NV. Burniske suggests that a repricing to match MATIC’s relative price to tier-1 would indicate a 23X increase, which does not account for Bitcoin appreciation.

According to investor Chris Burniske, Bitcoin’s layer-2 ecosystem is nearing its peak, and the lack of competition in this area could benefit Stacks (STX), a project that aims to increase the use of Bitcoin. If STX sees significant gains, it could lead to increased interest in Bitcoin’s programmability, which could ultimately boost the flagship cryptocurrency’s value.

Bitcoin’s Billionaire Lawyer: Chamath Palihapitya’s Predictions for the Future of Cryptocurrency

Chamath Palihapitya, a billionaire venture capitalist and early Bitcoin (BTC) investor, has identified a new opportunity that he considers to be even more important than his investment in BTC more than a decade ago. During a fireside discussion at Wharton, Palihapitya said he will devote the next two decades of his life to addressing global issues in energy production, computation and life sciences.

According to him, investors who understand these trends can be “incredibly wealthy and wealthy,” as these challenges can yield trillions of dollars in wealth. Palihapitya’s investment firm, Social Capital, has invested in companies working in clean energy, life sciences and technology, including Syapse, Proterra and Groq.

His statement about Bitcoin’s explosive rise in terms of what’s coming next suggests that he sees significant potential for growth and development in the cryptocurrency industry. This could potentially lead to increased investment and interest in the space, including Bitcoin.

Bitcoin price

As of now, Bitcoin is priced at $23,400, with a 24-hour trading volume of $17 billion. Over the past 24 hours, the digital currency has seen a value increase of 1.08%. With a market cap of $451 billion, Bitcoin is currently ranked #1 on CoinMarketCap. It has a circulating supply of 19,303,075 BTC coins, while its maximum supply is capped at 21,000,000 BTC coins.

Bitcoin is currently facing resistance at the $23,500 level, and its immediate support level remains at $22,800. If the price falls below this level, it could expose Bitcoin to the next support area at $22,150. However, as the BTC/USD pair has entered the oversold zone, there is a possibility of a pullback that could lead to a breakthrough of the $23,500 resistance level , pushing the price up to $24,250.

The immediate support level for the BTC/USD pair is at $22,800. If the pair breaks below this level, it could potentially expose the price of BTC to the next support area at the $22,150 level.

Buy BTC now

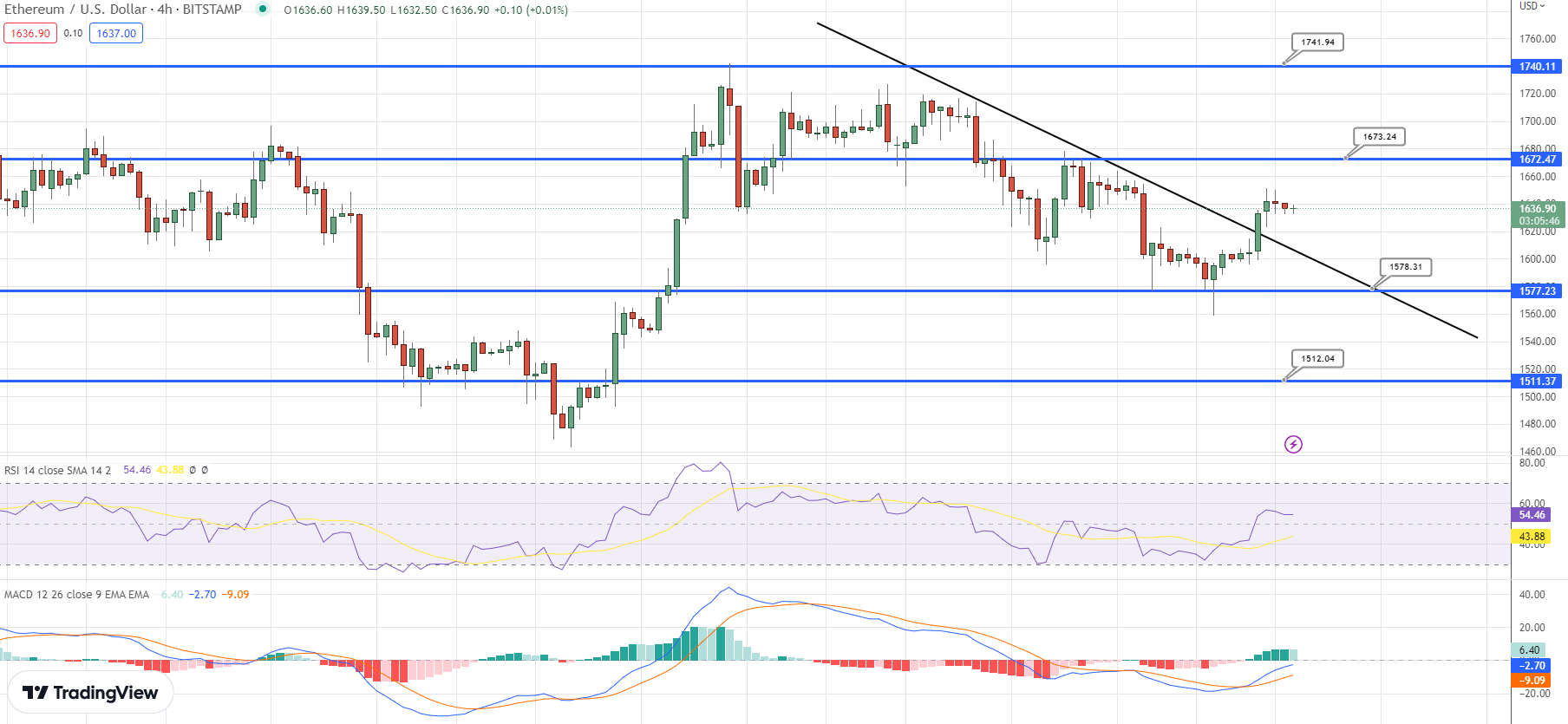

Ethereum price

The current live price of Ethereum is just below $1,600 and on the technical front, the ETH/USD pair is currently facing a significant resistance level at $1,620, which is reinforced by the 50-day EMA. If the pair closes below this level, it could trigger a selling trend in ETH.

The current live price of Ethereum (ETH) is $1,635, with a 24-hour trading volume of $6.1 billion. Ethereum has risen 2.22% in the last 24 hours. As of now, it holds the second position in the CoinMarketCap ranking with a market capitalization of $200 billion.

Ethereum’s price is currently trading below the immediate support level of $1,675. Once this level is breached, the next support for Ethereum is at $1,600. On the other hand, if the Ethereum price breaks through the $1,675 resistance level, it could rise to the $1,750 level.

Buy ETH now

Top 15 Cryptocurrencies to Watch in 2023

Investors in the cryptocurrency market have many options beyond Bitcoin (BTC) and Ethereum (ETH). The Cryptonews Industry Talk team has compiled a list of the top 15 altcoins to watch in 2023.

The list is regularly updated with new ICO projects and altcoins, so be sure to check back often for the latest additions.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

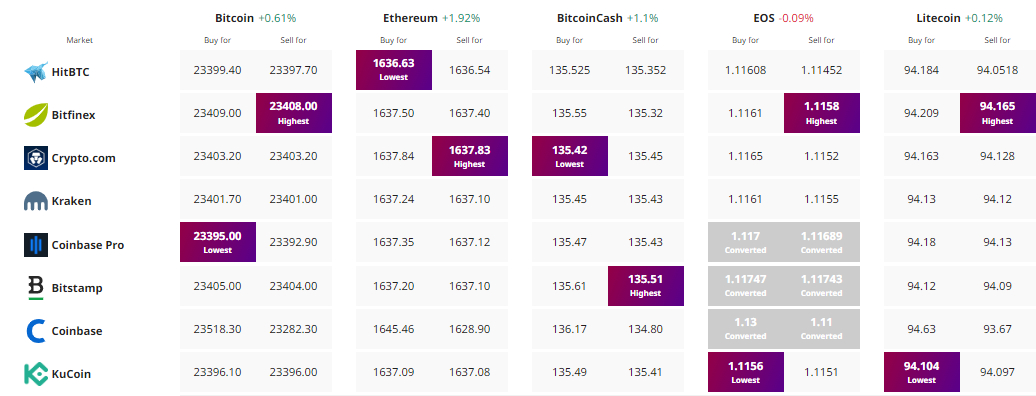

Find the best price to buy/sell cryptocurrency