Remitly Q4 Earnings: A Fast-Growing Fintech Play (NASDAQ:RELY)

pcess609

Investment thesis

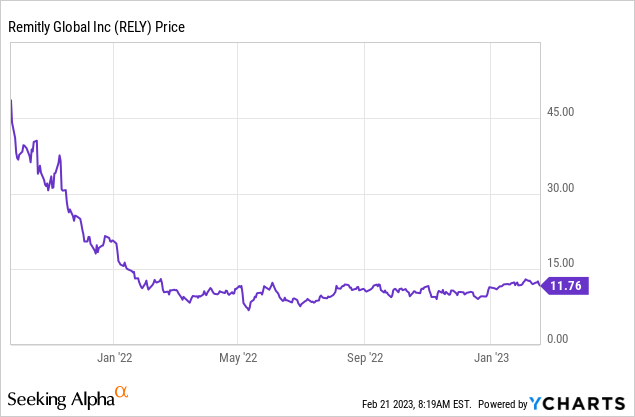

Remitly Global (NASDAQ:RELY) went public in late 2021 at a value of $7.8 billion. The company has fallen non-stop since due to soaring inflation, rising interest rates and a lack of appetite for high-growth stocks. It is currently being traded to $11.76, down nearly 70% from its IPO price.

I think this presents a bottom fishing opportunity for long term investors. The money transfer market is massive, but outdated, which offers huge opportunities for expansion. The company continues to show strong growth despite macro headwinds. It is still not profitable, but the loss is minimal and it has a pile of cash in hand. The current valuation looks compelling considering the growth. I think there should be meaningful upside potential as the company begins to scale and become more profitable. That’s why I consider Remitly a buy.

Great market opportunities

Remitly is a Washington-based financial technology company founded in 2011. The company focuses on C2C (customer-to-customer) money transfers for immigrants and other users abroad. It currently has over 3.8 million customers from 170 countries, with an annual volume of $30 billion. The remittance market is massive, with over 280 million migrants worldwide currently.

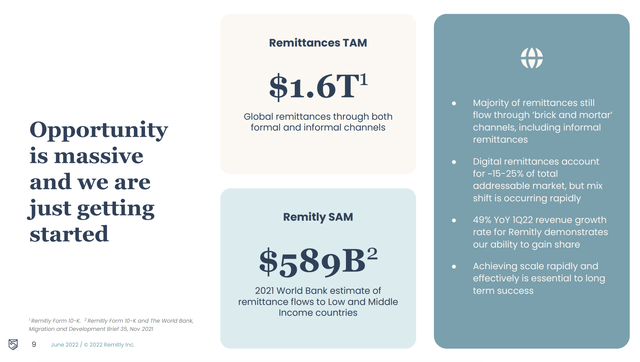

According to Remitly, the TAM (total addressable market) for global remittances is around $1.6 trillion and the SAM (serviceable addressable market) is $589 billion. However, the majority of the market is for traditional channels such as checks. The services are very dated and ready for a transformation, which opens up many possibilities.

Digital remittance is a smaller market, but is also growing much faster. According to Allied Market Research, digital remittance TAM is expected to grow from $21.8 billion in 2022 to $60.1 billion in 2030, representing a strong CAGR (compound annual growth rate) of 15.6%.

The market is expanding rapidly as shippers move to digital channels. Compared to older transmission channels that are slow, inconvenient and expensive, digital transmissions provide a much better user experience. Most transactions can be made via bank accounts or mobile wallets and reach the other party within minutes. It also has lower costs and better exchange rates. The transition should still be a strong tailwind for the company.

Remitly

Q4 Earnings

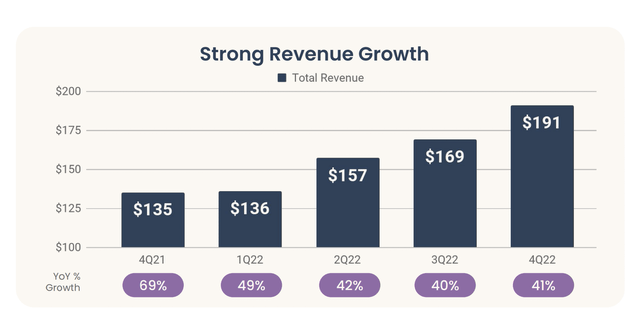

Remitly has just announced its fourth quarter earnings and the results are very strong with robust top line growth.

The company reported revenue of $191 million, up 41% year over year, compared to $135.3 million. On a constant currency basis, revenue growth was even higher at 46%. The growth is driven by a strong increase in both customers and volume. Active customers increased 48% year-over-year from 2.8 million to 4.2 million, as the company continues to expand into new markets. Broadcast volume also increased by 35% from $6 billion to $8.1 billion. Gross profit was $119.2 million compared to $78.7 million, an increase of 51.5% year over year. This is due to improved fraud loss rates, which reduced transaction cost as a percentage of revenue. This also resulted in the gross margin increasing by 380 basis points from 58.5% to 62.3%.

Matt Oppenheimer, CEO, on geographic expansion:

We continue to add new broadcast markets, including New Zealand in the fourth quarter and the United Arab Emirates market last month. The UAE is the second largest remittance source market after the US, with significant receiving corridors that we already served well, including India, Pakistan, the Philippines and Bangladesh.

Remitly

Net loss increased by 16.9% from $(16.6) million to $(19.4) million. EPS was $(0.11) compared to $(0.10), down 10%. This is largely attributed to large increases in R&D (research and development) and G&A (general and administrative) expenses. Research and development expenses increased 125% from $19.1 million to $42.9 million as the company develops complementary new products. G&A expenses grew 48.5% from $23.5 million to $34.9 million as headcount increased due to expansions. I think these expenses should start to taper off in the coming quarters.

On the positive side, marketing efficiency continues to improve, as marketing spend only increased 12.8% to $43.2 million. Adjusted EBITDA also turned from negative $(7.1) million to positive $7.5 million. It ended the quarter with $300 million in cash and no debt, giving them the financial flexibility to continue investing for future growth. The company initiated guidance for FY23 and it expects revenue growth of 32% to 35% with adjusted EBITDA to be between breakeven and $10 million, which is very optimistic in my opinion.

Investor Takeaway

After the significant fall in the share price, Remitly’s valuation looks quite convincing. It currently trades at an EV/Sales ratio of just 2.84x (I use EV/Sales since the company is still unprofitable). This is in line with other fintech payment companies such as Block (SQ) Marqeta (MQ), and Payoneer (PAYO), which have an average EV/sales ratio of 2.47x. But remember that Remitly is growing much faster, therefore a premium should be justified. The market opportunities are massive and should allow the company to maintain high top line growth for a long time. Profitability is a potential concern, but I’m not too worried at the moment. It is close to being profitable and it expects adjusted EBITDA to be positive for FY23. Costs and marketing expenses are starting to be scaled back, and R&D should also follow the same path. All things considered, I think the current price level offers decent upside potential and I rate it a buy.