Here’s why recent Bitcoin rallies can’t keep their momentum above $25K

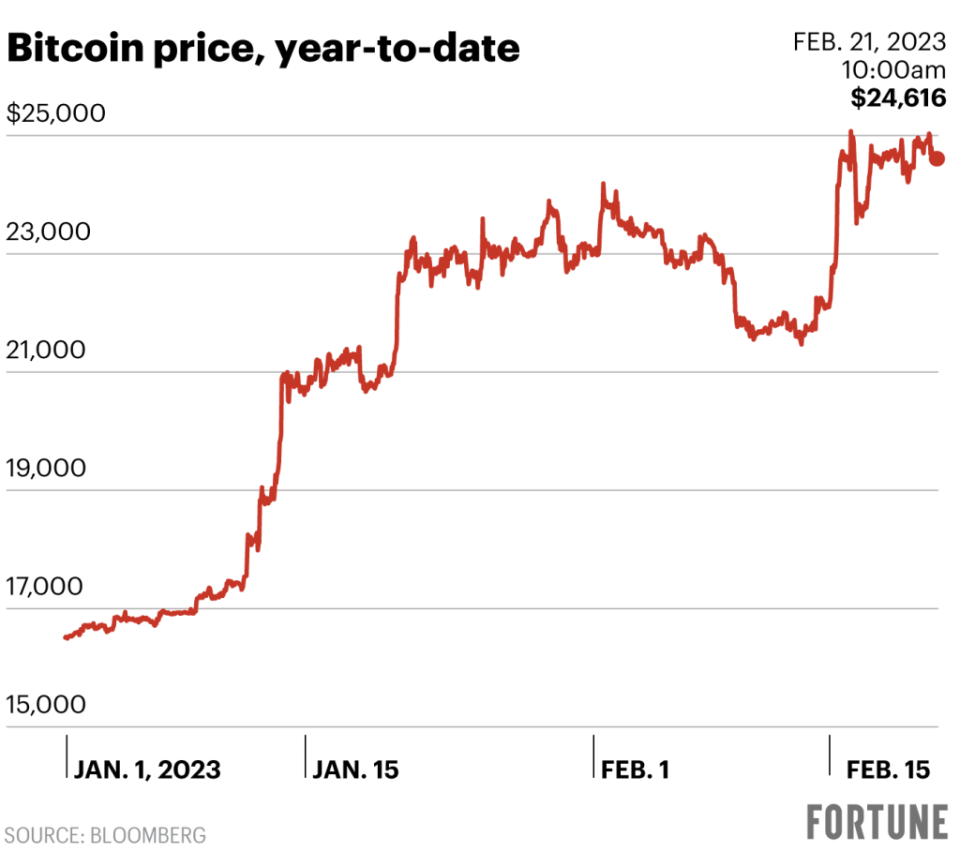

During a three-day weekend marred by mudslinging over the Fed’s next rate hike, Bitcoin broke above the $25,000 level four times before pulling back quickly on each occasion, according to data from CoinMarketCap.

After surpassing that benchmark for the first time in eight months on February 17, Bitcoin did so again on Sunday, twice on Monday and again around 3:30 a.m. ET on Monday.

As of Tuesday morning, the cryptocurrency had pared its gains and was trading around $24,500, down 1.5% in the past 24 hours. The second leading cryptocurrency, Ether, traded down 2% to around $1,600 on Tuesday.

The most popular cryptocurrency faces resistance at the $25,000 level fueled in part by what could be a higher-than-expected rate hike by the Federal Reserve at its March meeting. St. Louis Federal Reserve President James Bullard said last week that he had pushed for a half-percentage-point rate hike at the last meeting and may do so at the March meeting. Cleveland Fed President Loretta Mester agreed. Stocks fell on the news, which likely contributed to investors’ reluctance to push Bitcoin above $25,000.

Tougher regulatory enforcement could also be a hindrance to crypto investor optimism. Last week, Paxos said it would stop minting the Binance USD (BUSD) stablecoin, after the New York Department of Financial Services ordered it to do so. The New York-based crypto company also faces a possible lawsuit from the Securities and Exchange Commission over whether the cryptocurrency is an unregistered security – an action that could have ramifications for investors and US-based stablecoins.

Despite inflows of $158 million so far this year, Bitcoin last week saw an increase in money leaving the asset, according to a note from digital investment and trading group CoinShares. There were about $25 million in Bitcoin outflows, the highest among the top cryptocurrencies, along with $3.7 million in inflows into investment products meant to short it — or bet on it losing value.

Still, after a miserable end to 2022, Bitcoin is up nearly 50% in 2023. Last week, fueled in part by new NFT collection ordinals, the total number of Bitcoin wallet addresses with a non-zero balance hit an all-time high of 44 million, according to a note from the crypto exchange Bitfinex.

“This suggests an influx of new investors, likely helping to drive recent gains for Bitcoin,” the exchange wrote.

This story was originally featured on Fortune.com

More from Fortune:

5 Side Hustles Where You Can Make Over $20,000 Per Year – All While Working From Home

Millennials’ average net worth: How the nation’s largest working generation stacks up against the rest

Looking for extra cash? Consider a checking account bonus

This is how much money you need to earn annually to comfortably buy a $600,000 home