Law enforcement alert on increasing money laundering of cryptocurrencies

Until the advent of cryptocurrencies, “cleaning” illicit funds was a much more complex process. In recent years, laundering cryptocurrency has become easier.

Money laundering involves illegally converting income from criminal activities into legitimate funds. Traditionally, this was done by funneling illegally obtained money through legitimate businesses. The aim is to avoid detection and disguise the illegal funds as legal profits.

However, criminals are increasingly turning to crypto. Cryptocurrencies have two characteristics that make them a very attractive option for criminal organizations. First, the decentralized nature of cryptocurrencies allows for a degree of anonymity, which can make it more difficult for law enforcement agencies to track transactions.

Second, convenient cross-border transfers are useful for those who want to move significant amounts of money quickly and discreetly. As a result, cryptocurrencies have become a preferred choice for criminal organizations looking to move large sums of money undetected.

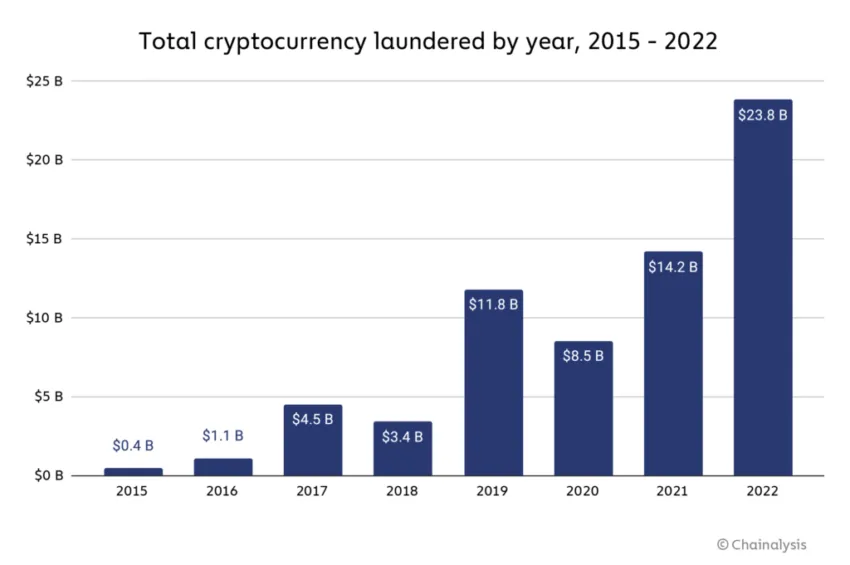

2022 was a record year for cryptocurrency laundering

According to Chainalysis, 2022 was the biggest year yet for cryptocurrency laundering. In 2022, illegal addresses transferred around $23.8 billion in cryptocurrency, a 68.0% increase from 2021.

Common centralized exchanges received almost half of the total illicit funds, despite having compliance measures in place to report suspicious activity and take action against offenders. This is notable because these exchanges are where illegitimate cryptocurrency is converted into cash. They are also the most monitored by law enforcement.

Recent findings from Elliptic, a blockchain analytics company, indicate that RenBridge, a specific cross-chain bridge, has laundered at least $540 million in cryptocurrency linked to criminal activity since 2020. Of this amount, $153 million was associated with ransom payments. Hackers use RenBridge after infiltrating corporate networks and extorting payments from companies to retrieve stolen data. Elliptic claims that RenBridge plays a critical role as an enabler for ransomware groups with ties to Russia.

According to Martin Cheek, CEO of SmartSearch, which offers anti-money laundering (AML) and Know Your Customer (KYC) services, cryptocurrency has been a popular way to launder money for criminal organizations since the mid-2010s.

“As cryptocurrencies became popular and increased in value, criminals were given a largely unregulated method to launder money and hide illegal activities,” he says. “Over time, as cryptocurrencies have been scrutinized by regulators, their use for money laundering has become more difficult.

“Criminals, however, continue to find new ways to use crypto for money laundering. As a result, it remains a challenge for law enforcement agencies and financial regulators to detect and prevent money laundering in the crypto space.

85% of crypto firms failed UK FCA standards

Earlier this year, the UK’s Financial Conduct Authority (FCA) failed to pass 85% of all crypto firms that applied for registration. Many of their demands were related to anti-money laundering and anti-terrorism regulations. (These are the same rules that apply to the traditional financial system.)

In most cases, Cheek believes this is due to a lack of competence and internal process. “The registration process is not impossible, the Financial Conduct Authority provides feedback and clear expectations. Last month, the FCA reported that 41 had been approved by the regulator out of the 300 applicants received. There is an opportunity to reapply, so it is important for firms to reach the necessary level and then evolve with the latest FCA guidelines and regulations to prevent their business from being exposed to the fraud, financial crime and Ponzi schemes that have made a mockery of the market.”

In a few cases, the Financial Supervisory Authority identified possible financial crime or direct links to organized crime. Law enforcement agencies were notified of suspected cases by the FCA.

Decentralized exchanges, which offer a higher level of anonymity, are increasingly being used to “clean” dirty cash. Sheek believes that smaller exchanges are not doing nearly enough to prevent money laundering on the scale that is needed. “By adopting cutting-edge electronic verification (EV), a small crypto exchange can check the identity of a user, protect assets and enforce accountability. Common practices such as asking for an ID document are no longer sufficient. Not only do they not meet know- your-customer (KYC) and AML standards, but they can also leave the door open to identity theft.”

Law enforcement is approaching

One of the law enforcement agencies that focuses on money laundering is the National Crime Agency. They are often considered Britain’s answer to the FBI. Together with its international counterparts, it uses better cryptographic knowledge and blockchain analysis tools to detect criminal activity.

It was founded in 2013 and includes tackling serious and organized crime in the UK and across international borders. It recently announced that it is recruiting for a new dedicated team based in the National Cyber Crime Unit, which will specifically deal with money laundering. The NCA is planning another dedicated group for the Complex Financial Crime Team.

Speaking to BeInCrypto, we were told that crypto is being used across all crime types in the UK. Including “increased use for money laundering”. However, this was “low in comparison to legitimate use.”

A spokesperson told BeInCrypto that: “Crypto-assets are increasingly being reported as an enabler of serious and organized crime. Although overall, the volume of crypto-related money laundering remains low compared to the wider economy.”

“The threat lies in the exponential adoption of cryptocurrencies, and the criminal activity that we will inevitably encounter through it. It is therefore crucial that our response in this area continues to adapt and develop, in close collaboration with partners, internationally and across sectors.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.