Bitcoin (BTC) dominance reaches critical level for Altcoin price

The cryptocurrency winter of 2022 has not given altcoin supporters much joy. The relentless decline in the Bitcoin (BTC) price led to even more severe losses across the broader crypto market. However, following the recent market recovery in early 2023, Bitcoin (BTCD) dominance has reached a key level that could affect the future fate of altcoins.

Bitcoin dominance measures the market value of Bitcoin relative to the total market value of other cryptocurrencies (altcoins). If BTCD rises, it means that BTC’s share of the cryptocurrency market is increasing. If it falls, the importance of the largest cryptocurrency is diminishing.

Bitcoin dominance can increase in two ways. First, the price of BTC can rise faster than other altcoins. Such a situation often occurs during a rapid recovery in the cryptocurrency market, when large capital first flows into Bitcoin.

Second, BTC price may decline more slowly than altcoin prices. This often happens during a long-term bear market, when riskier altcoins experience much greater capital outflows than relatively stable Bitcoin.

If, on the other hand, Bitcoin dominance declines, it means that Bitcoin is growing more slowly than its younger brothers. It is also theoretically possible that the price of BTC falls and the altcoin market rises. However, this happens very rarely and usually involves individual altcoins.

Bitcoin Dominance Attempts To Break Through 44.50%

On the weekly chart of BTCD, we see a long-term parallel channel dating back to May 2021. At that time, the sharp decline in Bitcoin dominance led to the famous altcoin season, where most of the leading altcoins bet everything. time highs (ATH) paired with BTC.

Since then, Bitcoin dominance has respected resistance in the 48-49% range (red circles) and support in the 38.50-39.50% range (blue circles). Meanwhile, two other key levels have emerged in 2022: support at 41.50% and resistance at 44.50%. The latter was recently reached on the back of Bitcoin’s rapid rise in value since early 2023

The daily chart confirms the readings from the weekly timeframe. Since the beginning of February, Bitcoin dominance has undergone a short-term correction, leading to the 43% level. It coincides with the 0.382 Fib retracement level, which measures the upward movement that started at the beginning of the year.

The shallow correction suggests that BTCD uptrend may continue and the indicator is poised to break through the 44.50% level. Moreover, the daily RSI has yet to generate a bearish divergence. This suggests that the upward movement is still strong and the trend can be expected to continue.

When Altcoin Season?

If the Bitcoin dominance realizes the bullish scenario and breaks out above the 44.50% resistance, we will still have to wait for the altcoin season. Perhaps it will appear only after the end of the upward impulse of the BTC price and after a bearish retest of the 48% area of BTCD.

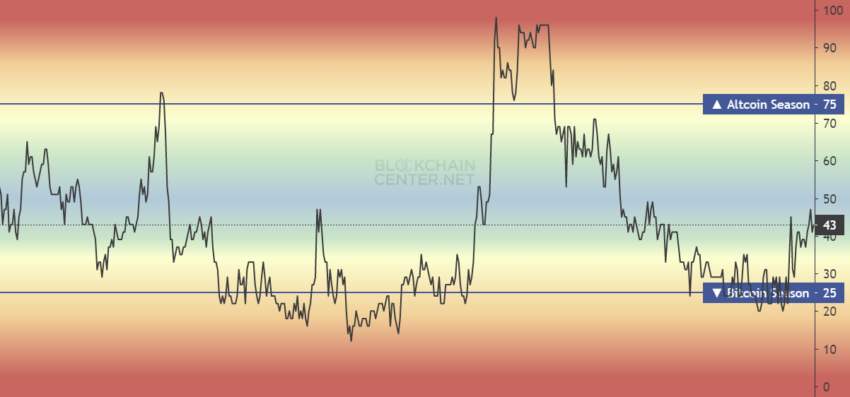

This interpretation seems to be favored by the Altcoin Season Index by Blockchaincenter. The index clearly shows that we experienced a minor Bitcoin season in early 2023, when it fell below 25.

Currently, the index is back in the neutral zone, giving a reading of 43. If it is rejected from this zone – as it was in May 2022 – the Bitcoin season will continue. If, on the other hand, it continues its upward trajectory, the long-awaited altcoin season can be expected in a few weeks or months.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use this information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.