Bitcoin NFT Wars Heat Up As L2 Token STX Rises

Stacks’ native STX token rode the Ordinals hype to hit a nine-month high of $0.79 amid growing interest in Bitcoin NFTs.

The STX token reached its all-time high of $0.79 on February 20, 2023, while Bitcoin NFT trading volume is up 1123% amid the recent craze surrounding Bitcoin NFT listing project Ordinals.

Stacks NFT ecosystem poised to take off despite criticism

According to Trust Machine CEO and Stacks co-creator Muneeb Ali, NFT creators have created $650,000 worth of NFTs on Stacks L2, with the ecosystem set to expand in 2023 with the introduction of the Nakamoto upgrade.

Stacks is an existing chain that will use a BTC-pegged derivative token sBTC for capital transfer between itself and the base Bitcoin chain after the upgrade later this year.

Unlike the Lightning Network, a Bitcoin scaling solution focused on payments, Stacks introduces smart contracts on a separate chain with an independent ledger. The Stacks chain connects to the Bitcoin network through a Proof of Transfer consensus algorithm.

Miners securing the Stacks blockchain use BTC to create new STX, and STX holders can stake their tokens to earn BTC rewards. STX is also used to pay gas fees for smart contract transactions.

Stacks raised $47 million in venture capital and $23 million through the STX token offering approved by the US Securities and Exchange Commission.

The designer of RSK, and the EVM-compatible Bitcoin sidechain, criticized Stacks in a 2021 blog post for promoting its relationship with Bitcoin, despite having its own native currency and a distinct incentive scheme. He also criticized the lack of extensive documentation explaining the Proof of Transfer algorithm. He also said Stacks’ smart contract programming language could introduce transaction bottlenecks that could drive up costs.

Ordinals are reviving interest in Bitcoin DeFi

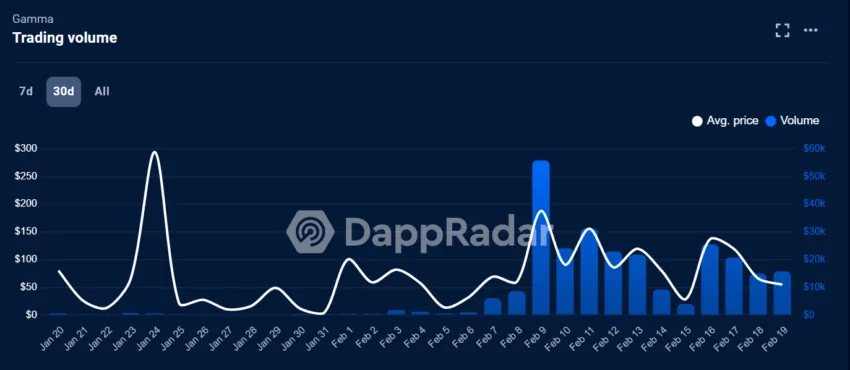

The Bitcoin ecosystem, including Stacks, has benefited from the interest sparked by the launch of a new NFT-like project on Bitcoin called Ordinals.

Minting an NFT on the new Ordinals protocol involves storing data from the Witness part of a Bitcoin transaction. Data from the NFT is entered on the first satoshi of the transaction’s first output. The ordinal numbering protocol assigns a unique identifier to each satoshi, making it traceable. A Satoshi is one hundred millionth of a Bitcoin.

While the project initially divided the Bitcoin community, recent data suggests growing interest from collectors and developers.

A Dune Analytics dashboard indicated that the number of Ordinal inscriptions exceeded 100,000 about a week ago. This bonanza allowed Bitcoin miners to rake in roughly $114,000 in transaction fees.

Wallet developers are reportedly trying to keep up with allowing Ordinals holders to view their NFTs in wallets. According to Ali, Ordinals currently share NFT creators with Stacks.

He hopes Stacks will help scale the Bitcoin NFT ecosystem by overcoming limitations associated with Bitcoin’s block size.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.