99.5% of crypto investors did not pay taxes in 2022 according to a report

US crypto investors account for more than 40 million users globally. However, many may face consequences or even jail time if they fail to file taxes.

Cryptocurrencies have grown in popularity in recent years, with many investors looking to profit from high volatility and potential returns. However, one issue arising from the increased use of cryptocurrencies is the need for clarity around reporting gains or losses on investments made using them. Only a small proportion of crypto investors globally paid taxes on their crypto. Thus causing significant concern for government revenue collection.

Complications when paying crypto tax

One of the reasons many investors have yet to pay taxes on their crypto investments is the complex nature of cryptocurrencies. The technology can be challenging to understand. Therefore, many investors must still be aware of the tax implications of their investments. This lack of knowledge can lead to unintended tax avoidance, resulting in lower tax revenues for the government.

In addition, the decentralized nature of cryptocurrencies makes it challenging for governments to regulate and enforce tax laws. Since cryptocurrencies operate independently of any central authority or institution, it can be difficult for authorities to track transactions. Ergo, enforce taxation. This lack of regulation and enforcement can be a significant reason why many investors have not reported their crypto gains or losses.

Another factor behind the low number of taxpayers reporting crypto gains is the relative newness of cryptocurrencies. Cryptocurrencies have only been around for a little over a decade. Furthermore, many investors may need to learn how to report gains and losses correctly. This lack of knowledge and understanding can lead to the under-reporting or non-reporting of crypto transactions.

Low tax payments reported last year

The low number of taxpayers reporting their crypto gains is a concern for governments globally. The complex nature of cryptocurrencies, the decentralized nature of transactions, the relative newness of cryptocurrencies, and the lack of clarity around tax rules all contribute to this problem.

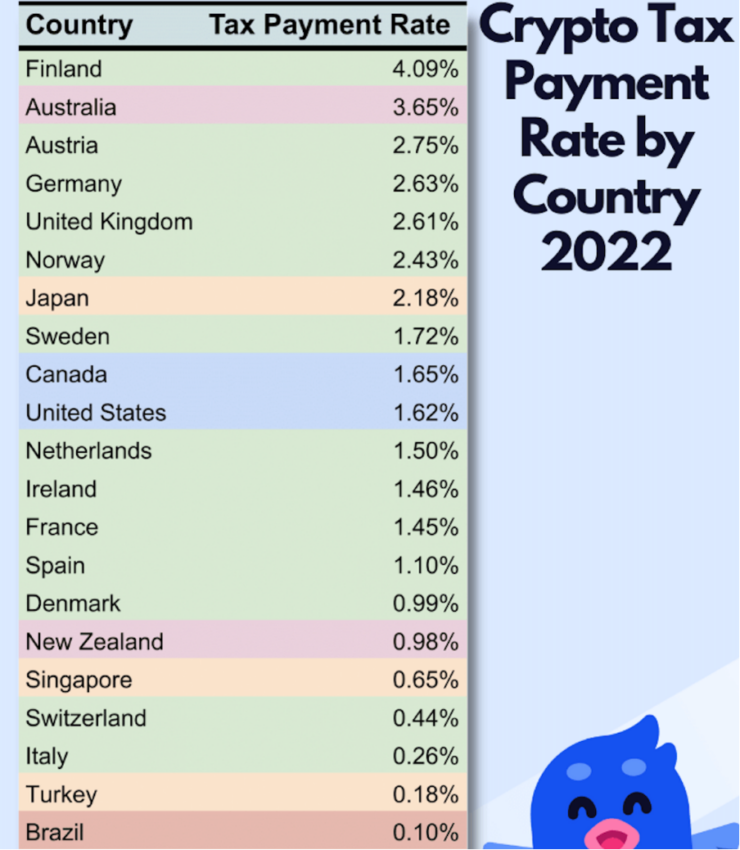

According to a report by Swedish crypto tax firm Divly, only 0.53% of crypto investors globally paid taxes on their cryptocurrency in 2022. The approach to determine the tax payment rate for cryptocurrencies in 24 different countries used a multi-step process. The method included analysis of official government statistics, search volume data and available cryptocurrency ownership data.

The report estimates that Finland has the highest proportion of crypto investors. That is, those paying the required taxes on crypto in 2022, at 4.09%, with Australia following close behind at 3.65%. Surprisingly, the US ranked 10th on the list with only 1.62% tax payment.

The difference in tax payment rates across countries was attributed to differences in awareness, general tax compliance and government policies. The report analyzed countries with the highest number of crypto taxpayers, with the US at the top of the list, followed by Japan, Germany, the UK and Australia.

Despite the US ranking lowest among the top ten countries for tax payment rate at 1.62%, the US has a high cryptocurrency usage rate and a large population, resulting in almost twice as many tax returns involving cryptocurrency compared to the country with the other – highest number of declarations.

US crypto users could face jail time

An authority on the matter is Danny Talwar, global head of tax at crypto tax software Koinly. In a discussion with BeInCrypto, Talwar shared data that has raised concerns among US crypto investors. According to internal findings shared by Koinly, 20% of global users fail to file their taxes on time. These statistics highlight the need for more awareness and education about tax compliance in the cryptocurrency industry.

According to global statistics, there are around 45 million crypto users in the US, which means around nine million Americans could be at risk of legal consequences for tax evasion. With the US tax year ending in a week (April 18), those involved in cryptocurrency must take the opportunity to file taxes on time and ensure compliance with the law. Failure to do so can result in serious fines and legal penalties, including the risk of imprisonment.

The specific fines and consequences will depend on various factors, for example the type and amount of tax owed, how long the taxes have been unpaid, and whether the failure to pay was intentional or unintentional. Individuals who fail to file their tax returns or pay taxes on time can face fines, interest charges and even legal action. The Internal Revenue Service (IRS) may impose penalties for late filing, late payment, and failure to pay assessed taxes. Penalties can be significant, including fines and even imprisonment in some cases.

Above all, governments need to establish clear tax laws for cryptocurrencies and educate investors about the tax implications of their investments to ensure that taxpayers accurately report their crypto gains.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.