7 VC firms are investing heavily in Bitcoin and blockchain technology – Cryptopolitan

In February 2023, RootData reported 120 public investment projects involving cryptocurrency venture capital (VC), a 62% increase compared to 74 projects in January and a 23% decrease from the 155 projects recorded in February 2022.

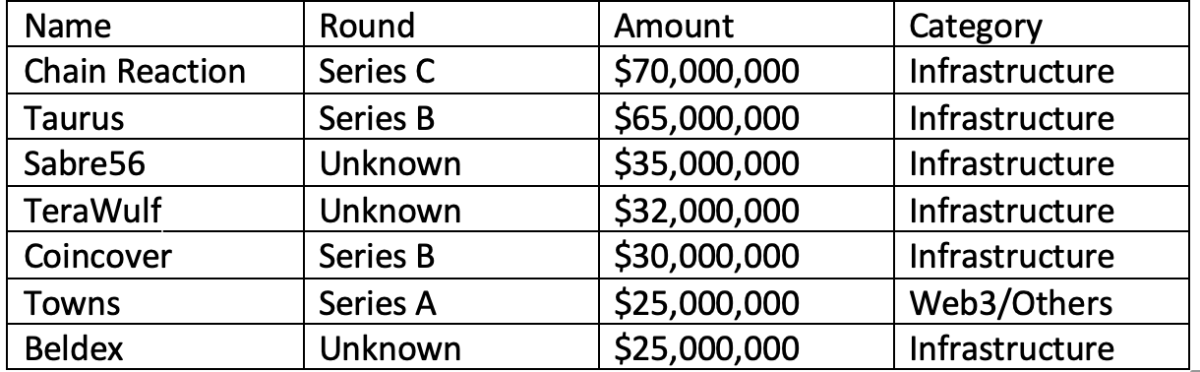

In February, infrastructure projects accounted for approximately 28% of the cryptocurrency market’s total funding, DeFi for 18% and NFT/GameFi for 24%. The total funding amount during that month was US$950 million, representing an increase of 66.7% from the US$570 million seen in January 2023 and a decrease of 76.6% from the US$4.06 billion recorded in February 2022, and ended a four-month decline. Excluding CeFi, miners and other centralized institutions, more than USD 20 million has been rotated through the market during this time; the breakdown is as follows:

Chain reaction

Chain Reaction, a blockchain startup, recently secured funding from Morgan Creek Digital and will use the funds to expand its engineering team. Alon Webman, CEO of Chain Reaction, stated that the company plans to start mass production of its flagship product Electrum in Q1 2023 and aims to launch a “full homomorphic encryption” chip by the end of 2024. This chip will allow users to both process and encrypt data at the same time.

The bull

Taurus SA, a Swiss digital asset infrastructure company, has closed a funding round led by Credit Suisse and backed by Deutsche Bank, Pictet Group and Cedar Mundi Ventures. This investment enables the firm to provide companies with comprehensive services related to the issuance, hosting and trading of digital assets – including asset staking and tokenization. Cedar Mundi Ventures is a Lebanese investment company specializing in technology.

Zebra 56

Sabre56, a bitcoin mining consultancy, recently raised $35 million to build its hosting sites. This investment was primarily raised from private funds, and the company aims to reach an installed capacity of 150MW by the end of 2021. So far, construction has already started on four locations in Wyoming and Texas with a total of 115MW.

TeraWulf

Cumulus Data recently announced plans to launch TeraWulf, America’s first nuclear-powered bitcoin mine. This groundbreaking move seeks to optimize energy efficiency in the crypto value chain by maximizing the power output of BTC mining. TeraWulf is scheduled to go live this year and will mark a major milestone for cryptocurrency mining in the US.

Coin cover

Coincover, a leading provider of innovative technologies to protect digital assets held by crypto companies and individual investors, closed a major funding round led by Foundation Capital. Their solutions include monitoring and analytics to detect unauthorized access, compensation in the event of a hack, and strong end-to-end encryption vaults for secure storage and private key recovery. Their mission is also to protect users’ digital assets.

Cities

Towns, the first product from Here Not There Labs, is a Web3 group chat protocol and application designed specifically for online communities. This decentralized platform enables online communities to create blockchain-based collections without worrying about outside organizations changing the rules or profiting from their activities. Funding for Towns was led by a16z crypto, allowing users to meet and chat freely in Spaces tailored to their needs and protected by their rights.

Beldex

Beldex, a privacy technology startup, recently secured funding led by digital asset maker DWF Labs. The investment will be used to further research and develop the Beldex ecosystem, including BChat, a private messaging application; BelNet, a decentralized virtual private network (VPN); the Web3 browser; and privacy protocols across chains. DWF will also offer advisory services and assist with marketing measures.