7 Cryptos to Watch as Blockchain Greets the New Year

After a terrible year in the best cryptos to watch, it’s only natural that many investors look ahead to 2023 for potential upside opportunities. Nevertheless, it is important that the market players do not lose focus. First and foremost, the Federal Reserve likely represents the key to the trajectory of the blockchain ecosystem. As the juxtaposition between the digital benchmark and the M2 money stock shows, the two metrics share a strong direct correlation.

Stated differently, as the money supply increases (inflation), circumstances put upward pressure on crypto (and other commodities). And when the money supply decreases (deflation), the resulting framework puts downward pressure on virtual currencies. While blockchain advocates have waxed poetic about forming an independent ecosystem, for now crypto market valuations depend on the Fed.

For this list of cryptos to watch, I’m going to focus on technical analysis, especially key price targets to watch. This way, you can prepare for several scenarios as we enter a potentially eventful new year.

Bitcoin (BTC-USD)

The original virtual currency and still the reference to cryptos, Bitcoin (BTC-USD) enjoyed wild gains in 2021. At that point, however, the Fed continued to implement a dovish policy, thereby increasing the money supply from already high levels. Looking back, it wasn’t that surprising that Bitcoin and other digital assets jumped.

The current hawkish profile presents major challenges for risky assets like these top cryptos to watch. For Bitcoin in particular, investors need to watch out for the $17,000 level. Honestly, this represents the level naked minimum for BTC to exceed. To have any hope of a sustained upside rally, BTC must convincingly clear the 20K barrier, which represented roughly the peak of the bull market cycle that peaked in late 2017/early 2018.

Ultimately, bulls should see a return on BTC at 40K. Then and only then can we engage in a realistic discussion of Bitcoin returning to previous highs and perhaps setting new records. However, not getting to 20K can mean heavy losses in confidence. And it can give a trip to under 10K.

Ethereum (ETH-USD)

Source: Ycharts.com

Another one of the best cryptos to watch, Ethereum (ETH-USD) built up a strong reputation over the years. In addition, ETH also plays a significant role as a sector reference. As with Bitcoin above, Ethereum had a torrid year in 2021, eventually shooting up towards the 5K level. However, near the middle of Nov. In 2021, ETH started to struggle, badly. Then, in 2022, it lost about 68% of its market value.

Going forward, Ethereum needs to convincingly move past the $1,400 level. That was roughly the average weekly price of the asset during its peak in January 2018. Of course, $1,400 represents a minimum target. From there, bulls will want to see Ethereum challenge and move past the $2,500 milestone. This point represents a previous support and resistance line from 2021 and 2022. Unfortunately, ETH has meandered around the $1,200 price point, where it stands at the time of writing (December 31). If it cannot reach the $1400 minimum threshold, I suspect the downside risk will be around the $700 range.

Tether (USDT-USD)

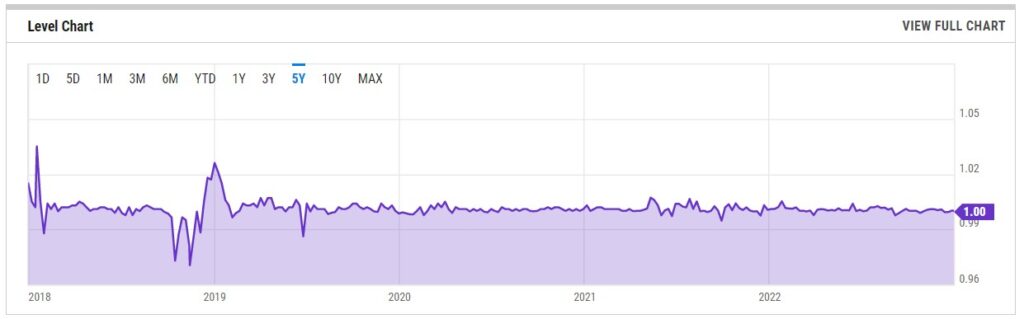

Source: Ycharts.com

Technically, Tether (USDT-USD) has an exponentially less interesting profile than other cryptos to watch. Obviously, as a stablecoin or digital asset tied to a fiat currency (usually the dollar), USDT should stay at $1. With a few notable exceptions, this has largely been the case. Therefore, you may ask, what is there really to talk about?

I’ve been thinking a lot about stablecoins, and the harsh reality is this: holding an excessive amount of your wealth in USDT exposes you to double risk. For example, very few young investors sit on cash during normal market cycles. With the purchasing power of the dollar eroding 2% to 3% in modern times, cash holders end up losing out.

When you hold Tether, you also end up losing (during inflationary cycles) due to the 1:1 ratio with the dollar. But just holding USDT in itself opens up the possibility of a digital bank run and complete implosion. Therefore, think very carefully about heavy exposure to such cryptos to see.

BNB (BNB-USD)

Source: Ycharts.com

Speaking of implosions, GDP (BNB-USD) – essentially the digital resource that underlines Binance exchange—experienced a significant boost in interest, especially because it wasn’t FTX. As you’ve probably heard by now, the issue posed a major credibility threat to the blockchain. In addition, investigators uncovered details that make this case very ugly.

Unfortunately, the enthusiasm seems to have been short-lived. Currently, BNB is changing hands for $245.11. In 2022, the formerly branded Binance Coin suffered a year-to-date loss of around 53%. In the last month heading into the new year, it is down approx. 18%. Going forward, BNB bulls need to target the $450 level. From there, it could create a realistic challenge with the $600 threshold.

However, we can’t talk about $600 until BNB at least breaks into the $300 territory. But that is the problem. With many investors losing interest in the top cryptos, BNB faces a credibility threat. I would be extremely careful.

XRP (XRP-USD)

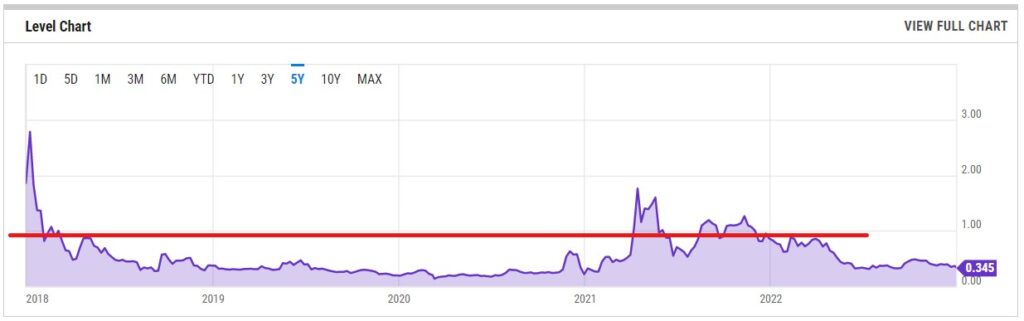

Source: Ycharts.com

Always any discussion about XRP (XRP-USD) focuses on its core business Ripple Labs and the lawsuit brought against it by the Securities and Exchange Commission. To summarize, the SEC views XRP as a security and therefore places Ripple under the regulatory agency’s responsibility. Naturally, Ripple disagrees, claiming that XRP represents one of many cryptos.

Ultimately, the prize that Ripple seeks is legal clarity and precedence. If the company emerges victorious, it will achieve for its coin what no other digital asset enjoys. Hopefully that will mean a significant move higher because frankly, XRP needs it. Currently, the coin is trading hands at around 34 cents a pop. But $1 has long symbolized a critical support and resistance line.

In the shorter term, you would like to see XRP now convincingly between 53 cents and 63 cents. That’s where XRP previously fell to and where the bulls provided strong support. Failing that – and perhaps a legal setback – XRP risks falling to around 14 cents.

Dogecoin (DOGE-USD)

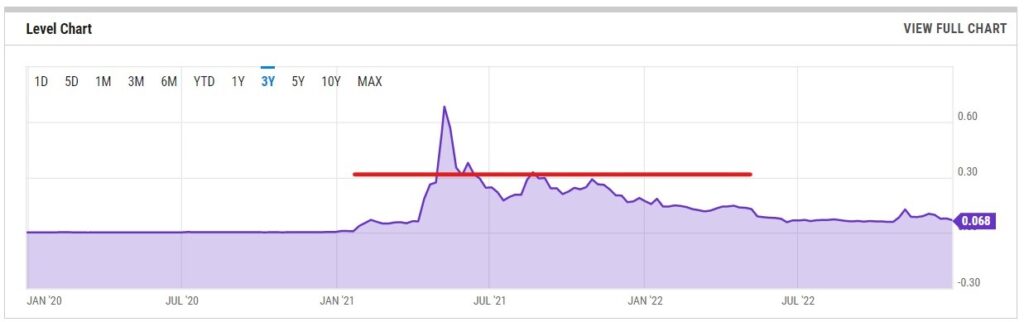

Source: Ycharts.com

Not shockingly, Dogecoin (DOGE USD) generated considerable criticism throughout its existence. Starting as a joke, several social influencers and renegade celebrities – obviously Elon Musk comes to mind – latched onto Dogecoin. For conservative investors, this fanfare may be too distracting. In addition, DOGE shows the wild nature of cryptos. However, the “sincere” profile of the underlying community brings some charm to the table.

With Dogecoin, you won’t find too many people talking about changing the world through its underlying blockchain architecture. Instead, the focus is on community and fun. Unfortunately, however, there hasn’t been much fun with DOGE in 2022. But will 2023 be different?

For the optimistic narrative to be true, Dogecoin needs to get to the bottom line of the mountain so to speak. And this threshold is around 30 øre. You get to 30-cent DOGE and grassroots enthusiasm can quickly return it back to previous highs. If that doesn’t work out, it wouldn’t be surprising to see Dogecoin drop below a penny.

Cardano (ADA-USD)

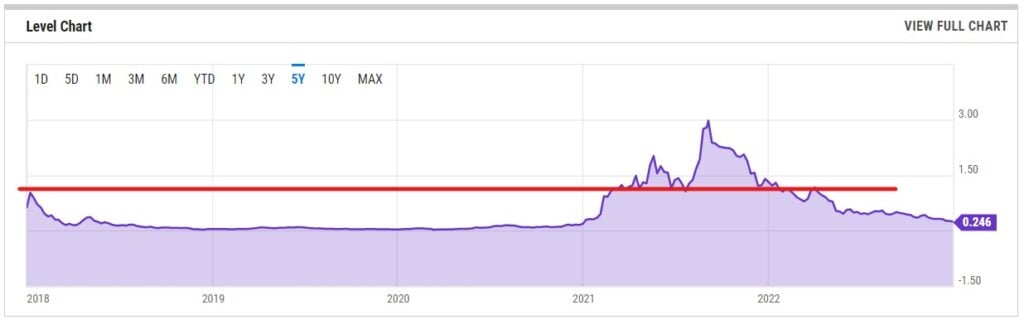

Source: Ycharts.com

One of the more popular cryptos available, Cardano (ADA-USD) is the little engine that could. Of course, the underlying blockchain architecture represents more than just resilience. Cardano effectively pioneered the protocol known as proof of stake, which is a more energy efficient consensus mechanism. In fact, Ethereum switched from its previous proof-of-work to a stake protocol in a much-publicized transition.

Tragically, the underlying powerful fundamentals of Cardano’s ADA coin did not insulate it from volatility. By 2022, ADA was bleeding roughly 82% of its market cap. It is one of the worst performers among major cryptos. The bears have been particularly hard on the ADA, leading to an ugly spiral.

For bulls to have any chance, it must first stop the bleeding. From there, it must regain control at $1. It was roughly the top of the culmination in late 2017/early 2018. Additionally, it represented support and resistance in 2021 and 2022. However, given the negative momentum, my concern is that ADA will fall to around 10 cents.

As of publication date, Josh Enomoto had a LONG position in BTC, ETH, USDT, XRP, DOGE and ADA. The opinions expressed in this article are those of the author, subject to InvestorPlace.com Guidelines for publication.