6 technology trends affecting banking and fintech – Tearsheet

Lately, it seems like every year is a good year for technology, and the last one was no different. While products tend to get all the hype, it’s often technological processes that really make the biggest waves.

Let’s look at the biggest movements from last year that are likely to impact the banking and fintech industry in 2023.

Big Tech is making big moves

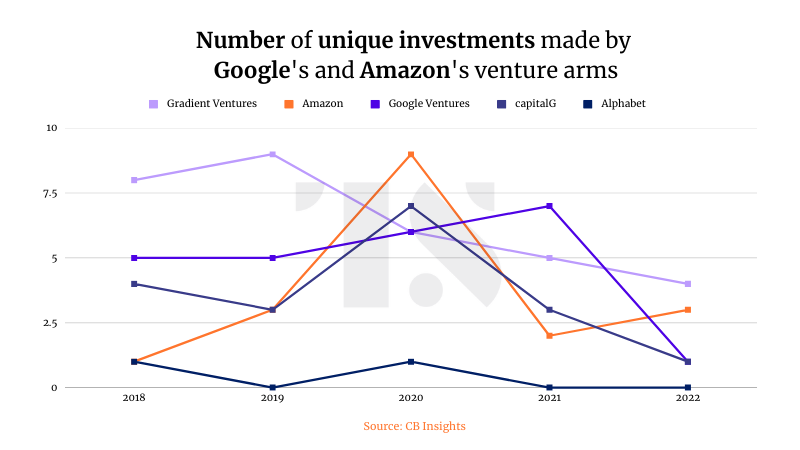

Big Tech made some big moves in financial services last year, and the divide between well-known social media giants and financial institutions is eroding fast. Research shows that Google was the most active technology giant in fintech services in 2022.

Not to forget that earlier that year Google also announced the release of its digital wallet that enables P2P payments, detailed privacy controls and virtual cards on the platform.

Source: CB Insights

But other tech giants are not far behind and continue to expand functionality. Meta-owned WhatsApp introduced its ‘first’ end-to-end in-app shopping experience in India, called JioMart. Similar call trading strategies were also implemented on this side of Prime Meridian by Attentive. Shopify and YouTube announced a partnership that will allow merchants to sell through the platform.

Meanwhile, Apple is looking into the digital ID space and wants to expand its Mobile ID features and State ID to more regions of the country – currently 8 TSA checkpoints offer support. In these states, customers can use the digital version of their driver’s license or other authorization in Apple Wallet to clear security checks through airports.

Gamification

As the line between technology and finance becomes thinner, one technological process that has been the focus of an enormous amount of public intrigue is gamification. While the GameStop incident raised many questions, Robinhood’s model was able to make a strong case for how sticky some gamification practices can be.

Although the smoothness of this process has been particularly scrutinized, its introduction has not met with any backlash. Recently, Robinhood announced an attempt at retirement savings.

Gamification is also gaining ground in other applications within financial services. For example, Daffy is a fintech company that offers donor-advised funds and tax-advantaged charitable accounts on its platform that makes it easy and accessible.

For more on how gamification affects user behavior and what the interface can cost us, check out my article on the double-edged sword of good UX. Regardless of how one feels about gamification, convenience is unlikely to grow unchecked at the expense of consumers’ financial well-being.

Research already points to the need for UX elements to focus on the long-term security and interests of investors, as well as give them chances to consider and reflect on their decisions. The considerations are not lost on CEO and co-founder of Daffy, Adam Nash, who noted that “gamification is not the primary driver of giving, but we know it helps. People usually give because they think it’s the right thing to do, and at Daffy we lean into gamification to amplify the positive feelings people feel when they give and give them more reasons to share their giving with others. If we can gamify spending, saving and investing, why not use gamification to motivate people to be more generous?”

Towards responsible AI

AI has improved leaps and bounds this year, with more and more financial services incorporating its capabilities into their process automation tasks or customer experiences. From generating images through a message to getting pre-written scripts, both DALL-E 2 and ChatGPT have been at the center of what is possible for AI.

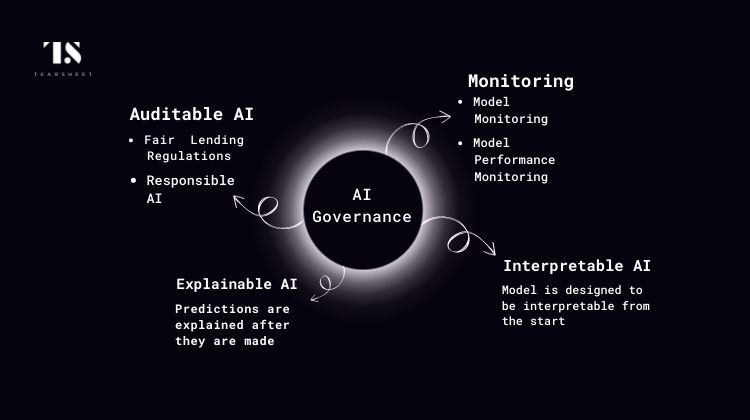

However, not all of these opportunities are good for consumers’ financial well-being. For example, as powerful as AI is considered to be, many privacy and security harms can arise from its use. In addition, bias remains a prevalent problem. To address this, financial institutions are adopting various strategies from explainability to interpretability, and the devil, as usual, is in the details.

Like the customer experience, process automation AI is expected to grow in wealth management as well, with more and more financial advisors showing an affinity for the technology. But it’s not all smooth sailing, with 55% of advisors reporting that the insights generated were too complicated to use.

It is likely that as the use of AI becomes a more central part of financial institutions’ digital strategies, explainable AI will be along for the ride. The questions going into next year will not only be about explainability, but also about explainability to whom.

KYC: Behavioral biometrics will continue to build

While advances in technology offer businesses a chance to improve security, they also offer scammers and fraudsters a chance to run their scams through innovative channels.

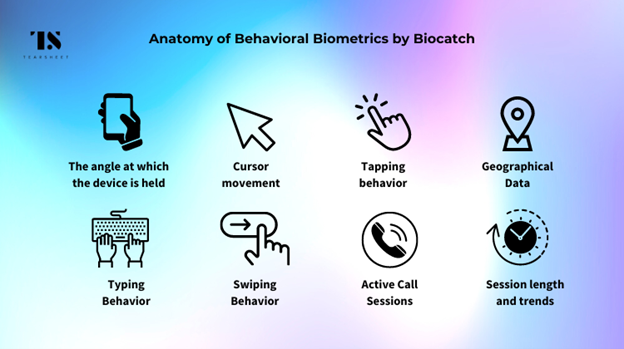

In the first half of last year, fraudulent financial transfers reached $3 billion. To counter this activity, banks work with companies like BioCatch, which can avoid storing personally identifiable information and still verify your identity by analyzing how you interact with your device, tap, swipe, etc.

This new field of behavioral biometrics has implications far and wide in the coming age of digital finance; but it also raises questions about identification and identity in modern times.

Source: Tearsheet

Digital equality

We may be able to buy products in chat or even smile to pay in our local stores, but we still have to crack available PDFs in the financial industry. Our progress in speed and options is not matched by our progress in issues of equal access and universal usability.

Enter Procure Access: a B2B initiative by the non-profit organization Disability:IN, which has brought together 20 firms such as Microsoft, Fidelity Investments and Google in a pact to prioritize accessibility in their procurement process. Also, companies like Deque Systems build a variety of products to help businesses meet accessibility standards as well as compliance requirements. Thales Group recently launched a voice-activated payment card that works to protect the visually impaired from fraud, by reading out the amount of each transaction before validation.

Open bank

Survey data shows that open banking is becoming increasingly important to customers, with 56% reporting that it is a necessity.

Making these expectations a reality requires thorough work on the part of financial institutions. Data from many different institutions must be collected reliably, and compliance, regulatory and security issues must be addressed.

As part of this journey towards “openness”, institutions used the practice of screen scraping to access data hosted on other platforms. As the name suggests, services will log into customers’ accounts using their provided credentials and “scrape” the entire website and store all of its content. Although the practice became terrifyingly common, financial services are increasingly moving away from the practice on a global scale.

Its place is being taken up by open banking services, where individuals can share data with their bank using secure authorization standards such as OAuth. The likelihood that screen scraping will suffer even more blows this year is high. However, it is important that we are sure what we replace it with.