6 FinTech tips that can improve your business

Looking for ways to improve your business?

If so, you should consider incorporating some of the latest financial technology (FinTech) into your business. Doing so can help you streamline processes, reduce costs and improve customer satisfaction. Not sure where to start? Here are six FinTech tips that can help you take your business to the next level:

1. Use cloud-based accounting software

If you’re still using a traditional desktop accounting program, it’s time to switch to a cloud-based solution. Cloud-based accounting software is more efficient and easier to use than its desktop counterpart. In addition, it offers additional security features, which is important given the sensitive nature of financial data. Additionally, consider Cloud Migration for HSMs. It refers to the process of moving data and applications from on-premises hardware security modules (HSMs) to cloud-based HSMs. The migration process can be complex and time-consuming, but it can provide significant benefits in terms of cost, flexibility and scalability. There are several reasons why organizations may choose to migrate their HSMs to the cloud. For example, local HSMs can be expensive to maintain and operate. They also tend to be inflexible, making it difficult to scale up or down as needed. In contrast, cloud-based HSMs can be more cost-effective and easier to scale.

2. Automate the invoicing process

If you’re still creating and sending invoices manually, you’re wasting valuable time. Fortunately, there are now several programs that can automate this process for you. By automating your invoicing, you’ll be able to spend more time on other aspects of running your business. If you’re not sure where to start with invoicing software automation, it’s best to do some research online about what the best invoicing software is as of today. The FinTech world is improving and changing rapidly. So looking at trends in different software is essential to ensure you make the right decision. But remember that what may work for one company may not work for you. Ask for advice, but also make sure that the decision you make about the software you choose to incorporate is specific to you and your business.

3. Accept credit card payments

In today’s world, customers expect to be able to pay by credit card. If you don’t already accept credit card payments, you’re missing out on potential sales. Likewise, since Covid-19, many businesses have enforced card-only policies for sanitary and health purposes. Since then, the use of cash is now considered unsanitary and outdated.

For every company, it is important to keep up with the times. You can lose potential customers if you deny them the ability to pay by card. There are different ways to accept credit card payments, so choose the option that best suits your needs.

4. Use mobile banking apps

There are a number of ways mobile banking apps can improve businesses. Firstly, they can help to streamline the process of managing finances and keeping track of expenses. This can be a huge time saver for busy entrepreneurs who need to focus their energy on other aspects of their business. In addition, mobile banking apps can provide valuable insight into spending patterns and help business owners identify areas where they may be able to cut costs. Finally, mobile banking apps can help businesses build stronger relationships with their customers by providing convenient and easy-to-use tools for managing finances. Overall, mobile banking apps offer a wealth of benefits that can be very useful for businesses.

5. Invest in personal finance software

Personal finance software is a tool that can help individuals manage their financial affairs. It can be used to track income expenditure and investments, create and manage budgets and generate reports. Some personal finance programs also offer features such as bill payment reminders, tax preparation help, and credit score tracking. If you’re not using personal finance software to manage your finances, you’re missing out on a valuable tool. Personal finance software can help you budget, track your expenses, and save money.

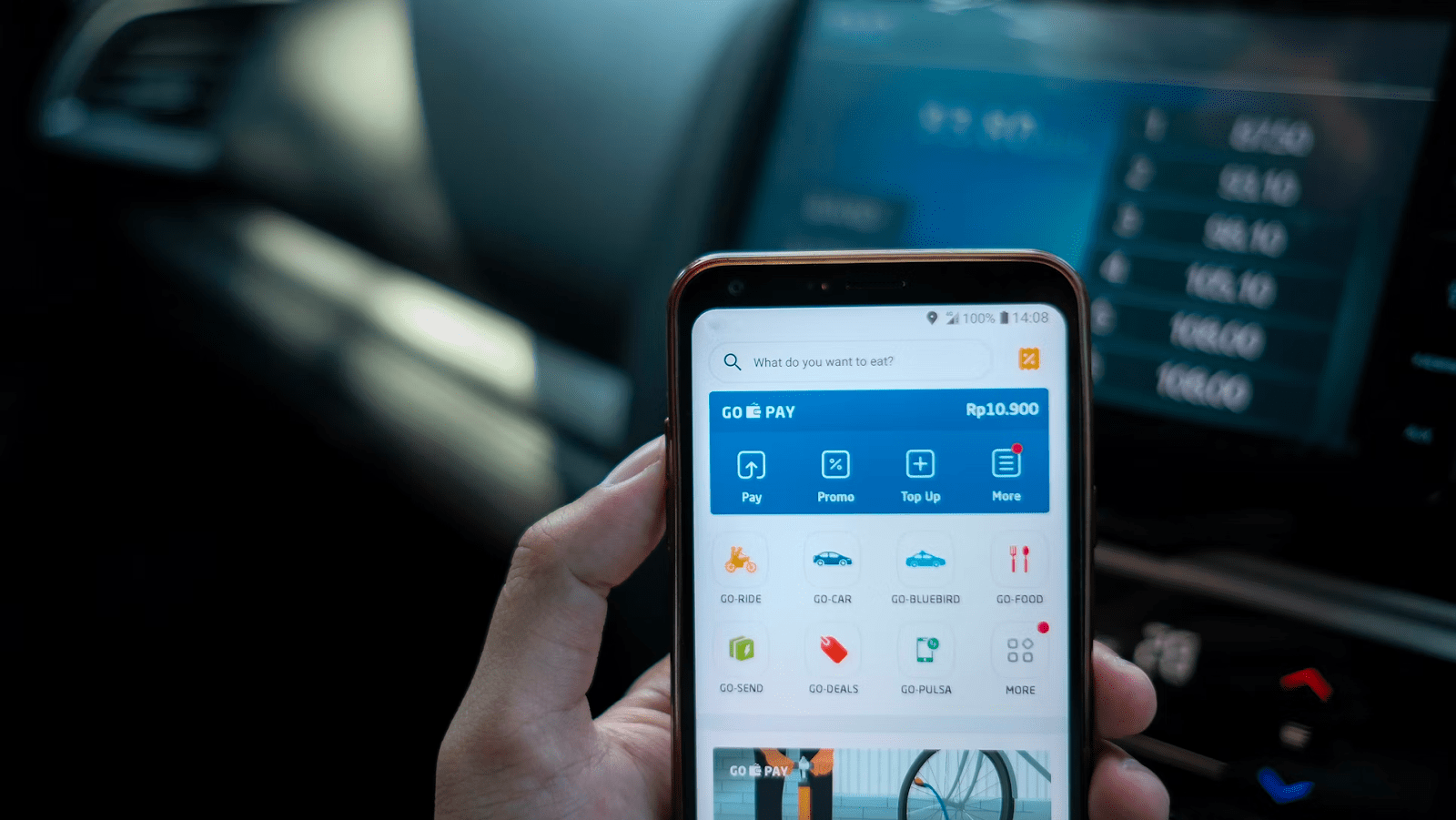

6. Use a digital wallet

A digital wallet is a great way to store your payment information securely. A digital wallet is a type of software that allows individuals to store, send and receive digital currencies such as Bitcoin. Many digital wallets also allow users to track their cryptocurrency balances, as well as transaction history. Digital wallets are useful for businesses because they provide a convenient, fast and secure way to make payments. With a digital wallet, businesses can accept payments from customers anywhere in the world.

Conclusion

Overall, incorporating FinTech can be extremely beneficial for businesses of all sizes. FinTech can help businesses save time and money, while increasing efficiency and security. When used correctly, it can help businesses streamline operations and improve the bottom line. However, it is important to remember that not all FinTech solutions are created equal. It’s important to do your research and choose a solution that works best for your specific business needs. Good luck!