56% of top bank officials do not consider crypto-related products and services a priority

- Most officials predict that cryptotechnology will not be necessary for liquidity management practices for at least the next five years.

- The US Federal Reserve plans to release the digital dollar when lawmakers approve the proposal.

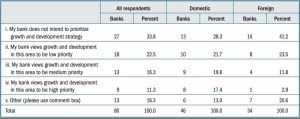

A US Federal Reserve board surveyed top bank officials from 80 banks to know their stance on the near future of crypto-related products and services. The board published the results of its survey on 15 July. The results showed that over 56 percent of these officials said that their growth and development plan for the next two years includes distributed general ledger technology (DLT) or crypto-related products and services.

However, 27 percent said they would make this technology a medium or high priority within the period mentioned above. Meanwhile, 40 percent of these officials said they would make this technology a medium or high priority for their banks over the next five years.

The results of the Fed survey. Source: Federal Reserve

The responses from these banking officials in line with the impact crypto has had on liquidity management practices. Most study participants predicted that cryptotechnology would have no relevance to liquidity management practices over the next five years.

However, a few of the bank officials said they would adjust if necessary. Therefore, they actively follow events in the market. The participants in this survey were the chief financial officers of banks, which hold almost 75 per cent of the total reserve balances in the banking system as of May 2022. 46 of these surveyed senior bank officials were from domestic banks, while the remaining 34 were from foreign financial institutions.

The case for a digital dollar

If US lawmakers or regulators approve the release of the digital dollar, the US Federal Reserve will be responsible for its release and supervision. Some lawmakers support the launch of the digital dollar. On Wednesday, the Connecticut House of Rep. Jim Himes Congress proposed the benefits of the digital dollar.

Himes argues that a digital dollar would enable the United States to keep pace with innovations in financial technology. However, he suggested that the digital dollar should be an alternative, not a substitute, for the fiat dollar.

Nevertheless, the best financial regulators in the United States (Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) work together to enforce cryptocurrencies and regulate other sectors of the financial services system.

Earlier this week, the Senate approved that Michael Barr would be the next deputy head of supervision at our top bank. The confirmation of Barr (a former Ripple adviser) means that there will be seven members of the US Fed’s board this year.

Part of Barr’s responsibility will be to make policy proposals for the Fed and oversee the enforcement of specific financial firms. He only reports to Fed Chairman Jerry Powell.