5 Crypto Analysts Who Perfectly Timed Bitcoin This Week

The crypto market and its reach has challenged many traders and their predictions. Still, there were some analysts who managed to time the Bitcoin price perfectly this week.

Bitcoin (BTC) price and global crypto market capitalization, after the gains in late October, continued to move in a tight range last week. For most of the past week, the BTC price was trading in the red on the daily chart as it fell from the higher $20,700 to the lower $20,200 range.

With the Bitcoin price recording a pullback of close to 3.9% from Monday to Thursday, Friday offered some fresh gains for the crypto market. BTC price was up 1.15% on November 4th as most cryptos traded in the green.

Although the momentum in the crypto market has been quite unpredictable, some technical analysts have managed to time Bitcoin perfectly. Here are a few instances when reputable traders were able to execute Bitcoin price action.

Crypto Analysts Acing Bitcoin Price Action

Technical analyst Crypto Lark told his 1 million followers on Twitter that the Bitcoin monthly MACD is behaving exactly as it did in the last two bear markets. Lark predicted that this could be “the start of a long and slow grind back,” which is exactly how the crypto market seems to be trending at the moment.

Another well-known analyst, Dylan Le Clair, highlighted that the Bitcoin Seller Exhaustion Constant was flashing a potential bottom. The last two times the indicator presented such low figures were in July 2020 and November 2018.

The crypto trader noted that while a move in either direction could be violent, the BTC price could be in range for a while.

Le Clair highlighted in a tweet that there is strong support for border buyers in the $18,000-$19,000 range, while there are many border sellers in the $20,000-$21,000 range. As a result, the Bitcoin price could “pinball in this range for weeks or even months.”

Notably, Bitcoin has actually moved between the aforementioned range over the past 1.5 months.

Similarly, Bitcoin Archive said on October 25 that Bitcoin price may break out after DXY short-term breakout trend. Interestingly, the BTC price saw an important price increase of 7% soon after.

Perfect timing of the dumping

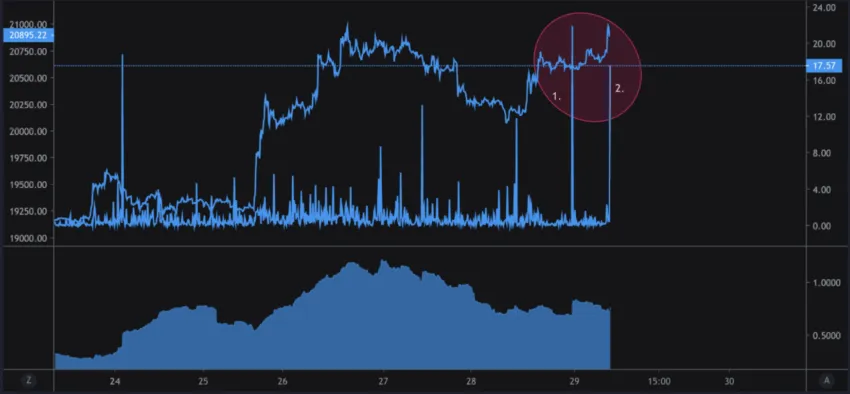

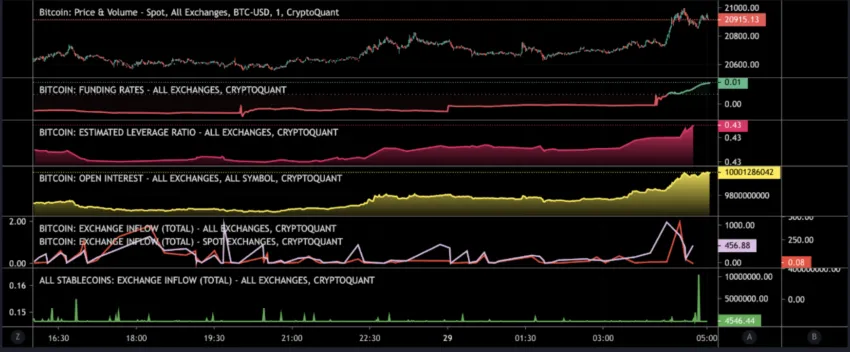

CryptoQuant analyst Onchain Edge said on October 29 that “BTC could dump in the next 12 hours.” During the following day, the Bitcoin price recorded a 2.8% pullback.

At the time, the analyst noted the following caveats:

- High BTC inflow to exchanges: Indicative of the number of BTC entering exchanges in a short period of time. The first was an average of 21 BTC, and the second was 17 BTC.

- The financing rate was positive with rising open interest and a lot of stock was sent to stock exchanges (possibly short positions).

- A lot of liquidity on crypto exchanges around the $21,400 range. If the Bitcoin price shoots up to that level, it could lead to a cascade of liquidations.

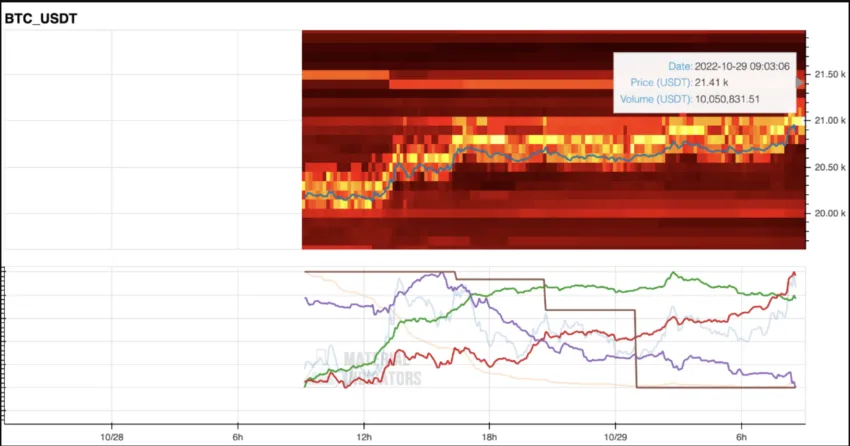

Another CryptoQuant analyst suggested on October 31 that Bitcoin whales were making a move. There was a notable spike in activity for whales holding 1,000-10,000 BTC, which is the highest activity in the month of October.

The high value indicated higher selling pressure in the spot exchange. In the case of derivatives exchanges, since coins could be used to open both long and short positions, an increase in inflows produced higher volatility.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use this information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.

(@DylanLeClair_)

(@DylanLeClair_)