4 innovations that didn’t live up to the hype • TechCrunch

During the last decade, fintech has evolved from a brand of smart startups to a sustained movement that has disrupted the traditionally heavyweight financial industry. Much has been written about the success of fintech and how this wave of technological innovation has changed the lives of consumers.

But lost in all the celebration of success and billions of dollars in venture capital funding are the ideas that failed. Over the past decade, many once-promising innovations have failed and failed to live up to expectations. It is important not only to celebrate success, but also to learn the lessons of failure.

It is worth first defining how we categorize “error”. This article is not focused on highlighting the demise of individual high-profile fintech startups that never justified their lofty valuations. We also do not consider the various failed initiatives taken by large companies, such as BloombergBlack or UBS’s SmarthWealth.

Rather, this piece will focus on fintech ideas that received some initial hype and momentum but ultimately failed to live up to their promise. We will look at ideas that failed to go mainstream and change financial services in the way the founders originally intended.

Algorithmic buy/sell/hold advice for investment portfolios

Fintech must remember that the average consumer does not like to think about money and often wants someone else to take care of it.

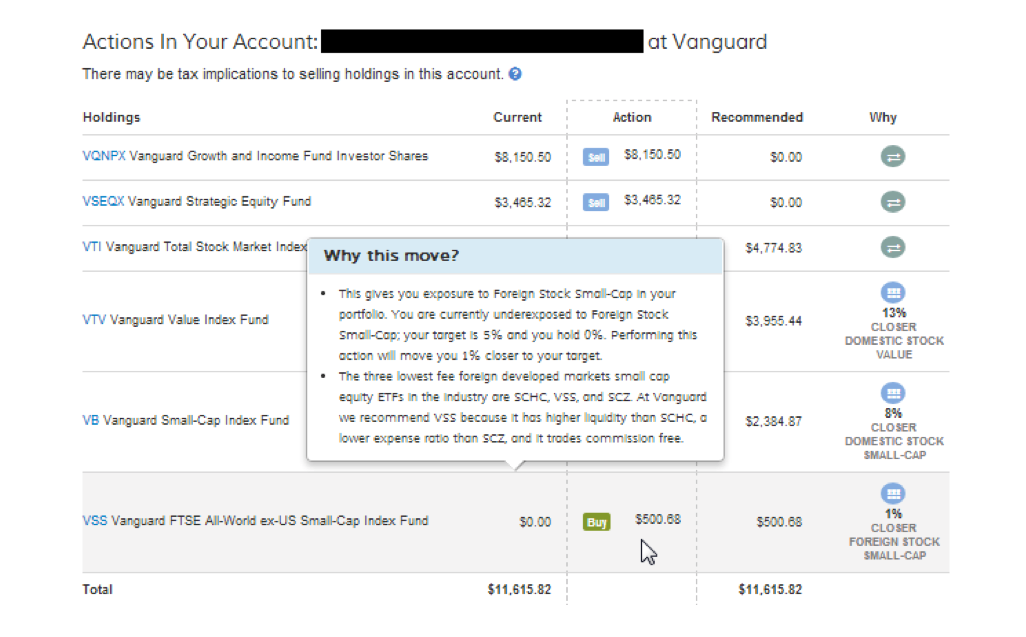

Several firms that would eventually be called “robo-advisors” started life as fintech companies that offered algorithmic buy, sell and hold advice for a user’s investment portfolio. Customers would enter usernames and passwords for their financial accounts, and these services would provide comprehensive and specific advice for each individual holding (eg, sell this stock and buy this ETF instead).

This technology will help consumers improve their investment portfolios across all their accounts, regardless of the institution at which it was held. Below is a picture of what this looked like.

Screenshot of buy/sell/hold recommendations on FutureAdvisor from 2013. Image credit: Grant Easterbrook

The technology was very impressive, but the idea did not become mainstream. Within a few years, the firms that offered this service (such as Financial Guard, FutureAdvisor, Jemstep and SigFig) had all switched to a different business model. According to Simon Roy, the former CEO of Jemstep, “the cost for unbranded startups to acquire clients who were both wealthy enough and willing to trade their own portfolios using our service was too high. We didn’t find enough to make the economy work, and like everyone else, we fluctuated.”

Why didn’t the established giants in financial services give their customers direct access to this technology? Since so many of the big firms offer their own proprietary mutual funds and ETFs, which an independent buy/sell/hold advisory engine might recommend selling, the established industry was not interested in offering clients a service that could divert money away from the company.

By 2023, the average online investment tool will fall far short of the services available a decade ago.

Peer-to-peer (P2P) lending and insurance

In the 2010s, P2P lending and insurance startups received considerable attention. Companies such as Lending Club and Prosper in the lending area, and Lemonade and Friendsurance in the insurance area, launched their businesses with a focus on the P2P model. This model promised a better experience and deal than receiving a loan or insurance from a faceless company.