3 Ways You Can Turn Bitcoin’s Volatility to Your Advantage Today

FTX – one of the world’s largest cryptocurrency exchanges – recently went bankrupt.

Many billions of dollars in value evaporated within minutes when this unhealthy institution collapsed.

It has created a real “blood in the streets” moment, weighing heavily on the Bitcoin price.

Bitcoiner Matt Odell summed it up best:

“This is a story of fiat incentives, shitcoin games, regulatory corruption and counterparty risk that ended in inevitable disaster. It will serve as a costly reminder that bitcoin held in self-custody is unique in its lack of counterparty risk. You can easily and cheaply store it yourself and send it around the world without trusting anyone or asking for permission. Learn how to keep bitcoin yourself and use it in a superb way.”

It deserves to be emphasized that FTX, and other companies like it, are not at all the same as Bitcoin – a growing global money that no one can inflate or control and that is available to anyone.

For example, suppose there was an unscrupulous gold storage company that went insolvent. It does not mean that gold is defective.

The collapse of FTX will undoubtedly be a drag on the Bitcoin price in the short term. But on the bright side, it will help purge the industry of bad actors and offer some crucial lessons.

I don’t expect the FTX meltdown to have a lasting negative effect on Bitcoin.

Bitcoin has gone through several more explosive events recently and emerged stronger than ever (see Mt. Gox’s bankruptcy in 2014 for example).

However, I expect Bitcoin to remain volatile – as it always has been since its inception.

Something does not go from having no value to being significant global money without volatility.

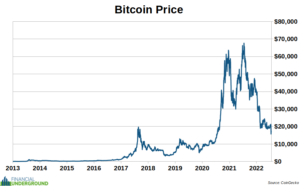

For example, Bitcoin went from having no value in 2009 to $69,000 in November 2021 to around $17,000 today, down more than 75% from its previous peak.

It’s important to keep in mind that recent volatility is par for the course.

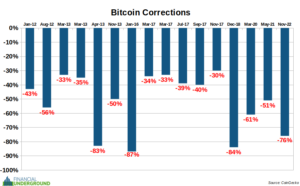

It is common for Bitcoin to have significant corrections of 50% or more, which has happened eight times. Furthermore, there have been three occasions where Bitcoin has fallen by 80% or more.

If you zoom out and look at the big picture, Bitcoin’s volatility has been mostly to the upside over the long term.

Suppose you went back four years ago and told someone that Bitcoin “crashed” to $16,000. That would have been so unbelievable that you would probably have been laughed out of the room.

Bitcoin continues to bounce back stronger than ever due to the fundamentals underlying this megatrend. It’s about a new and superior form of money in the earliest stages of adoption.

The monetization of new global money is unlike anything anyone alive has ever seen. It doesn’t happen overnight, and it’s inherently a fleeting process.

As adoption grows and Bitcoin becomes more established as money, volatility should level out – but likely at a much higher price. That’s why you’ll want to buy Bitcoin—and the best Bitcoin mining stocks (more on that below)—before the rest of the world figures out its superior monetary properties, namely its total resistance to supply inflation.

It will be a wild ride – like a violent roller coaster – but I think it will reward patient investors.

Swallowing Bitcoin’s volatility is the price we have to pay to make big gains as it goes through the process of monetization.

Here’s the bottom line.

Investors will have to deal with Bitcoin’s volatility for the foreseeable future.

Instead of anxiously watching price charts daily, I suggest focusing on the big picture and the fundamentals of the underlying trend.

The key is to understand the disruption before most others do, invest early, and have small enough position sizes to ride the megatrend without worrying about volatility whipsawing you out at the worst possible time.

When you see volatility in the Bitcoin price, ask yourself two things:

1) Does Bitcoin still have superior monetary properties (total resistance to supply inflation)?

2) Is Bitcoin still unstoppable?

If the answer to those two questions is “Yes”, I wouldn’t be too concerned.

With that in mind, let’s take a closer look at three key strategies that can help tame Bitcoin’s wild volatility.

Strategy #1: Dollar Cost Averaging (DCA)

The best way to buy Bitcoin is to avoid buying it in one big lump sum.

Instead, given Bitcoin’s volatility, a long-term dollar cost averaging (DCA) approach is optimal.

For example, suppose you want to invest $10,000 in Bitcoin. Instead of buying $10,000 all at once, make a purchase of about $192 each week for a year.

DCA significantly reduces the risk of buying too much at the top of a cycle and not buying at the bottom.

That’s how DCA can turn Bitcoin’s volatility to your advantage.

Swan Bitcoin offers a convenient platform that automates DCA purchases for you – including withdrawals to your own wallet, which is essential to eliminate counterparty risk. I have personally used it and found their service helpful.

More details can be found at the link above, including a helpful calculator showing how a DCA strategy performed in the past and a $10 free Bitcoin bonus for signing up with this link.

Strategy #2: Don’t Let Someone Else Hold Your Bitcoin

Bitcoin is a digital bearer instrument. A bearer instrument gives its holder ownership of it.

If you hold your Bitcoin on Coinbase or another platform, you do not actually own your Bitcoin and are taking on significant counterparty risk. Instead, you own a Bitcoin IOU, which is something else entirely – as FTX clients are finding out right now.

It is much safer to keep your Bitcoin off the exchange’s website in your own self-managed wallet, where you control the private keys.

For beginners, start with Muun Wallet or Blockstream Green Wallet for your phone. Both are excellent choices and are among the easiest to use. BlueWallet is a good choice for intermediate mobile phone users. Finally, Electrum and Sparrow Wallet are good options for laptops and desktops – which are often more secure than a mobile phone.

Whichever self-managed wallet you use, ALWAYS make sure you have properly backed up your wallet. Each wallet is different and will give you instructions on how to back up. That way, you won’t lose your money if you lose your phone or laptop.

It is critical to take this step when setting up your self-deposit wallet because this is the ONLY way to get your money back if something happens to your device. Bitcoin has no customer service department.

Strategy #3: Have a four-year time horizon

Plan to hold Bitcoin for at least four years – through a halving cycle.

According to the fixed protocol, we know exactly how Bitcoin’s supply will grow in the future. A key feature is that the new supply is halved every four years, a process known as halving.

There has rarely been a period where the Bitcoin price was lower than it was four years ago. When that happened, they were fantastic buying opportunities. But, of course, past results do not indicate future results.

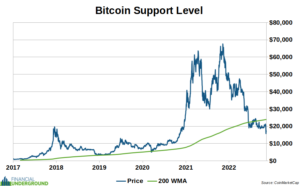

The 200-week moving average (200 WMA) is a useful metric, as it contains almost four years of price data – about the length of a halving cycle. Historically, the 200 WMA has been a good indication of the Bitcoin price floor.

As we can see in the chart above, now is one of the rare times when the Bitcoin price is trading below the 200 WMA.

However, the opportunity may be gone soon.

Historically, Bitcoin’s biggest moves to the upside happen very quickly… especially in the middle of a financial crisis.

With multiple crises unfolding right now, the next big move could happen immediately.

That’s why I’ve just released an urgent PDF report, it’s called:

The Most Dangerous Economic Crisis in 100 Years…the 3 Best Strategies You Need Right Now

It details how it could all develop soon…and what you can do about it. Click here to download the PDF now.