3 reasons why a crypto comeback is on the way

Krypto: What Doesn’t Kill You Makes You Stronger?

It’s been about a year and four months since Bitcoin peaked above $65,500. The last brutal bear market in Bitcoin and crypto wasn’t the first. In fact, Bitcoin fell 80% or more on three separate occasions – the 2017-2018 bear market, the Mt. Gox bear market of 2013-2016 and the initial brutal bear market of 2010-2013. Despite Bitcoin’s resilience over the past decade, much has changed. Due to the maturation of the industry over the years, the last bear market has been the worst in terms of both dollars lost and market capitalization. The Grayscale Bitcoin Trust GBTC, a proxy for Bitcoin, illustrates the destruction:

Image source: Zacks Investment Research

The steep fall in crypto assets led to the demise or bankruptcy of crypto hedge fund Three Arrows Capital (3AC), Terra Luna stable coin, crypto lender BlockFi, crypto lender Celsius Network, and most prominently, Sam Bankman Fried’s FTX and its sister company. Alameda Research.

“It’s only when the tide goes out that you learn who has been swimming naked”

The destruction of crypto is not unlike the collapse of stock markets over the years. A brutal bear market ensues, investment money dries up, and weaker companies and fraud are exposed. However, the companies (and in this case, the protocols) that survive ultimately end up stronger during the next bull market. While it is too early to call a bottom in crypto, some positive signs are developing in the industry, including:

1. Institutional appetite for crypto-related assets: Silvergate Capital SI is a crypto-centric bank that was investigated for doing business with Sam Bankman Fried’s FTX. Since the revelations were made public, shares have fallen more than 80% in the past year, profits have fallen, and the company had to endure a bank run. Despite negative press, falling share prices and high short interest (65% of shares are short), some of Wall Street’s sharpest minds are hunting shares in Silvergate. According to 13F filings, Citadel owns more than 5% of the company. Ken Griffen’s Citadel made the most money of any fund last year. Blackrock BLK, the world’s largest asset manager, owns more than 7% of the shares. Bill Miller, a value investing legend and long-term Bitcoin bull, also owns shares. The bold bets show that institutional money sees the recent crypto crisis as an opportunity.

Image source: Zacks Investment Research

2. Bitcoin disconnection: Over the past few years, Bitcoin, the world’s most watched crypto-asset, has traded more like a leveraged equity ETF than a standalone asset. However, recent data suggests that may finally be changing. For the first time since the FTX debacle, Bitcoin has a negative correlation compared to the S&P 500 index.

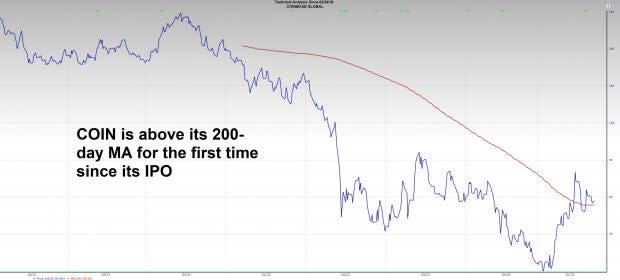

3. Price action versus news: Crypto-related assets such as Riot Blockchain RIOT, Coinbase Global COIN, and Microstrategy MSTR, has regained its 200-day moving average. In other words, instead of succumbing to the bad news, these stocks absorb the news and find buyers. Remember that bull markets tend to climb a wall of worry.

Image source: Zacks Investment Research

Conclusion

Institutional sponsorship, Bitcoin’s disconnect and strong price action suggest that the crypto bear market may be on its last legs. While it’s too early to call a bottom, investors should keep crypto-related stocks on their watch lists. If stocks like Coinbase can hold above 200 days in the next few weeks, 2023 could mark a turnaround year for the industry.

Want the latest recommendations from Zacks Investment Research? Today you can download 7 best stocks for the next 30 days. Click to get this free report

Silvergate Capital Corporation (SI): Free Stock Analysis Report

BlackRock, Inc. (BLK): Free Stock Analysis Report

MicroStrategy Incorporated (MSTR): Free Stock Analysis Report

Grayscale Bitcoin Trust (GBTC): ETF Research Reports

Riot Platforms, Inc. (RIOT): Free Stock Analysis Report

Coinbase Global, Inc. (COIN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research