3 Reasons to Be Cautious About Crypto Market Outlook

Hal Press, the founder of North Rock Digital, has taken a cautious stance on the market’s future and advises crypto investors to do the same.

While Press does not expect a sharp decline, he believes that the crypto market may face several challenges.

Low liquidity levels do not favor the bulls

Hall Press tired that many short positions have accumulated during a period of low liquidity. This has led him to believe that a brief squeeze may be on the horizon.

A short squeeze occurs when the price of a cryptocurrency suddenly rises, forcing traders who had bet against it to quickly buy the cryptocurrency to cover their positions and minimize their losses. This sudden buying action can cause the price to rise further, creating a cycle that “squeezes” the short sellers.

The short squeeze can lead to rapid price increases, which can be driven by market sentiment, news or other factors that trigger a shift in the market’s direction.

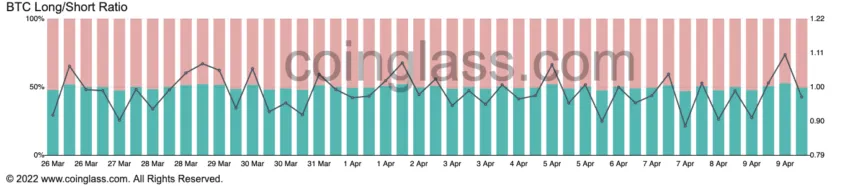

Data from CoinGlass reveals that the number of short positions is higher than the number of long positions on the top cryptocurrency exchanges. About 50.69% of all traders are betting that the price of Bitcoin will go down.

Despite the high probability of a short squeeze, Press maintains that long-term concerns for the crypto market remain.

Several factors crypto investors must consider

Press noted that Ethereum is the fund’s largest position and that his cautious stance is not primarily due to the upcoming Shanghai or Shapella upgrade, scheduled for April 12. The hard fork will unlock over 16 million ETH in circulation, which is 14% of power supply.

Instead, Press is concerned about the broader global landscape, where many countries are adopting stricter regulations on crypto, making it harder for the technology to gain mainstream adoption.

Leaders in the UK, Japan, Canada, Germany, France, the US and the EU support stricter regulations for customer protection and greater transparency for crypto businesses. These G7 nations plan to establish global regulatory standards for crypto.

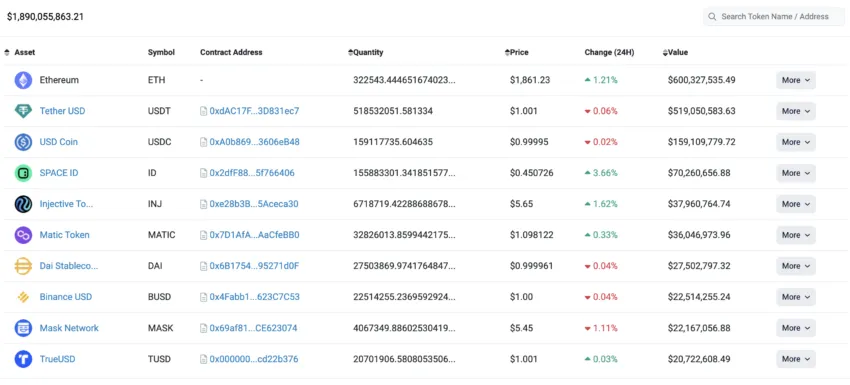

According to Press, the resilience of major cryptocurrencies can be attributed to inelastic demand. For example, Binance CEO Changpeng Zhao has converted nearly $1 billion in BUSD from the Industry Recovery Wallet to “native crypto” such as BTC, BNB, and ETH.

This move was prompted by Paxo’s decision to stop minting the BUSD, which caused its market cap to gradually decrease.

Now that this conversion is slowing down, little new money is entering the space. Press believes this dynamic poses a challenge for the market to maintain its current levels in the long term.

The North Rock Digital founder also warned that potential regulatory actions could force investors to reconsider their positions. He emphasized that the price drives the narrative. Therefore, as soon as a significant regulatory action occurs without a strong buyer to support the market, the narrative is likely to change.

Press acknowledges the possibility that he could be wrong and the market could continue to trend upwards. However, he considers the risks outlined above worth considering for a more measured approach to the cryptocurrency market.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.