Crypto trading charts can look intimidating at first. All the lines, lights and indicators can be confusing. However, charts are actually relatively easy to read once you know what you’re looking for.

With that in mind, we’ll cover the basics of reading crypto charts, different types of charts, important indicators, and common chart patterns. By the end of this guide, you should have a basic understanding of how to read crypto charts and what to look for when trading.

What is a crypto chart?

A cryptograph is simply a graphical representation of data. In the case of crypto trading, this data is typically the price of a cryptocurrency over time. Crypto charts are used to track price movements, identify trends and spot trading opportunities.

There are many types of crypto charts, but the most common is the candlestick chart. Traders use candlestick charts to track price movements over time. Each “candle” on the chart represents a specific period, usually one day, but can be adjusted to different periods. The body of the candle represents the open and close price for that period, while the wicks represent the high and low price. Green candles represent periods when the price went up, while red candles represent periods when the price went down.

What are the most important cryptographic indicators?

There are dozens of different indicators that traders can use to analyze crypto charts. However, most indicators can be grouped into two main categories: trend indicators and momentum indicators. Trend indicators are used to identify the general direction of the market. The most popular trend indicator is the moving average.

Momentum indicators are used to identify when the market is overbought or oversold. The most popular momentum indicator is the Relative Strength Index (RSI). There are many other indicators that traders can use, but these are the two most important.

What are the most common chart patterns?

Traders use chart patterns to identify potential trading opportunities. There are many chart patterns that traders can use to identify trading opportunities. However, some patterns are more common than others. Each pattern can provide traders with different information about the market, such as the direction and strength of a trend and potential reversal points.

If you are new to the crypto world, understanding the market can be difficult. But don’t worry. Some tried and true chart patterns can help you navigate these waters.

1. Head and shoulders

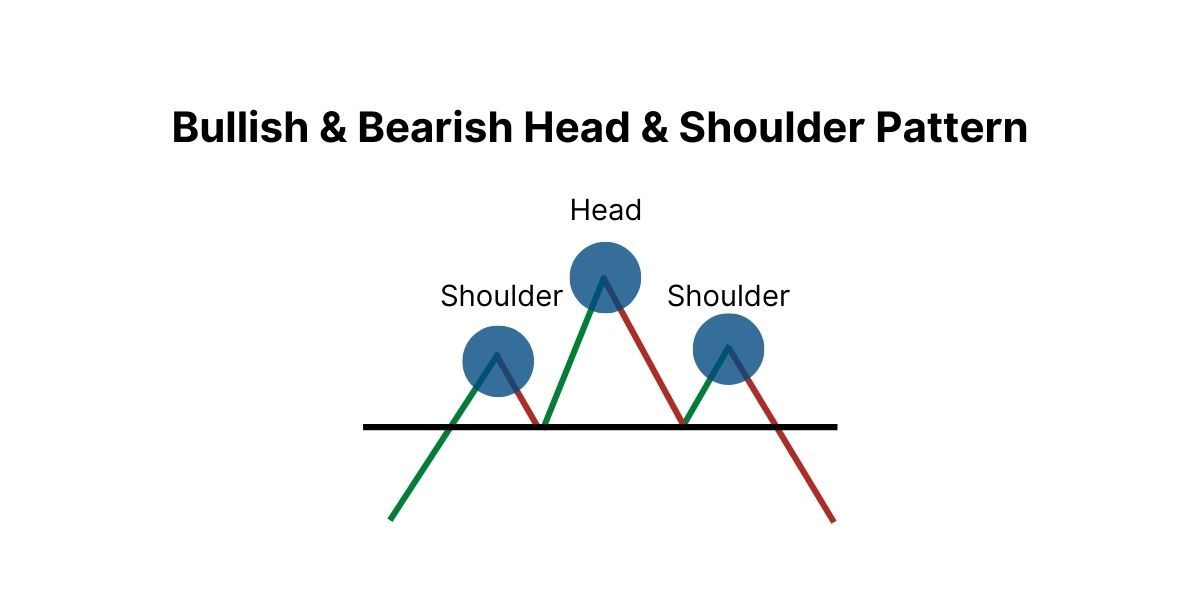

The head and shoulders pattern looks like this:

The head and shoulders pattern is one of the most reliable reversal patterns in all technical analysis. This pattern has been observed in crypto markets for years and is a reliable predictor of price movements. The head and shoulders pattern is characterized by a series of three peaks, with the middle peak being the highest.

This pattern indicates that the market is in a downtrend and that prices are likely to continue to fall. However, there are a few things to look for when identifying a head and shoulders pattern.

- The three tops must be the same height.

- The middle peak should be higher than the other two peaks.

- The pattern should be symmetrical, with the two shoulders the same height.

Once a head and shoulders pattern is identified, traders can use it to predict future price movements.

2. Double top

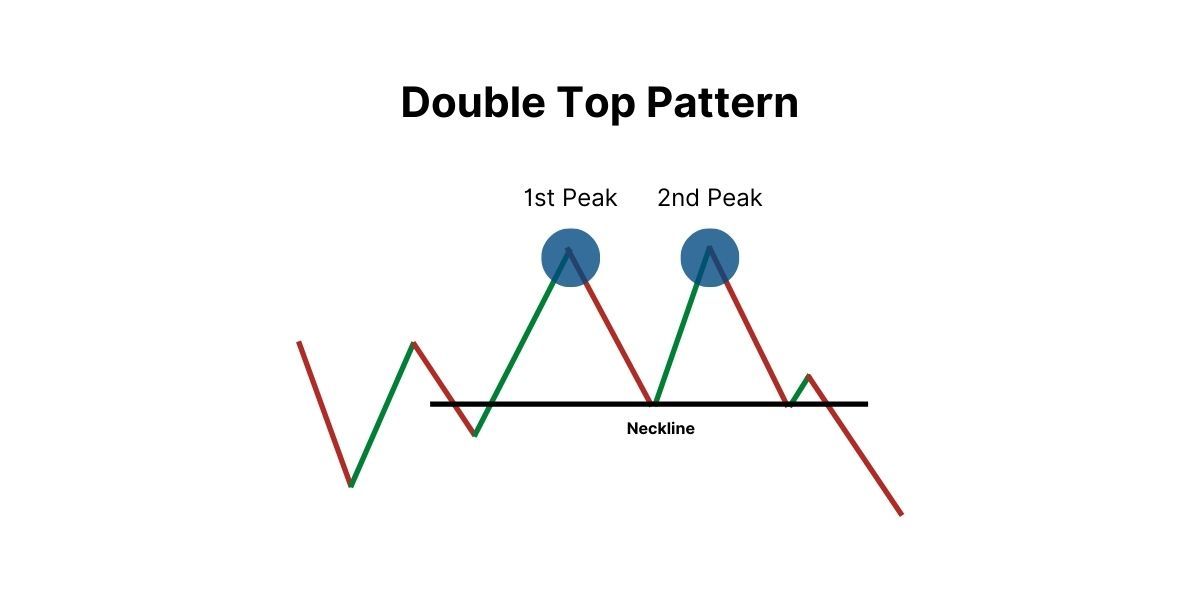

The double top is another bearish reversal pattern. It looks that way:

The double top pattern is a bearish reversal pattern found in the price charts of any market, including crypto. The pattern is created when the price of an asset reaches a new high, pulls back and then fails to reach the previous high.

The double top chart is considered a reliable bearish reversal signal as it shows that the bulls could not sustain the asset’s price at the previous high. This pattern can be found in any time frame, but is most often seen on long-term charts.

The double top pattern is usually completed when the price falls below the support level created by the pullback between the two tops. This level is usually referred to as the “neckline”. When the neck is broken, traders often use technical analysis tools to determine where price is likely to go next. A popular measure is the distance between the tops of the two peaks, which is usually measured using Fibonacci retracement levels.

As you can see, the double top is very similar to the head and shoulders pattern. The main difference is that there are two “tops” instead of one. The double top is created when the market rallies to a new high, retraces to support, and returns to the same high a second time. This second rally usually fails, leading to a sell-off.

3. Triple top

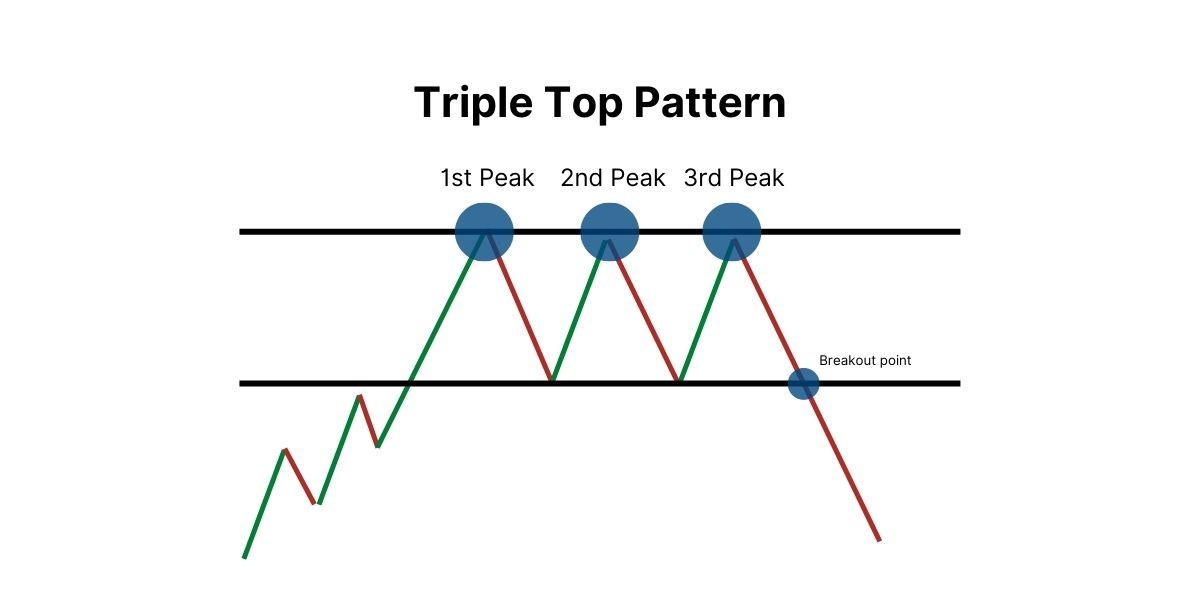

The triple top is a bearish reversal pattern that looks like this:

The triple peak is very similar to the double peak. The main difference is that there are three “tops” instead of two. The triple top pattern is created when the asset price reaches a peak and then declines to a bottom three times before finally breaking below support.

This pattern is believed to be a sign that the asset is no longer gaining strength and may be ready for a significant selloff. The first peak is usually followed by a trough, followed by a second peak. The second top is usually followed by a second bottom, which is then followed by a third top. After the third peak, the asset’s price usually breaks below support, signaling a potential sell.

The triple top pattern is often seen as a bearish signal, indicating that the asset is losing momentum and may be ready for a significant selloff. This pattern can be used to identify potential sales opportunities. When trading cryptocurrency, it is important to be aware of the triple top pattern as it can help you make more informed decisions about when to sell.

These are just three of the most common chart patterns that can help you understand the market. So the next time you feel lost, look at the charts and see if any of these patterns are present.

Learn how to read crypto charts to make better trades

The crypto market is full of opportunities for those who know how to spot them. Chart patterns are one tool that can be used to identify these opportunities. While there is no guarantee of success, knowing how to read and trade chart patterns can give you an advantage in the market.

Reading crypto charts is relatively easy once you know what you’re looking for. However, it can take some time to learn how to read charts and identify trading opportunities.

.jpg)