3 Biggest Crypto Price Predictions for March 2023

Crypto Price Predictions, March 2023: Ripple (XRP) price is likely to experience volatility. Meanwhile, Ethereum (ETH) price may surpass Bitcoin (BTC) price. And the rapid rise in Stacks (STX) price is expected to continue.

February 2023 has been a relatively bullish month for the crypto market, and March 2023 could bring more of the same. Here are BeInCrypto’s top three crypto price predictions for March 2023.

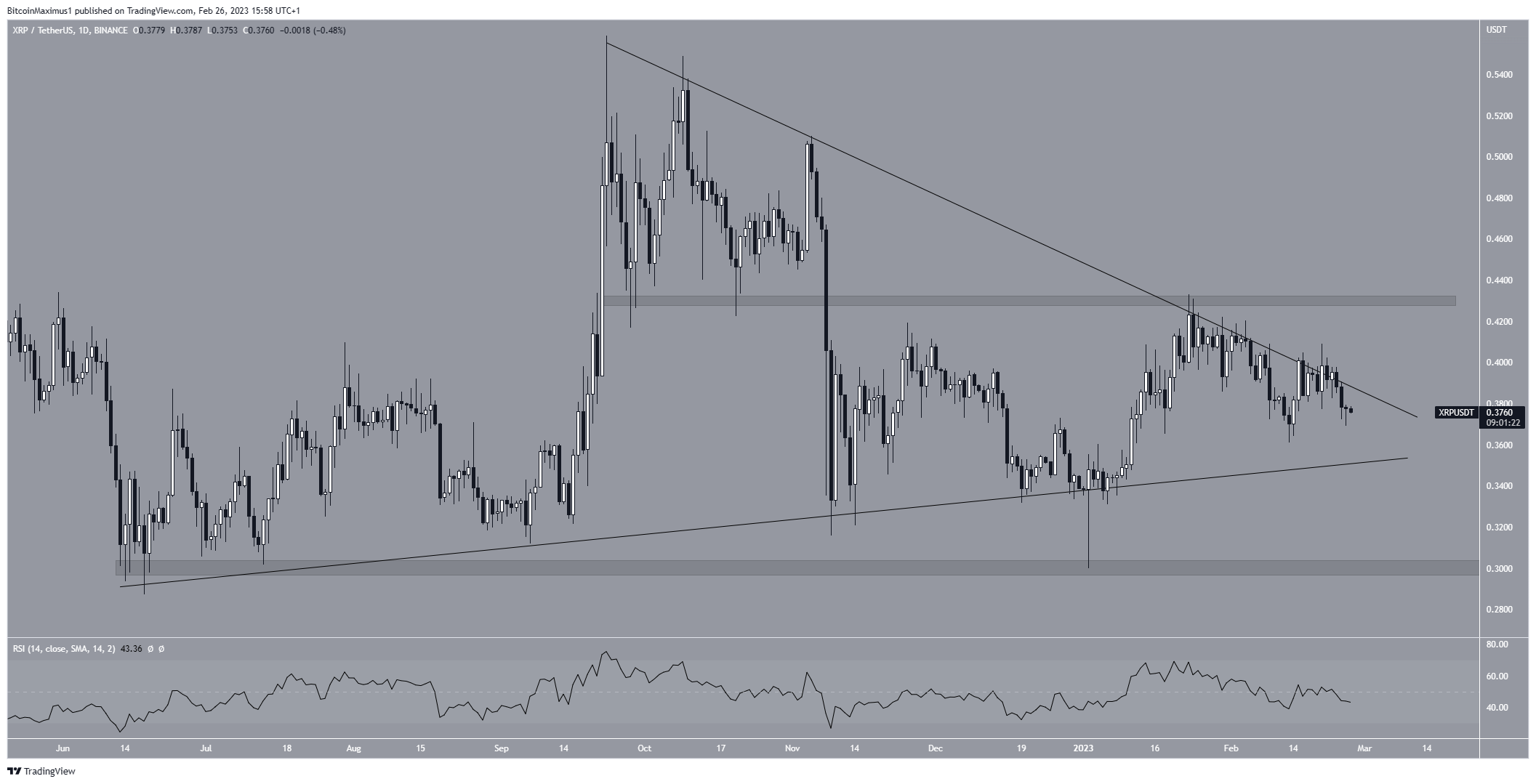

Ripple (XRP) Price Prediction: Volatility will return

The XRP price has been trading in a long-term symmetrical triangle since June 2022. Now the Ripple price is approaching the point of convergence between resistance and support.

At that point, a decisive move outside the pattern is likely for the XRP price. Since the consolidation has been going on for a long time, a significant move is expected once Ripple is outside of this technical formation.

If the Ripple price breaks out, it could rise to at least $0.43 and possibly $0.52. Still, a drop to $0.30 could follow if it breaks down.

Since both technical indicators and the XRP price action are neutral, both remain possible.

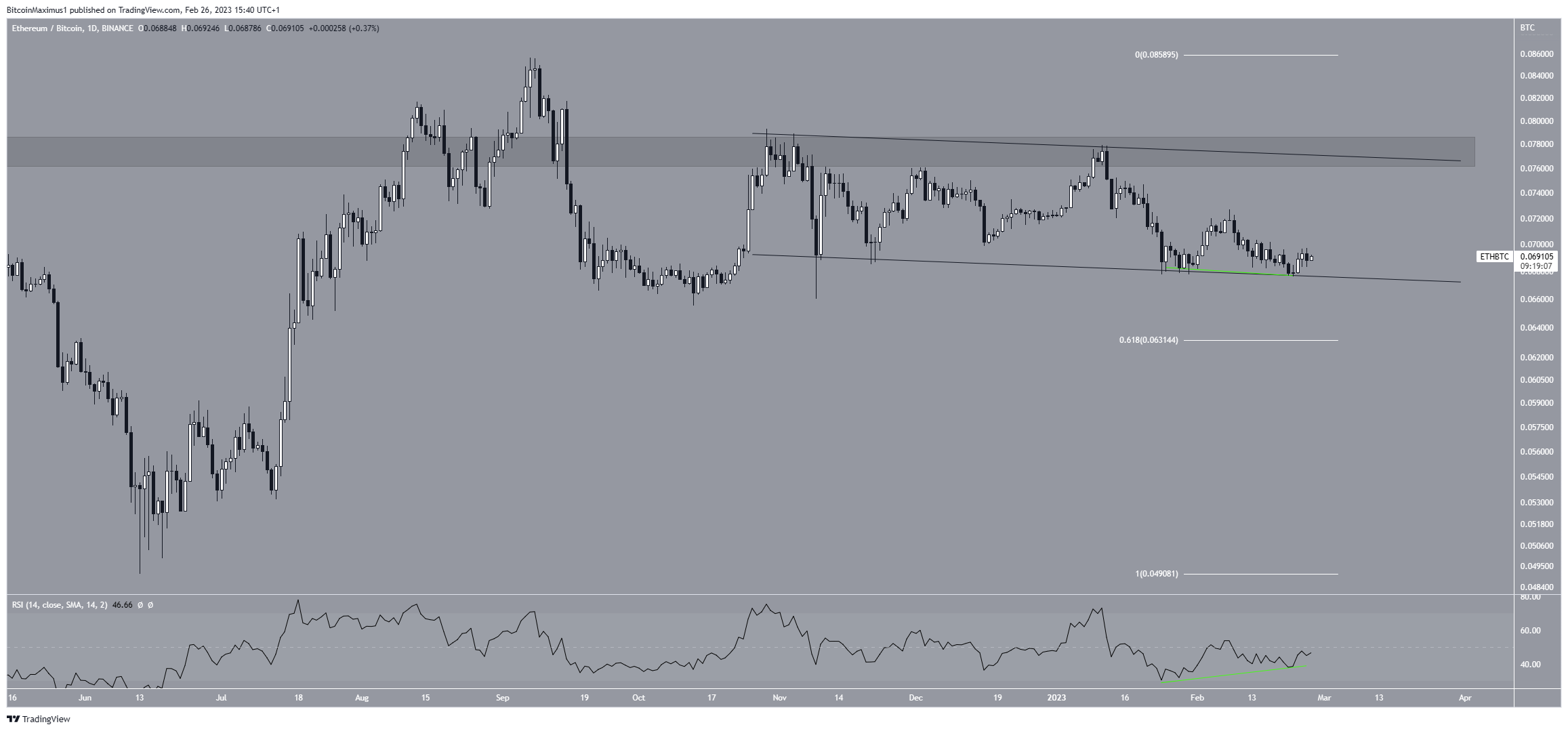

Ethereum (ETH) Price Prediction: More Than Bitcoin (BTC) Price

ETH is the original token of the Ethereum blockchain, created by Vitalik Buterin. Based on market capitalization, it is the second largest cryptocurrency in the crypto market, only after Bitcoin. The ETH/BTC trading pair presents a bullish picture. This means that the Ethereum price is likely to surpass that of Bitcoin, and here is why:

First, the ETH price has been trading in a descending parallel channel since October 29. Such channels usually contain corrective movements, which means that an eventual breakout is expected.

Second, the Ethereum price has generated a bullish divergence in the last month (green line). The divergence that occurs right at the channel’s support line further increases its importance. Since the divergence has been developing for more than a month, it would make sense for it to catalyze a month-long upward movement for the ETH price.

Therefore, the most likely scenario is a rise towards at least the channel’s resistance line of ₿0.077. However, a breakout from the channel will invalidate this bullish hypothesis. If that happens, it could lead to a drop in ETH price against BTC to the 0.618 Fib retracement support level of ₿0.063 (white line).

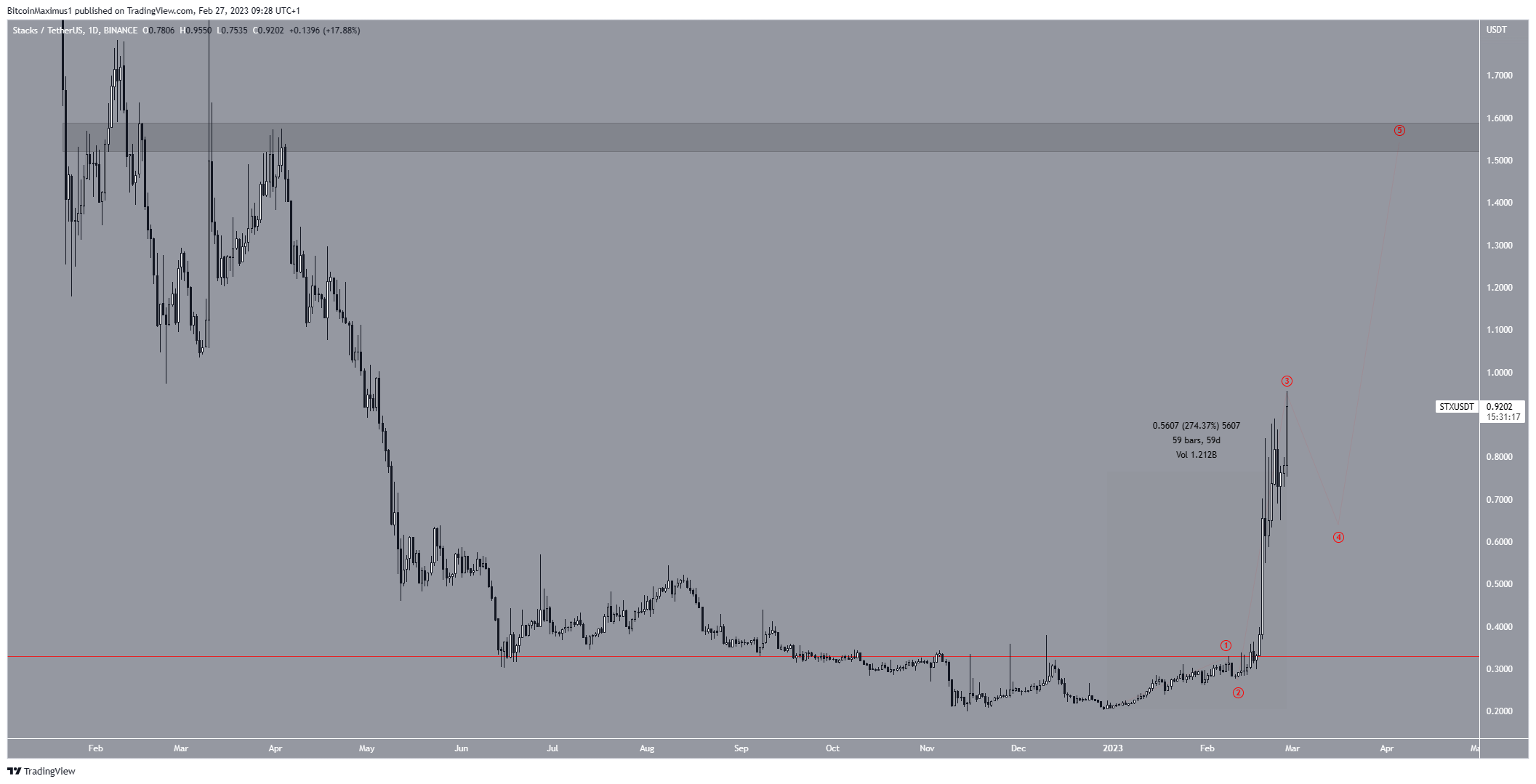

Stacks (STX) Price Prediction: Moving above $1.50

The Stacks prize has been one of the biggest gains of the year, increasing by 275% to date. Despite the massive increase and the completely parabolic rally, the upward movement may not yet be complete. This is visible in both RSI and wave numbers. While the former is overbought, it has yet to generate any bearish divergence.

The shape of the increase is an indication of wave three. Therefore, while a short-term drop for the STX price may occur, another rise is expected to complete the entire upward movement. If wave five also extends, the Stacks price could reach the $1.55 resistance area, which has not been reached since April 2022.

On the other hand, a drop below the wave one high (red line) of $0.33 would invalidate this bullish wave figure for the STX price. If so, the Stacks price could fall towards $0.20.

For BeInCrypto’s latest crypto market analysis, click here.

Sponsored

Sponsored

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use this information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.