3 Big Crypto Predictions for October 2022

With another month of Bitcoin (BTC), Ether (ETH) and most altcoins in the red or in a range-bound trajectory, all eyes are hoping for greener price charts for top cryptos in the final quarter.

“Wake me up when September ends,” was the dominant sentiment for a majority of cryptocurrency HODLers over the past month. As macro conditions continued to dictate the short-term trajectory of cryptocurrencies, bearish sentiment took over the larger market.

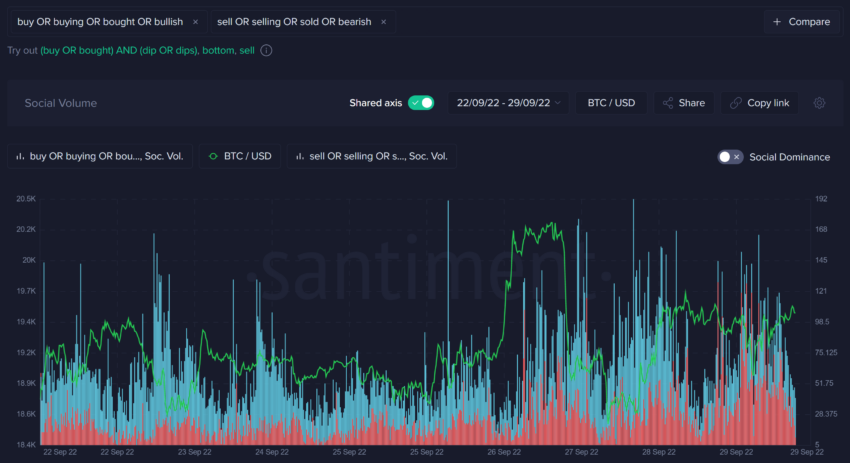

Throughout September, bearish opinions gained a lot more heat, as shown in the red bars below that represent how many mentions there are of sell, sell, sold or bearish.

Reduced demand

The total fees used to use a blockchain show the willingness to use and demand to use it. During the most recent quarter, Bitcoin fees generated just under $30 million from the network, down from $42.9 million in Q2 2022.

On the other hand, Ethereum fees fell further, from $1.29 billion in Q2 to $264 million in Q3, showing a 79% quarter-over-quarter (qoq) drop.

Although there was a slowdown in blockchain demand, prices held up relatively well with Bitcoin consolidating and Ether rising 30% qoq.

Additionally, net flows indicated that while BTC saw a neutral sentiment, ETH saw a more bullish stance compared to BTC. Bitcoin recorded modest inflows to centralized exchanges of less than $50 million, higher than the net outflow of $192 million from Q2.

For Ether, over $1 billion of ETH left exchanges for the fourth quarter in a row, while outflows in Q3 were $57 million lower than from Q2.

3 things to remember in October

Bitcoin’s price has struggled to keep pace with the $20,000 psychological support barrier throughout September. Without a good pump from whales and dealers, a significant price increase seems like a distant dream.

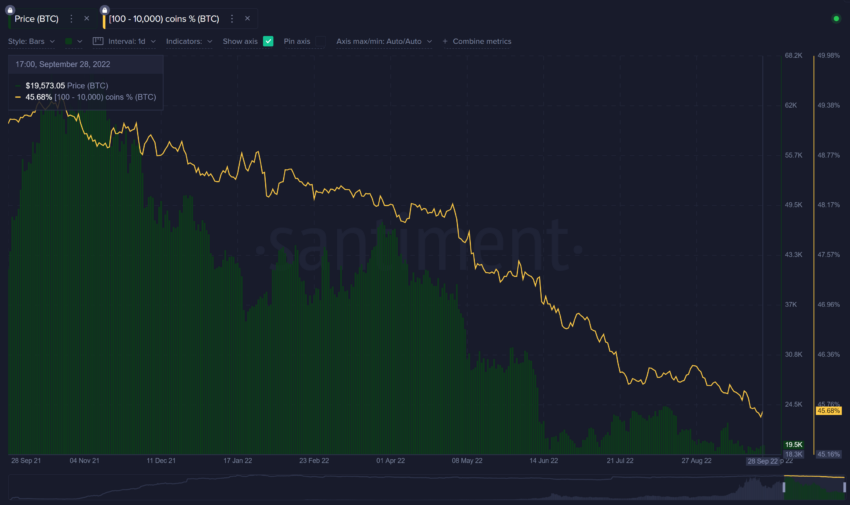

Whale measurements from Santiment showed that there is neither whale accumulation nor great utility in BTC to be excited about at press time.

The main BTC whales that hold between 100 and 10,000 BTC continue to dump. Over the past year, these key addresses have dropped 3.5% of supply to addresses that have much less impact on future price movements. In September alone, another 0.4% of BTC’s supply was dumped. In October, a key trend is to watch out for the potential accumulation of whales.

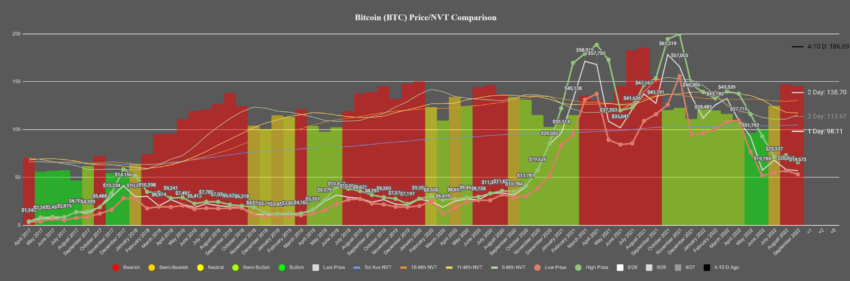

The amount of unique BTC moving from address to address remains scarce, which has led to the NVT signal presenting a bearish signal for the second consecutive month. A rise in the same could prove to be a bullish indicator.

A look at the BTC funding rates presented another worrying trend where traders are gradually longing more and more when the price does not dump. After the longs get high enough, another dump takes place, traders try to short temporarily, and they give up and start longing again.

Therefore, it may be crucial to look at the aforementioned key indicators going forward. A reversal in these on-chain metrics could present a bullish turn for BTC, ETH, and the larger market.

For Be[In]Crypto’s Latest Bitcoin (BTC) Analysis, click here

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.