3 altars with setup for the next crypto bull cycle (part 3, Aave) (cryptocurrency:AAVE-USD)

Anna Bliokh

Produced in collaboration with Avi Gilbert and Ryan Wilday.

From the previous article:

For those who have followed the work of myself and Ryan Wilday, you know that while Bitcoin (BTC-USD) has not yet reached our expected goals for the rally patterns from both the 2018 and 2020 declines, we still see the price action as constructive. The price has been in a larger holding pattern, termed a flat correction from the April 2021 highs, and the greater degree of support for this perspective continues to hold. Although micro setups have developed to take BTC back to $24k, the price has avoided a deeper drop. BTC has not been able to push below $30ki for any significant period of time before attracting an excess of buyers pushing the price back up. In short, the expectations for higher goals described in my various articles titled with some iterations of “Moonpath” still appear to be very much on track.

The guidance we provide in Crypto Waves tends to center around Bitcoin as the core holding among digital assets, and we tend to be cautious about both overallocating to altcoins and holding altcoins as a long-term investment. Nevertheless, we track select altcoins for high quality trading setups (not long-term investments) and view them as having the prospect of slightly short-term outperforming (relative to 100% Bitcoin holdings) for select coins during specific periods .

This mini-series of articles focuses on three well-known altcoins with higher market capitalization that show higher probability of outperformance and anticipation of new records in the next bullish cycle. These are Binance Coin (BNB-USD), polygon (MATIC-USD)and the Aave Liquidity Protocol (AAVE-USD).

Since the previous article, the price has fallen sharply. Not only was the long-term support level $24k reached, it was resoundingly exceeded to the downside, tested below $18k. As such, our longer time frame analysis, while still quite bullish, now favors only a swing up to new highs before a long-term correction. As for the altcoins featured in this series, BNB, MATIC and (upcoming) AAVE, long-term support for new all-time highs has held up nicely.

This article, Part III, focuses on AAVE

Before discussing AAVE:

Please note that we view listings in altcoins as speculative and unproven, and therefore “best practice” would be to view holdings as trading rather than investments, and that allocations are fairly minimal given both risk and reward.

AAVE is a decentralized finance – DeFi – platform built on the Ethereum network that enables trustless cryptocurrency loans actualized via Smart Contract to execute loans. Users of AAVE can participate as either lenders or borrowers. Lenders deposit funds into a liquidity pool for interest, and borrowers can borrow from the pool and pay interest on the borrowed funds. Borrowers can post a number of other digital assets, i.e. different cryptocurrencies, from multiple networks as collateral for the loans they take. This form of decentralized platform is intended to democratize and decentralize lending and borrowing away from traditional banks.

Although there are many other cryptocurrencies that facilitate DeFi lending/borrowing, AAVE is one of the largest hubs for such transactions in the space. The AAVE token is both a governance token and an exchange token, and possession gives the right to vote on any issues or potential changes to the protocol, as well as discounts on some of the fees associated with using their platform.

From an Elliott Wave perspective (see attached charts for reference / visual aid):

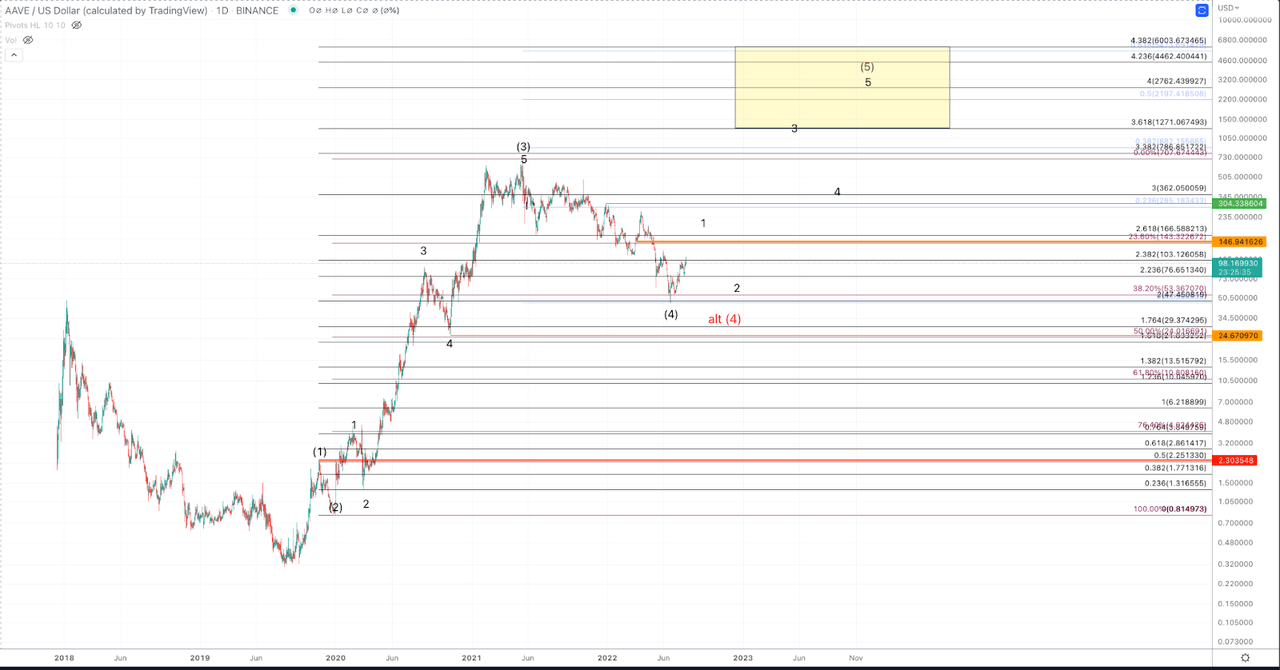

AAVEUSD Daily Chart (Jason Appel (Cryptowaves))

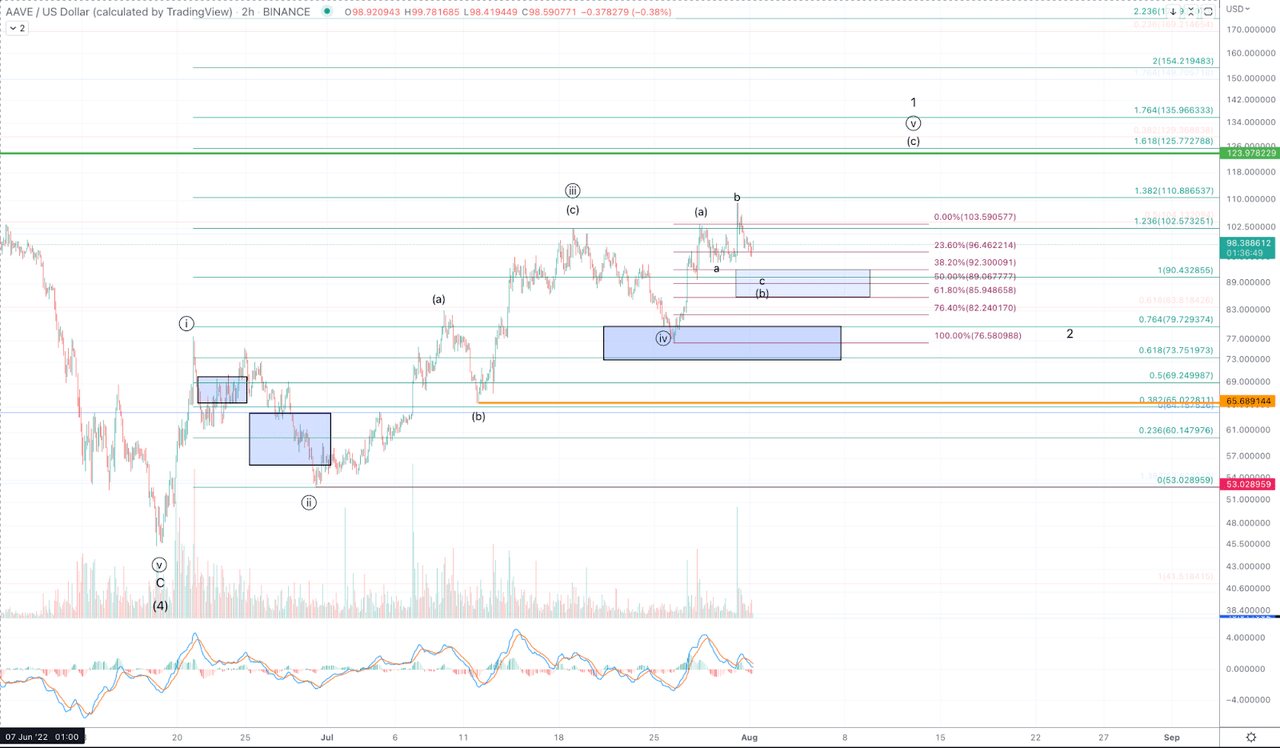

AAVEUSD 4h Chart (Jason Appel (Cryptowaves))

Elliott Wave Theory describes trends in market prices as 5 wave formations. An impulse is a type 5 wave formation that indicates a strong trend in which market participants eagerly (hence: “impulsive”) push the price primarily in one direction. In the case of uptrends, action is characterized by strong buying with participants chasing the price higher as the lower priced “stock” is bought up. The waves that increase the price in the direction of the trend, called “motive” waves are labeled 1, 3 and 5, and those that correct part of the previous advance are known as “corrective” waves and occur in wave 2 and wave 4 positions. In an impulse, by definition, all the motive waves themselves are formed in 5 wave movements, with wave 3 typically being the biggest and strongest trend advance, and wave 1 and 4 never overlapping.

The daily AAVE chart is a textbook example of the previous description of an Elliott Wave Impulse and largely fulfills all the characteristics. That said, only 3 waves up so far have completed (marked (1)-(2)-(3)), and so the Elliott Wave view of this chart is that it is a currently incomplete impulse, but one that shows good promise to complete by completing the wave (5) to a new high.

Observing the daily chart: From the 2019 low, AAVE formed an initial 5-wave impulse marked (1) into the November 2019 high. From there, price pulled back correctively, pulling only part of (1) into the December decline: wave (2). After wave (2), AAVE took off to the upside in a massive third wave that rallied over 300x from the top of wave (1) to the top of wave (3). Also note that the wave (3) rally is a clear 5-wave movement.

The strict rules for price to maintain an impulse pattern after the first 3 waves up (assuming the 3 waves are satisfactory for their part of an impulse) is that price cannot overlap into wave 1 territory in wave 4. In practice, we consider some closer supports after a particularly extended 3rd wave, as it would not be appropriate to wait for the price to reach $2.30 (the wave (1) high) to indicate that the impulse is dead. Our rough heuristic for this is to note that a 4th wave in an impulse should not make a sustained break below the 50% retrace of (3). That said, the ideal support for wave (4) is the 38.2% retracement of wave (3).

As for AAVE, the price has formed a clear 3-wave decline from the all-time high in May 2021. See the microchart of the displayed labels of ABC down in the expected wave (4) low right into 38.2% back at the low in June 2022. From here we look for evidence of a lichen in place. In order to provide sufficient evidence that a low has been hit and price is on the way up in wave (5), we need price to fulfill all of the following items on the list.

1) An initial 5 waves up

2) Pullback and successful test of support holding above low before 5 up

3) A takeout of the highest of 5 up.

4) A withdrawal of wave iv of C high as resistance

Although it is of course possible and in this case preferred that the low wave (4) has been hit, that narrative is still unconfirmed. Assuming confirmation via fulfillment of all the elements in the aforementioned list, it becomes very likely that the low is in and the price is on its way to higher heights without breaking the June 2022 low.

Considering that AAVE has well maintained 38.2% retracement from previous wave (3) advance and very nicely designed impulsive structure before this year+ pullback from all-time highs, these are the technical reasons to consider AAVE as a more likely candidate for further progress to a higher altitude to complete the wave (5).

As mentioned, the wave (4) low is unconfirmed, and while we can consider an initial 5 up for wave 1 of (5), it is still likely to be incomplete even without considering the others that have yet to be fulfilled. This chart could sustain a lower low this year, but should the low price break below $24, the setup for higher highs becomes increasingly compromised. Note that $24 is not a level that will invalidate the setup. It is a loose “stop” of sorts, but the longer and deeper the price moves below that level, the less likely a recovery becomes.

Regarding the potential wave (5), in terms of the Fibonacci proportions traced to call targets, it is typical to see wave (5) reaching at least a 50% extension of waves (1)-(3). Based on the AAVE chart, if we do indeed have a low in place for (4), the 50% extension occurs at $2170, which is more than 21x from the current price. Based on the size of the wave (3) in relation to the initial (1)-(2), and only reaching the 3,382 extension, minimal expectations, if a higher high is seen, are for the price to reach the 3,618 extension to $1,270. As such, although listings following this method (and frankly Cryptocurrencies as an asset class) involve significant downside risk, the overall risk to reward for listings in AAVE is quite favorable. As a reminder, we view listings in altcoins as speculative and unproven, and therefore remember that “best practice” would be to view inventory as trading rather than investments, and that allocations are fairly minimal given both risk and reward.