2 Reasons Crypto Investors Are Wary of Polygon Price (MATIC).

Polygon’s original token has performed poorly amid the crypto market downturn. A deep dive into chain data suggests that the MATIC price may experience more decline, given the lack of retail interest.

The polygon mesh does not grow

Polygon is a Layer-2 scaling solution designed to reduce Ethereum’s throughput issues and exorbitant gas fees. Ethereum’s successful transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) seems to raise concerns about the long-term viability of the Polygon ecosystem.

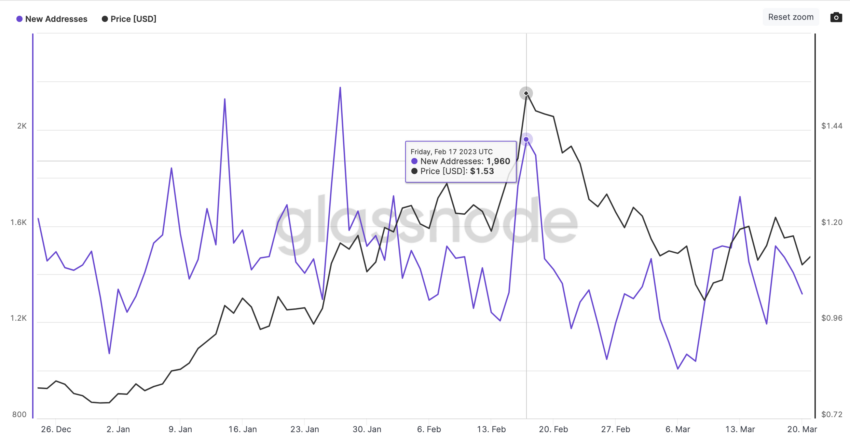

On-chain data from Glassnode shows that the volume of new addresses created on the Polygon network has been steadily declining since December 2022. The downward trend now appears to have been reinforced by the recent announcement of the Shanghai upgrade scheduled for April 12 .

After the resurgence in early March, new daily addresses created on the Polygon blockchain entered another decline on March 17, a few days after the Shanghai upgrade date was announced.

In fact, the number of new daily addresses on the Polygon network has decreased by 32% from the local peak of 1,960 addresses created on February 17th to 1,318 addresses as of March 21st.

A declining volume of new addresses on a blockchain network indicates declining interest in its core services and use cases. Consequently, the underlying token may struggle to find new demand.

Likewise, crypto whales appear to be spooked. Data from Santiment shows that addresses with 10 million to 100 million MATIC tokens have sold or redistributed about 43 million MATIC in the past month, worth about $55.9 million.

Between February 22 and March 21, this group of crypto whales depleted their reserves from 253 million to 211 million. In particular, a closer look at the chart shows that the buying and selling pattern of crypto investors holding between 10 million and 100 million MATIC has been closely correlated to the price.

MATIC Price Prediction: Potential drop below $1

IntoTheBlock’s Exchange Market Depth model provides a data-driven estimate of potential MATIC price movements in the coming weeks. It is a segregated aggregate of limit orders from token holders. It shows key support and resistance zones with respect to current prices.

The current bearish trend is likely to be stopped at 5% below today’s prices. This falls at $1.03, with a formidable demand for 3.5 billion MATIC.

Nevertheless, failure to hold this wall of demand could cause the price of Polygon to slide towards $0.90, where a buying wall for another 1.2 billion MATIC sits.

Conversely, MATIC needs to cross above $1.14, where 138 million tokens are up for sale, to invalidate the pessimistic outlook. After that, the selling wall of 1.35 billion MATIC at $1.30 will be the next resistance to hit.

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use all such information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.