2 charts that show Bitcoin is in trouble

Vertigo3d

When you’re a bear, everything looks bearish. You will read bearish news; you want to talk bearishly. However, the market does not care about a nickel of three. In the market, you are either right or wrong, and you can measure that in money. If there is any secret elucidate control everything, then your job is to predict it. If it really is a random walk, then it’s your job to measure the noise and monetize it. You win because you are right, you lose because you are wrong. That’s the beauty of markets, and a lot of people hate them because of it.

I don’t want to fight the bulls or beat the street etc, generally there is no “they” running things and the narrative is normally worthless. Making money in the markets is a job, and like any job, you need tools. Diagrams are important.

Charts are supposed to be useless because the future is not connected to the past. The past is clearly connected to the future, as anyone who has worn their shirt for two days knows, but like it or not, that connection is pretty fragile, and you could argue that when that connection breaks, you’ll lose all the money you has served from when that connection was in place. Overall, the random view of markets is extremely strong, but there is good profit to be made where it is not.

In crypto, “the random walk” is not very strong at all. As such, charts are of special use.

So here is an interesting example.

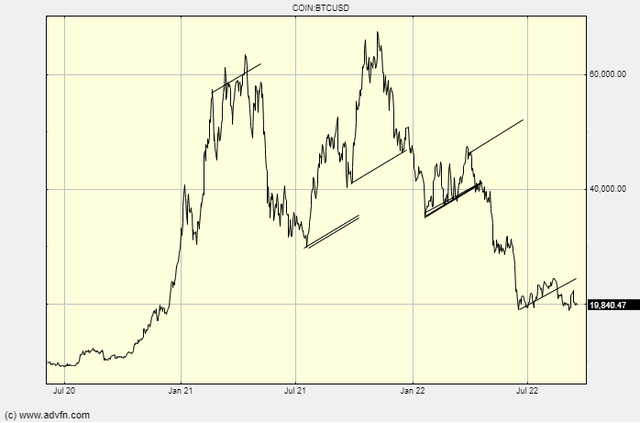

Bitcoin (BTC-USD) appears to be very cyclical in a calendar sense. Here is a chart showing that:

ADVFN.com

It seems that three months is an important period. People are very good at spotting patterns that aren’t real, but you can clearly see the quarterly action here. This is interesting because we are at the end of the last little cycle and to a bear it says we are going down soon. For me, this would be the last wave down.

If you look at the same charts as everyone else and use the same techniques as in the old books, chances are it won’t work. Markets change to trade away obvious edges. You have to look at things differently to see what others don’t.

I like to look at very long-term charts for that, as most people generally only care about the recent past now.

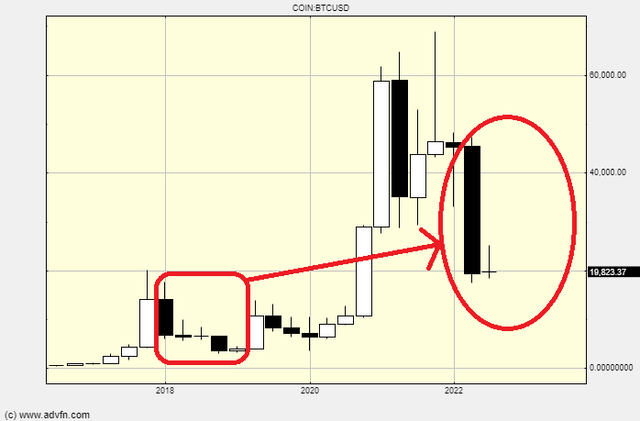

So this chart of BTC is interesting:

ADVFN.com

Of course, I’m suggesting a repeat, and I think it’s quite likely that we’ll get it. 2024 is the year of the “halving” and that is the ETA for the next big rally, so a bear market until then seems very plausible.

I would not argue against a long campaign of bet building at these levels. However, I prefer to buy the aftermath rather than entering a “buy and hold” strategy during a very difficult bear market with the aim of ignoring short-term losses for the promise of much higher highs eventually. For me, the chance of seeing $15,000 this year is high, and if this is not the bottom right now, Bitcoin could be halved before the bottom levels are reached.